Introduction

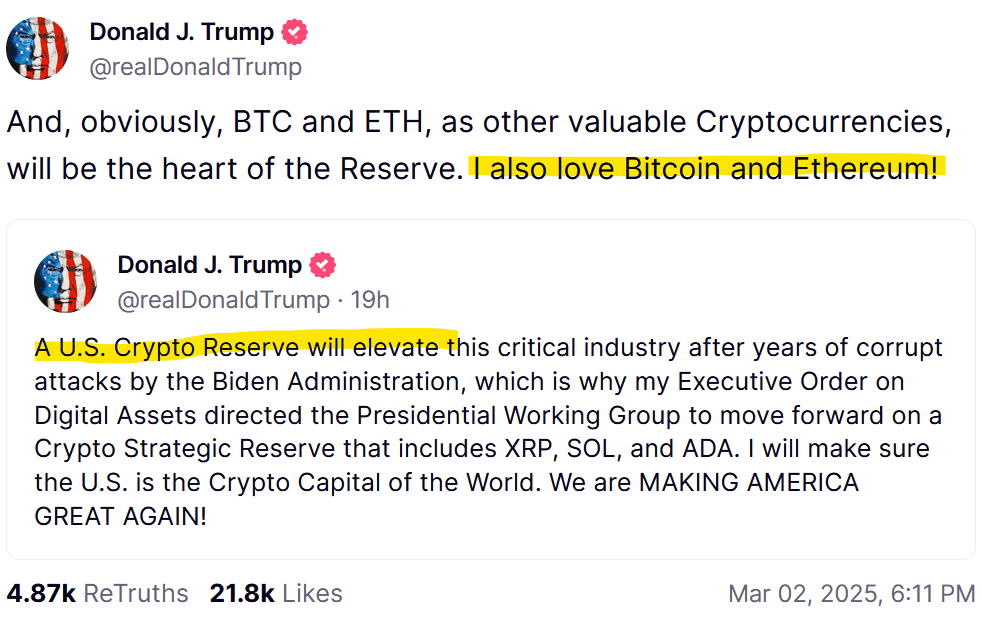

On March 2, 2025, U.S. President Donald Trump announced via Truth Social the creation of a U.S. Crypto Strategic Reserve, a landmark move signaling a significant shift in the federal government’s approach to digital assets. The reserve will reportedly include five major cryptocurrencies—Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA)—with indications that more digital assets may be added in the future. This announcement builds on Trump’s earlier January 23, 2025, executive order titled Strengthening American Leadership in Digital Financial Technology, which directed a working group to explore a national digital asset stockpile and propose a regulatory framework for cryptocurrencies.

Context of the Announcement

The announcement follows a turbulent period for cryptocurrencies in early 2025. After a post-election rally in November 2024, fueled by Trump’s pro-crypto campaign promises, digital asset prices slumped significantly, with Bitcoin dropping 21% from its January peak of $109,071 and erasing much of its earlier gains. Analysts attributed this decline to macroeconomic uncertainty, including hawkish U.S. Federal Reserve monetary policy and Trump’s tariff threats, as well as a lack of concrete policy action beyond the dismissal of some U.S. Securities and Exchange Commission (SEC) cases. The crypto industry had grown increasingly frustrated by the absence of a clear regulatory framework or tangible steps toward a promised Bitcoin reserve.

Trump’s March 2 announcement appears timed to reinvigorate the market ahead of the first White House Crypto Summit, scheduled for Friday, March 7, 2025. The inclusion of specific cryptocurrencies suggests the administration is moving beyond vague commitments to a more defined strategy, potentially leveraging assets seized through law enforcement actions (estimated at 200,000 BTC, worth approximately $21 billion) as a foundation for the reserve.

Concept of the U.S. Crypto Strategic Reserve

A strategic reserve typically involves a government maintaining a stockpile of critical resources—such as oil or gold—to mitigate crises, stabilize markets, or assert economic dominance. The U.S. Crypto Strategic Reserve adapts this concept to digital assets, positioning cryptocurrencies as a strategic financial tool. The reserve could serve multiple purposes:

- Market Stabilization: By holding a significant amount of BTC, ETH, XRP, SOL, and ADA, the U.S. could influence crypto prices, counteracting volatility or supporting valuations during downturns.

- Economic Hedge: Proponents argue that cryptocurrencies, particularly Bitcoin, could act as a hedge against inflation or dollar depreciation, complementing traditional reserves like gold.

- Global Leadership: Incorporating digital assets into national reserves could position the U.S. as a leader in the crypto economy, countering moves by nations like China and El Salvador, which have embraced Bitcoin in varying capacities.

- Debt Reduction Potential: Advocates, including Senator Cynthia Lummis, suggest that a rising Bitcoin price could generate profits to offset the U.S. national debt, estimated at over $35 trillion.

The mechanics remain unclear. The reserve might initially draw from seized cryptocurrencies, avoiding immediate taxpayer funding, though Trump has not ruled out open-market purchases. Legal experts are divided on whether Congressional approval is required or if the Treasury’s Exchange Stabilization Fund could be repurposed for this initiative.

Potential Impact on the Crypto Segment

The announcement has already triggered a sharp market response, with Bitcoin rising over 11% to $94,164 and Ethereum climbing 13% to $2,516 within hours on March 2. The broader crypto market gained approximately $300 billion in value, per CoinGecko data. Potential impacts include:

- Price Appreciation: Government backing could drive demand and prices for the named cryptocurrencies, particularly BTC and ETH, which Trump emphasized as the “heart of the reserve.” Lesser-known assets like XRP, SOL, and ADA may see outsized gains due to their inclusion.

- Institutional Adoption: A national reserve could accelerate institutional investment, as banks and sovereign wealth funds—already increasing allocations to Bitcoin ETFs in Q4 2024—view this as a legitimizing signal.

- Regulatory Clarity: The reserve’s establishment may necessitate a clearer regulatory framework, potentially boosting confidence but also introducing oversight that could constrain speculative trading.

- Market Sentiment: The move counters recent bearishness, though sustainability depends on implementation details and broader economic conditions, such as Federal Reserve interest rate decisions.

- Risks: Including less-established assets like SOL and ADA raises concerns about volatility or collapse, as seen with Terra in 2022. A misstep could damage the administration’s credibility and the crypto market’s reputation.

Feedback from the Financial and Crypto Industries

The announcement has elicited a mix of enthusiasm, skepticism, and cautious optimism from industry stakeholders:

- Crypto Industry Enthusiasm: Federico Brokate of 21Shares called it a “shift toward active participation in the crypto economy,” predicting accelerated institutional adoption and U.S. leadership in digital innovation. Posts on X reflect bullish sentiment, with users like @MaxBr0wn_BTC declaring “ALTSEASON IS CONFIRMED.”

- Financial Analyst Caution: Standard Chartered’s Geoff Kendrick remains optimistic, sticking to a $500,000 Bitcoin target by the end of Trump’s term, citing potential new buyers. However, IG’s Tony Sycamore warned that using seized assets alone is less bullish than direct purchases, as it represents a “transfer between accounts” rather than fresh capital.

- Mixed Industry Reactions: James Butterfill of CoinShares expressed surprise at the inclusion of XRP, SOL, and ADA, labeling them “tech investments” rather than pure stores of value like Bitcoin. He suggested this reflects a “patriotic stance” rather than a focus on fundamentals, raising questions about selection criteria.

- Skeptics and Critics: Economist Jason Furman questioned the funding mechanism on X, asking, “Where is this money coming from? We are already trillions in debt.” Some analysts worry that tying national policy to volatile assets could backfire if prices crash or if regulatory overreach follows.

Conclusion

Trump’s announcement of a U.S. Crypto Strategic Reserve on March 2, 2025, marks a pivotal moment for the cryptocurrency sector, elevating its status within national financial strategy. While the immediate market surge reflects renewed optimism, the long-term impact hinges on execution—how the reserve is funded, which assets are prioritized, and how regulations evolve. The crypto industry welcomes the move as validation, but financial analysts remain divided on its fiscal prudence and market implications. As details emerge from the upcoming White House Crypto Summit, this initiative could either cement the U.S. as the “Crypto Capital of the World” or expose it to unprecedented risks in an already volatile asset class.