The Libra token ($LIBRA) scandal has escalated into one of the most significant cryptocurrency controversies of 2025, with a class-action lawsuit filed in New York spotlighting alleged misconduct by key players in the token’s launch. Here are the latest developments surrounding this debacle, including the legal action initiated by Burwick Law against Kelsier Ventures, KIP Protocol, and Meteora, as well as the broader implications for the crypto market and investors.

Background of the Libra Token Scandal

Launched on February 14, 2025, on the Solana blockchain, the $LIBRA token was initially promoted as a groundbreaking economic initiative tied to Argentina’s recovery efforts, gaining significant traction after an endorsement from Argentine President Javier Milei on social media platform X. Marketed under the banner “Viva La Libertad” (Long Live Freedom), the token promised to fund private-sector projects such as small businesses and startups. Its market capitalization briefly soared to over $4.5 billion within hours of launch, fueled by hype and Milei’s public backing. However, the token’s value crashed by 94% shortly after, erasing over $250 million in investor funds and sparking allegations of a “rug pull” scam.

Blockchain research from firms like Nansen and Bubblemaps has since revealed a troubling picture: insiders allegedly withdrew approximately $107 million from liquidity pools shortly after trading began, leaving retail investors holding near-worthless tokens. Of the 15,430 largest $LIBRA wallets analyzed, 86% sold at a loss, totaling $251 million, while a small group of 2,101 wallets—linked to insiders—pocketed $180 million in profits. This stark disparity has fueled outrage and drawn comparisons to previous memecoin scandals.

The New York Lawsuit

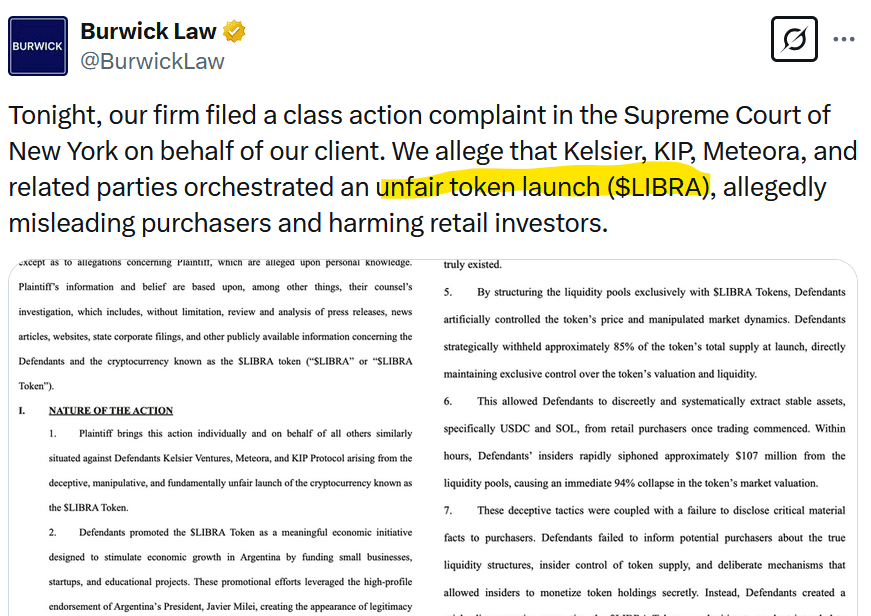

On March 17, 2025, Burwick Law filed a class-action lawsuit in the Supreme Court of New York against Kelsier Ventures, KIP Protocol, and Meteora, accusing them of orchestrating a “deceptive, manipulative, and fundamentally unfair” token launch. The complaint alleges that the defendants employed a one-sided liquidity model—unlike the typical two-sided structures in decentralized finance (DeFi)—to artificially inflate $LIBRA’s price and create an illusion of stability. Approximately 85% of the token supply was reportedly withheld at launch, allowing insiders to control market dynamics and extract massive profits at the expense of retail traders.

The lawsuit claims that Kelsier Ventures, led by CEO Hayden Davis, along with KIP Protocol and Meteora, failed to disclose critical details about the token’s liquidity structure and insider control, misleading investors who believed $LIBRA was a legitimate economic tool. Within hours of trading, insiders allegedly siphoned $107 million in stablecoins (such as USDC and SOL) from the liquidity pools, triggering the catastrophic price collapse. Burwick Law is seeking compensatory and punitive damages, the return of “unjustly obtained” profits, and injunctive relief to prevent similar schemes in the future.

Key Players and Responses

- Kelsier Ventures and Hayden Davis: Kelsier Ventures, a Delaware-registered firm, and its CEO Hayden Davis are at the center of the scandal. Davis, who reportedly netted around $100 million from the launch, has denied direct ownership of the tokens and claims he has no intention of selling them. However, his credibility has been questioned following reports of prior involvement in controversial memecoin projects like MELANIA, and an Argentine lawyer has requested an Interpol red notice for his arrest. Davis has also faced accusations of bribing Argentine officials, including Milei’s sister, Karina Milei, to secure presidential support—claims he has not fully addressed.

- KIP Protocol: KIP Protocol has distanced itself from the launch, asserting that it was solely responsible for post-launch technical oversight and project selection, not the token issuance or market-making. The firm denies profiting from $LIBRA and claims it faced significant “fear, uncertainty, and doubt” (FUD) following the crash, including threats against its staff.

- Meteora: As the DeFi platform hosting $LIBRA’s liquidity pools, Meteora has been implicated for enabling the alleged predatory structure. Co-founder Ben Chow resigned in February amid the fallout, with the firm’s leadership citing a “lack of judgment” in its operations. Meteora has not yet issued a detailed response to the lawsuit.

- Javier Milei: President Milei, whose endorsement initially propelled $LIBRA’s hype, has attempted to backtrack, claiming he merely “spread the word” rather than actively promoted the token. His involvement has sparked political repercussions in Argentina, with opposition parties calling for his impeachment—efforts that have so far gained little traction.

Market and Investor Impact

The $LIBRA scandal has sent shockwaves through the crypto market, particularly the memecoin and altcoin sectors. Analysts suggest that the fallout could dampen enthusiasm for similar projects in the short term, with QCP Capital noting a potential “long suppression” of altcoin markets. Bitcoin’s market share has climbed to a four-year high of 60%, reflecting a flight to safety amid the turmoil. Meanwhile, the scale of investor losses—estimated at over $250 million—has intensified scrutiny of DeFi platforms and token launchpads like Meteora and Pump.fun, with calls for stricter oversight growing louder.

Financial Analysis and Outlook

From a financial perspective, the $LIBRA incident underscores the inherent risks of memecoins and hype-driven crypto projects. The token’s rapid rise and fall highlight the dangers of concentrated supply control and opaque liquidity mechanisms, which can be exploited by insiders to devastating effect. The involvement of a high-profile figure like Milei adds a layer of complexity, illustrating how political endorsements can amplify both gains and losses in speculative markets.

For investors, the lawsuit’s outcome could set a precedent for accountability in the crypto space. If successful, it may force greater transparency in token launches and deter similar schemes. However, recovering funds from decentralized systems remains notoriously difficult, and retail investors may see little restitution even if the plaintiffs prevail. Hayden Davis’s claim of “reinvesting” his $100 million haul into $LIBRA lacks substantiation and seems unlikely to restore trust or value.

Conclusion

As of March 19, 2025, the Libra token scandal remains a cautionary tale of greed, manipulation, and misplaced trust in the crypto ecosystem. The New York lawsuit against Kelsier Ventures, KIP Protocol, and Meteora is a critical step toward holding the alleged orchestrators accountable, but the broader fallout—financial, political, and regulatory—will likely reverberate for months. Investors should exercise extreme caution with memecoins and unvetted projects, while the industry braces for potential reforms to prevent such debacles in the future. The Supreme Court of New York’s review will be closely watched, as its ruling could reshape the landscape of decentralized finance and token launches.