MicroStrategy ($MSTR), led by Michael Saylor, has once again made headlines with its latest Bitcoin acquisition. The company purchased 20,356 BTC for approximately $1.99 billion at an average price of $97,514 per bitcoin12. This move brings MicroStrategy‘s total Bitcoin holdings to approximately 499,096 BTC, acquired at an average price of $66,357 per Bitcoin, totaling about $33.1 billion.

Market Reaction and Price Movement

Since the announcement, Bitcoin’s price has experienced a significant decline, dropping below $90,00010. This downturn has raised concerns about MicroStrategy‘s strategy and its potential consequences:

- Unrealized Losses: With Bitcoin trading below the recent purchase price, MicroStrategy is facing unrealized losses on its latest acquisition.

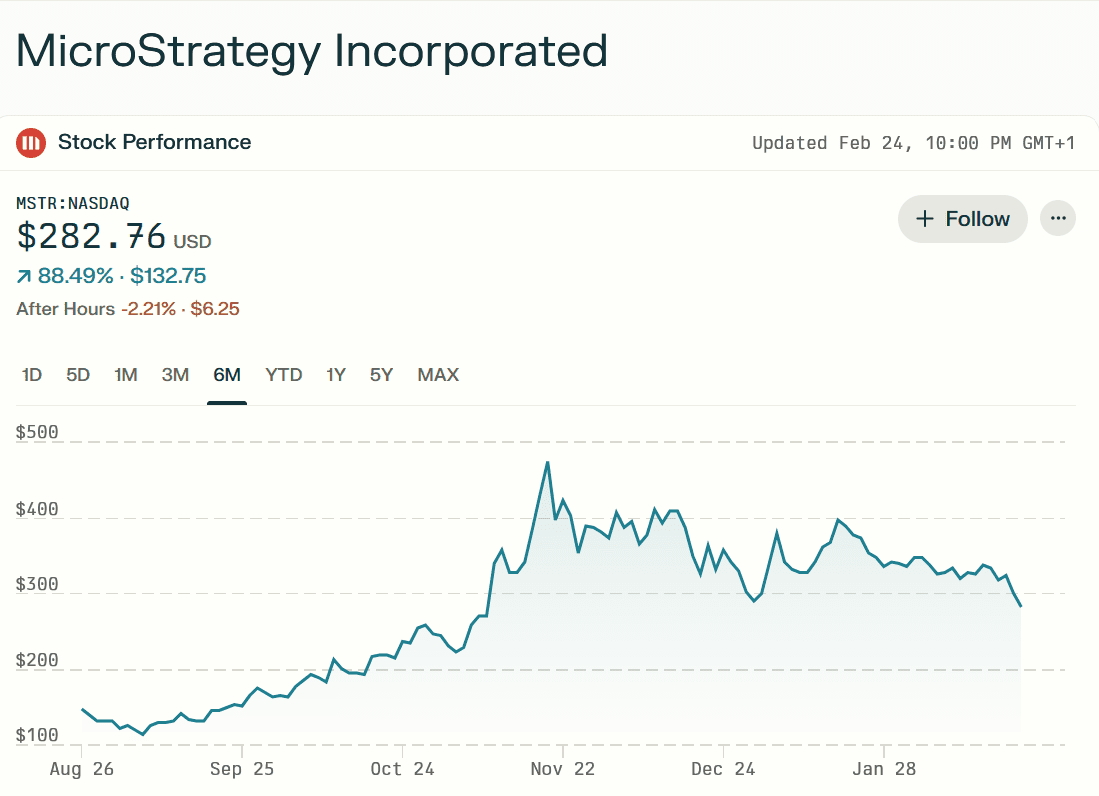

- Stock Performance: MSTR stock has declined by 5.65% to $282.76, reflecting investor concerns about the company’s Bitcoin-centric strategy.

- Market Capitalization: Despite the recent drop, MicroStrategy‘s market cap remains substantial at $73 billion.

Potential Consequences for MicroStrategy

- Financial Stability Concerns: The sharp decline in Bitcoin prices could potentially jeopardize MicroStrategy’s financial stability, raising concerns about debt repayment and the risk of bankruptcy3.

- Margin Call Risk: While much of MicroStrategy’s debt comprises unsecured convertible notes, reducing the immediate risk of forced liquidation, a sustained Bitcoin price decline could still pressure the company’s finances5.

- Amplified Volatility: As MicroStrategy accumulates more Bitcoin at higher prices, the impact of future price downturns on the company’s portfolio becomes more pronounced5.

Analysts & Market Observer Opinions

- Cautious Outlook: Some financial experts, like David Krause, warn that a significant decline in Bitcoin prices could severely impact MicroStrategy‘s ability to repay debts.

- Cyclical Strategy Concerns: Analyst Jacob King notes that MicroStrategy‘s strategy of raising funds to purchase Bitcoin is effective only if prices continue to rise, potentially leading to a collapse if prices stagnate or crash.

- Long-term Confidence: Despite short-term volatility, MicroStrategy remains bullish on Bitcoin. CEO Michael Saylor has previously predicted Bitcoin could reach $13 million per BTC by 2045.

- Market Impact: MicroStrategy‘s large purchases are seen as attempts to “catch the bottom” of the market, potentially influencing market sentiment.

Conclusion

While MicroStrategy‘s aggressive Bitcoin acquisition strategy has positioned it as a major player in the crypto market, the recent price downturn has heightened concerns about the company’s financial stability and strategy sustainability. Investors should closely monitor Bitcoin’s price movements and MicroStrategy‘s financial health in the coming months, as these factors will likely have a significant impact on the company’s future performance and market perception.