Executive Summary

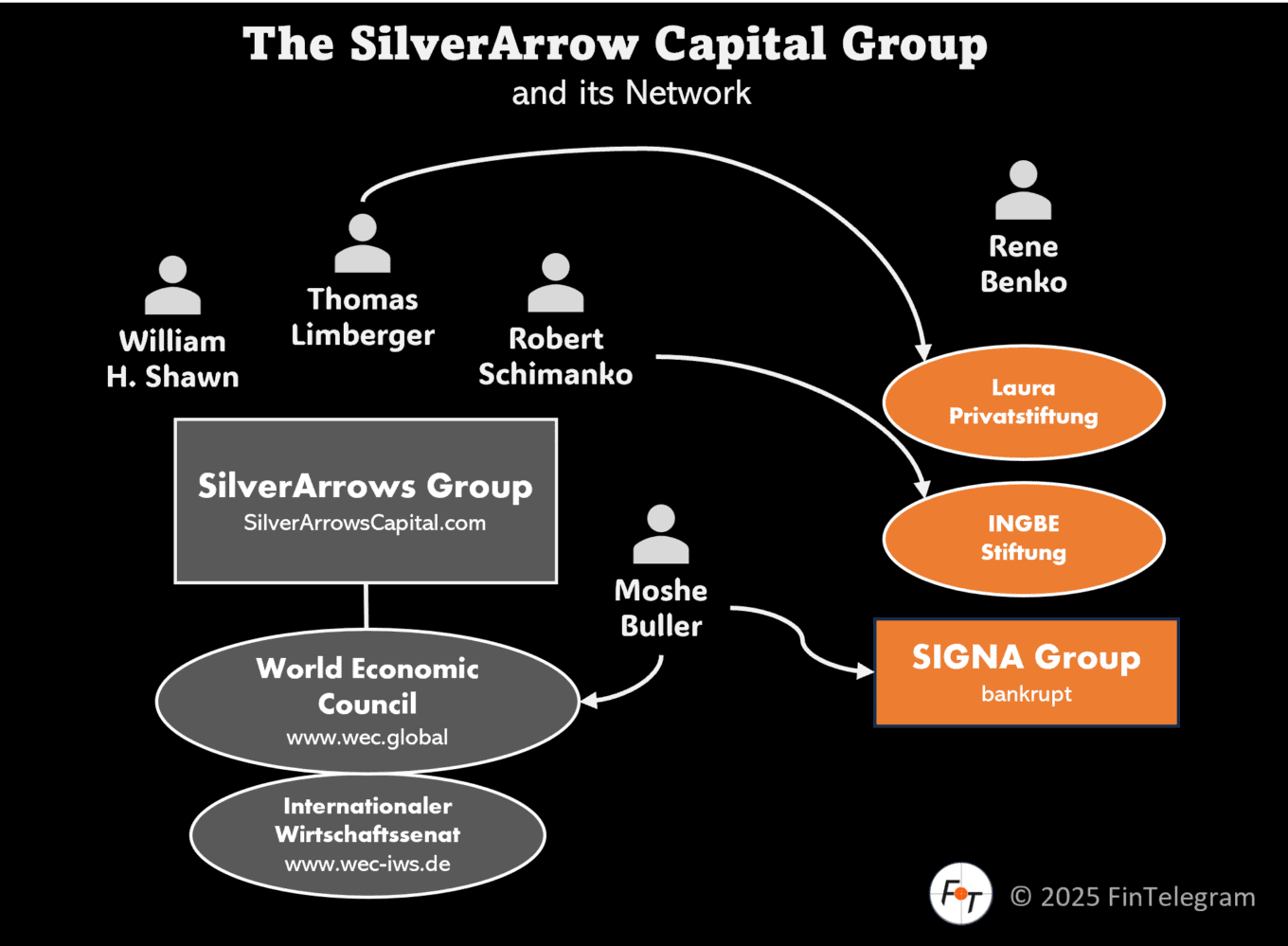

SilverArrows Capital Group (website), a global investment and advisory firm associated with high-profile figures such as Thomas Limberger, Robert Schimanko, and William H. Shawn, has recently come under scrutiny due to its proximity to the scandalous bankruptcy of Rene Benko’s Signa Group. The firm and its key personnel maintain strong ties to two seemingly influential yet opaque organizations in Germany and Austria:

- The World Economic Council (WEC), registered in Vienna (wec.global), and its counterpart,

- Internationaler Wirtschaftssenat (IWS-WEC), registered in Berlin (wec-iws.de).

Given the financial and legal entanglements of these entities, investors should exercise heightened due diligence when assessing involvement with SilverArrows Group and its network.

Key Individuals & Their Roles

Based on the available documents, the following persons can be identified as the key persons around the SilverArrows Capital Group and its extended network.

- Thomas Limberger – A former Oerlikon CEO and seasoned corporate executive, Limberger has a track record of managing high-stakes transactions.

- Founder of at SilverArrow Capital Group (download CV)

- In November 2024, he was appointed to the board of the Laura Private Foundation, a foundation tied to Benko’s financial sphere, according to Austrian public prosecutors.

- He is also a key player in SilverArrows Group, where he operates alongside Robert Schimanko and William H. Shawn.

- Robert Schimanko – A former banker with documented ties to major financial scandals, including alleged links to the Manhattan Investment Fund (MIF) fraud and the Madoff Ponzi scheme.

- Partner at SilverArrow Capital Group (Download CV)

- In November 2024, he was appointed to the board of the INGBE Stiftung (Foundation), another foundation under Benko’s alleged control.

- Austrian prosecutors suspect that he facilitated a transfer of assets from the Signa Group, given that he was reportedly purchasing private luxury items from the Signa estate on behalf of Benko.

- William H. Shawn – A US-based attorney who recently threatened legal action against the investigative platform Wiener Zocker for its reporting on Schimanko.

- Partner at SilverArrow Capital Group.

- Notably, Shawn did not disclose his various entanglements with Schimanko, SilverArrows Group, or WEC, instead presenting himself solely as Schimanko’s lawyer.

- His role within SilverArrows Group and WEC raises questions about the firm’s legal and financial strategies.

- Moshe Buller – An Israeli intelligence operative who has worked for both WEC and Signa Group.

- In 2023, Buller was reported to have conducted private intelligence operations for Signa Group, spying on business partners.

- His role as a WEC ambassador ties him directly into the same network as Limberger, Schimanko, and Shawn.

WEC, IWS-WEC & SilverArrows Group: A Complex Network

According to its brochure (download here), SilverArrow Capital Americas, LLC, is a Delaware limited liability company formed in 2017. It is owned equally by Robert Schimanko, William H. Shawn, and SilverArrow Capital Guernsey LTD. SilverArrow‘s UK (United Kingdom) affiliate, SilverArrow Capital LLP, began offering investment services in 2010 and continues to offer such investment advisory services in the UK.

SilverArrow provides investment advising and arranging services for eligible counterparties and professionals such as institutional clients (i.e., funds, banks, etc.) and high net-worth individual clients (qualified investors only).

Both the Vienna-based World Economic Council (WEC) and its Berlin-based IWS-WEC counterpart are registered entities with significant business and political influence. However, their exact operational scope and financial dealings remain opaque.

- WEC operates as an exclusive business network, boasting high-profile members such as Limberger, Schimanko, and Buller.

- IWS-WEC positions itself as an international economic and security think tank, yet its leadership mirrors that of WEC, raising questions about its independence.

- SilverArrows Group, which shares members with both entities, appears to be an investment vehicle that navigates between these networks, leveraging their political and financial influence.

The interconnection between these organizations, Signa Group, and the recent legal threats against journalists suggests a broader attempt to control narratives and financial movements. Investors should closely monitor developments surrounding WEC and SilverArrows Group, particularly in light of potential regulatory actions.

SilverArrows and the Benko Bankruptcy: What Investors Need to Know

The collapse of Signa Group has evolved into a global scandal, with financial and legal repercussions reaching the United States, Europe, and the Middle East. The following factors should be considered:

- Unclear Financial Involvement

- SilverArrows Group personnel have taken leadership roles in Benko-linked foundations (Laura Privatstiftung & INGBE Stiftung).

- This suggests continued influence over assets linked to Signa’s collapse.

- Suspicious Asset Transfers

- Schimanko’s acquisition of luxury goods from the Signa estate raises concerns of asset shifting, as suspected by Austrian prosecutors.

- If substantiated, this could lead to serious legal consequences for all involved.

- Legal & Reputational Risks

- Recent legal threats by William H. Shawn against Wiener Zocker highlight an aggressive stance against media scrutiny.

- If SilverArrows Group and WEC-linked entities are found to be obstructing investigations, they could face litigation, asset freezes, or regulatory action.

- Intelligence & Surveillance Concerns

- Moshe Buller’s involvement in private intelligence work for Signa Group signals the use of non-traditional financial risk mitigation strategies, which could expose investors to legal and ethical dilemmas.

Investment Considerations & Risk Assessment

Key Risks: ✅ Regulatory Scrutiny: Given the ongoing investigations into Signa Group, any entity linked to its financial network could be subject to audits, asset freezes, or legal actions. ✅ Reputational Risk: Associations with individuals involved in financial scandals, intelligence operations, and aggressive legal tactics could damage investor credibility. ✅ Lack of Transparency: The true nature of SilverArrows Group’s financial activities remains unclear, making due diligence difficult. ✅ Potential Asset Exposure: If Benko still controls assets via the foundations SilverArrows executives oversee, these assets could become targets of legal recovery efforts.

Strategic Recommendations:

- Enhanced Due Diligence: Any investor considering exposure to SilverArrows Group or WEC-linked entities should conduct rigorous background checks.

- Monitor Regulatory Developments: With investigations ongoing, new revelations could impact investment security.

- Assess Legal Liabilities: Investors should evaluate potential legal exposure when engaging with SilverArrows and its network.

- Reputation Management: Associations with high-risk individuals and opaque networks could jeopardize institutional credibility.

Conclusion: Proceed with Caution

SilverArrows Group, its affiliates, and the World Economic Council (WEC) network represent an intriguing yet high-risk investment landscape. The firm’s proximity to the ongoing Signa scandal, questionable asset movements, and aggressive legal tactics raise red flags that cannot be ignored.

As investigations into Signa Group and its financial entanglements intensify, investors must exercise extreme caution before engaging with entities or individuals connected to SilverArrows Group, WEC, or IWS-WEC.

The global ramifications of this scandal are still unfolding, and the true role of SilverArrows and its affiliates in the Benko saga remains an open question.