The reverse takeover of NAGA Group by the Key Way Group, owner of the CySEC-regulated reatil broker CAPEX.com, appears to have reached its final stages. Initially announced in December 2023, the merger has now received regulatory approval, with the companies expecting to close the deal by the end of August 2024. The CAPEX.com client accounts will be transferred to NAGA, the company recently announced.

Under the terms of the agreement, CAPEX.com did a reverse merge into NAGA Group through a non-cash capital increase. This strategic move was designed to leverage the combined expertise and market reach of both companies. As part of the deal, CAPEX.com’s Founder and CEO, Octavian Patrascu, made a personal cash injection of $9 million into NAGA via a convertible bond, which also positioned him as the CEO of the newly merged public entity.

On August 19, 2024, CAPEX.com informed its customers that their trading accounts would be transferred to NAGA by August 30th, signaling the operational integration of the two platforms. CAPEX.com and its shareholders have committed an additional $15 million in equity to the business combination, providing much-needed liquidity to NAGA, which has faced significant financial challenges in recent years. After heavy losses in 2022, NAGA managed to reduce these losses in the first half of 2023 but continues to struggle with refinancing its debt obligations.

The merger is expected to generate $250 million in revenue over the next three years, with projected annual cost savings of around $10 million. The combined entity will have approximately 1.5 million registered users across more than 100 countries, with ambitious plans to increase this number to over 5 million by 2025/26. Financially, NAGA ended 2023 with €57.6 million in revenue, a 32% decline, and deepened losses of €60.9 million, up 40% from the previous year.

In addition to Patrascu’s new role, the merger also led to significant leadership changes, including the departure of NAGA’s founder, Ben Bilski, three months after the merger was announced.

This merger marks a critical step for NAGA and CAPEX.com as they seek to capitalize on their combined strengths and navigate the challenges of the rapidly evolving fintech landscape.

Capex Key Data

| Trading names | Capex Capex.com NAGA Clicktrades |

| Domains | https://nagamarkets.com https://capex.com https://clicktrades.com https://keywayinvestments.com https://www.keywayinvestments.ro |

| Legal entities | The Naga Group AG, Germany Naga Markets Europe Ltd, Cyprus Key Way Investments Ltd, Cyprus KW Investments Ltd, Seychelles |

| Jurisdictions | Cyprus, Seychelles |

| Regulators | CySEC for Key Way Investments Ltd with license no 292/16 CySEC for Naga Markets Europe Ltd with license no 204/36 FSA Seychelles for KW Investments Ltd |

| Payment options | Bank wire, alternative payments e-wallet |

| Payment providers | Unicredit Bank AG (via Payabl.cy Ltd d/b/a payabl) Astrobank Public Company Ltd PayPal, Rapid, Skrill |

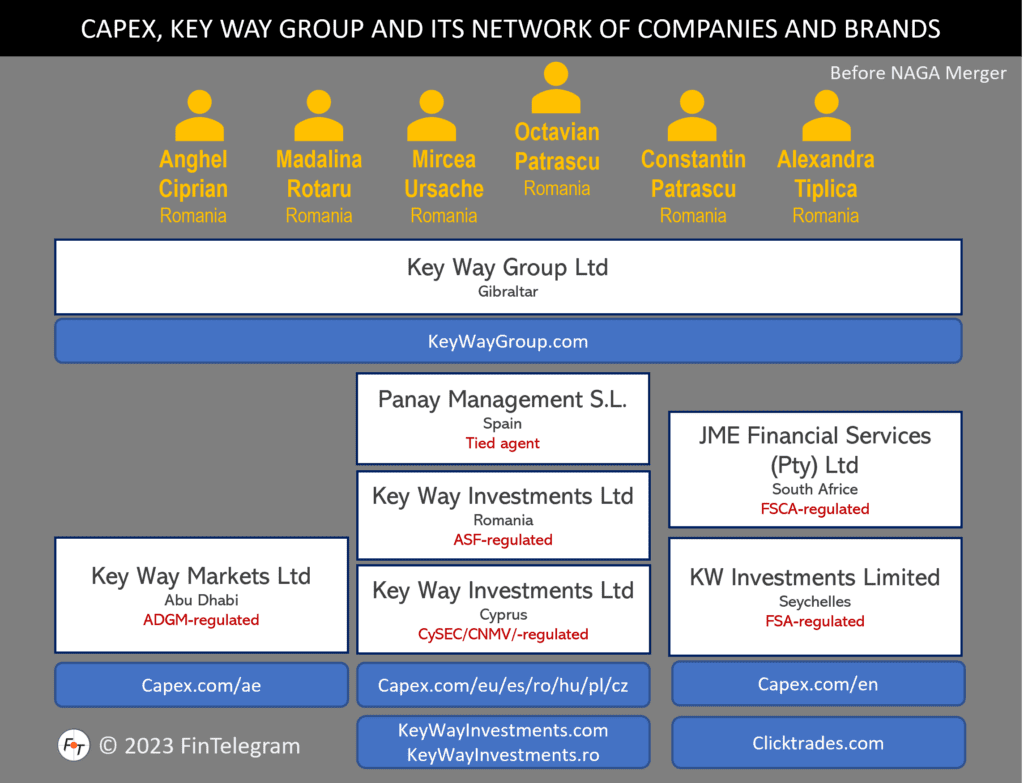

| Related individuals | Octavian Patrascu Constantin Patrascu Anghel Ciprian Mircea Ursache Madalina Rotaru |

Share Information

If you have any information about Key Way Group, its brokers Capex or clicktrades, or the acting persons and partners, please share it with us via our whistleblower system, Whistle42.