FinTelegram Financial Intelligence

My Featured Posts

Main Category

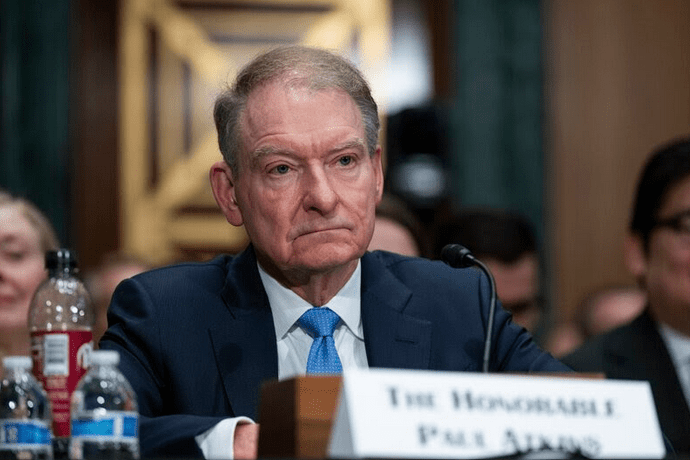

SEC’s New Era: Paul Atkins Sworn In—Will Crypto Finally Get the Regulatory Clarity It Deserves?

The U.S. Securities and Exchange Commission (SEC) has entered a new chapter with the swearing-in of Paul S. Atkins as its 34th Chairman, a move widely anticipated to mark a dramatic pivot in how the agency approaches crypto and DeFi regulation. For years, the financial industry—especially the burgeoning digital asset sector—has bristled under the SEC’s “Regulation by Enforcement” strategy.

Latest Updates

D

D

Main Category

Despite New Crypto Friendlyness: No Settlement Between U.S. CFTC And KuCoin?

A planned settlement between the U.S.CFTC and crypto exchange KuCoin is now in limbo due to a reported policy shift within the CFTC. This change is attributed to the Trump administration’s new approach, which deprioritizes enforcement actions against crypto companies. As a result, a CFTC attorney said that it is "unlikely that such authorization will be granted in the near term" regarding the settlement approval.

C

C

Main Category

Crypto Mogul Changpeng Zhao – Fallen, Rich, and Rising Again?

As spring 2025 blooms and Easter’s themes of rebirth fill the air, Changpeng Zhao emerges as one of the most controversial figures of startup mythology: a man who fell spectacularly, paid a price—then rose again, wealthier and louder than ever. Once the almighty architect of Binance, CZ now resides in Dubai with a net worth that Forbes estimates at $63 billion.

P

P

Main Category

Prison Update: Sam Bankman-Fried Transferred to Low-Security Federal Prison in Los Angeles!

Sam Bankman-Fried (SBF), the founder of the now-defunct cryptocurrency exchange FTX, has been transferred to the Federal Correctional Institution (FCI) Terminal Island in Los Angeles, California. This low-security facility is known for housing non-violent offenders and has previously held notable inmates such as Ramesh "Sunny" Balwani, former COO of Theranos.

S

S

Main Category

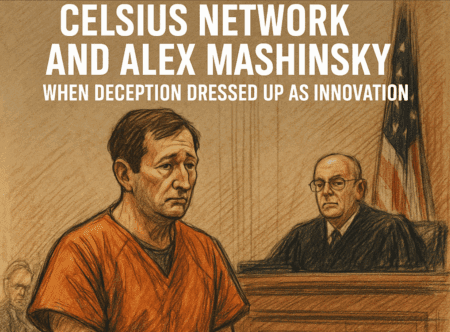

Startup on Trial: Celsius Network and Alex Mashinsky – When Deception Dressed Up as DeFi Innovation!

Celsius Network promised financial freedom through crypto, only to collapse into one of the most catastrophic failures in the DeFi sector. Founder Alex Mashinsky portrayed himself as the champion of the unbanked—yet behind the scenes, Celsius engaged in reckless trading strategies, misled customers, and operated more like a hedge fund than a lending platform.

Payment Processors

C

C

Main Category

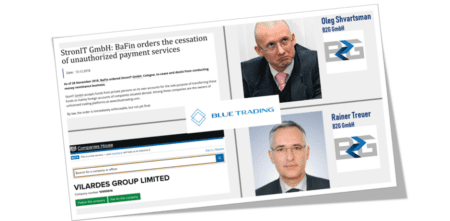

Cybercrime Legacy: The Status of Legal Actions Against B2G GmbH and Its Principals!

The case around the fraudulent binary options industry and its facilitating payment processors is still not closed. The illegal German payment processor B2G GmbH, operated by Rainer Treuer and Oleg Shvartsman, has been implicated in facilitating large-scale financial fraud. This report outlines the known details of their activities, the legal actions taken, and the unanswered questions surrounding their lack of prosecution.

O

O

Main Category

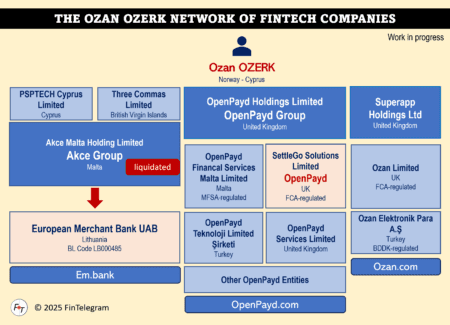

OpenPayd Founder Ozan Ozerk – Visionary Fintech Founder or High-Risk Enabler?

Ozan Ozerk is often portrayed in the media—most recently in a flattering Türkiye Today profile—as a visionary Turkish entrepreneur reshaping global finance through his fintech ventures, most notably OpenPayd, EMBank, and Ozan Elektronik Para. But as regulatory actions mount and his companies increasingly surface in investigations tied to high-risk payments, scam facilitation, and money laundering,

O

O

Main Category

OpenPayd Faces Regulatory Trouble in Malta After Investor Compensation Ruling!

OpenPayd, a Malta-licensed payment institution long flagged by FinTelegram for its involvement in facilitating high-risk transactions and supporting scam-related financial infrastructure, has now been officially held liable by Malta’s Financial Arbiter. The ruling follows an investigation into a case in which an elderly woman was aggressively manipulated by fraudsters and lost her investment through an account operated via OpenPayd’s virtual IBAN infrastructure.

F

F

Main Category

Financial Intelligence Report: The Disappearance of Magua Pay and Black Rabbit – A High-Risk Payment Processor in the Scam Broker Ecosystem

Magua Pay Inc., a Vancouver-based money services business (MSB license M21111044) operating under the brand Black Rabbit, has vanished from the digital landscape as of March 2025. Both its primary website (magua_pay.com) and Black Rabbit’s site are either under construction or offline, signaling potential operational collapse or regulatory pressure. FinTelegram exposed Magua Pay as a payment facilitator of broker scams and unauthorized broker schemes,

Cybercrime Court Cases

F

F

Main Category

Financial Intelligence Update: UK Lawsuit Against Google for Search Dominance Abuse

Google, a subsidiary of Alphabet Inc., has long dominated the global search engine market, commanding around 90% of global market share and an even higher percentage on mobile devices. This dominance has made Google the default gateway to the internet for billions of users and a critical platform for advertisers. However, such market power has drawn increasing scrutiny from regulators worldwide.

Regulatory Updates

S

S

Main Category

Startup on Trial: Binance and CZ – The Global Crypto Empire That Played by Its Own Rules

Binance, once celebrated as the world’s largest crypto exchange, fell from regulatory grace when founder Changpeng Zhao (CZ) pleaded guilty to money laundering charges in 2023. This case highlights how a tech behemoth grew rapidly by navigating around regulatory frameworks—and how global regulators, once slow to respond, eventually brought the empire to heel.

N

N

Main Category

New U.S. Ruling Confirms: Google Illegally Monopolized Online Ad Tech Markets!

Following FinTelegram’s recent investor alert warning of mounting legal and strategic risks for Alphabet Inc., the parent company of Google, a new U.S. court ruling has validated these concerns: U.S. District Judge Leonie Brinkema has found that Google unlawfully monopolized key markets in online advertising technology.

D

D

Main Category

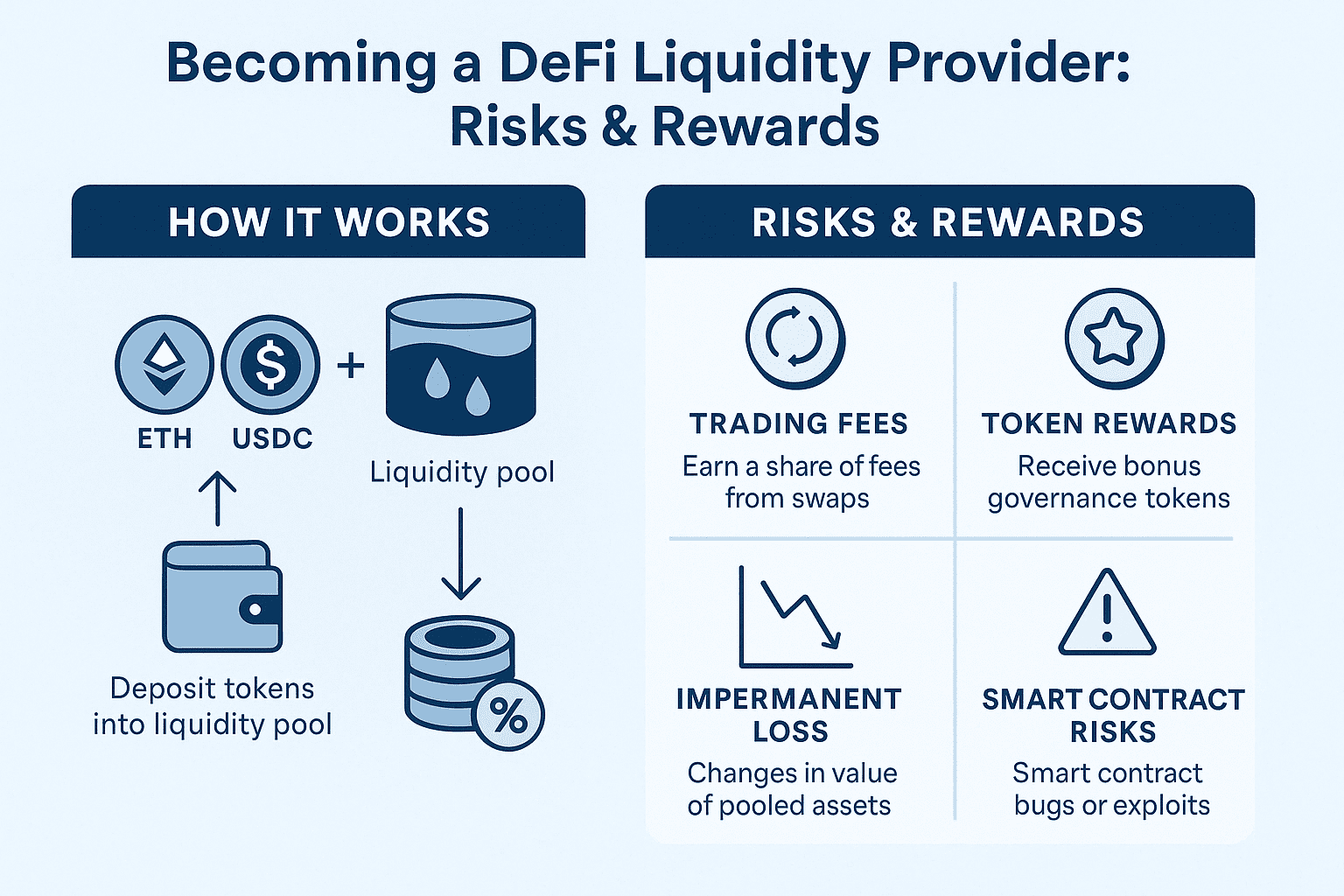

DeFi Education: What is a Liquidity Provider? Fueling DeFi’s Open Markets!

Liquidity Providers (LPs) are the silent engines that power DeFi markets, enabling decentralized exchanges, lending, and yield farming to function without intermediaries. But while LPs can earn trading fees and token rewards, they also expose themselves to risks like impermanent loss and smart contract exploits. In this third part of our FinTelegram DeFi Series, we explain who liquidity providers are, how liquidity pools work, and what dangers hide beneath the surface.

Support Scam Victims

Join the fight against cybercrime!

European Funds Recovery Initiative (EFRI) is a non-government organization with the mission to support scam and cybercrime victims.