Excerpt:

Swiss entrepreneur in Thurgau and coffee king Arthur Eugster has reportedly lost CHF 650 million in the collapse of Rene Benko’s Signa empire—one of the largest individual financial losses in Swiss history. As public prosecutors in Austria probe the inner circle of Benko’s fraudulent network, two familiar names from past scandals resurface: Robert Schimanko and Thomas Limberger. Both men, now linked to Benko’s foundations and operating under the radar, have longstanding reputations in financial scandals stretching from New York to Zurich.

Key Points:

- Arthur Eugster, Swiss coffee mogul, has declared losses of CHF 650 million linked to Signa Group—the largest private loss ever confirmed in Switzerland due to a single corporate collapse.

- In mid-2023, Eugster and Swiss chocolatier Ernst Tanner wired CHF 35 million to Benko, which was allegedly recycled through Benko’s own foundation and falsely declared as his own equity injection.

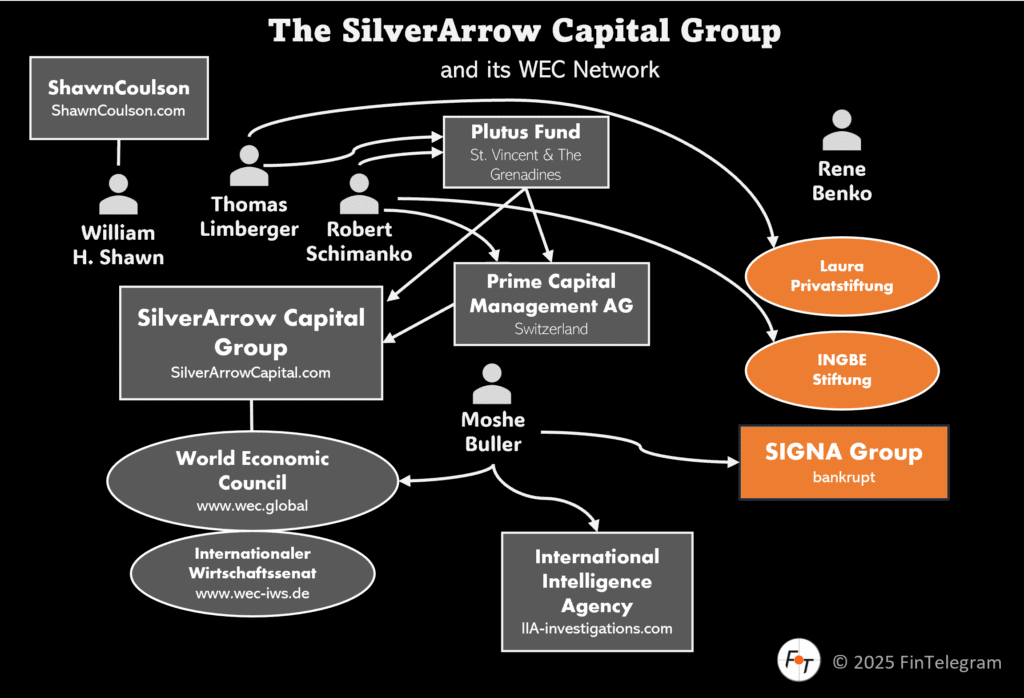

- Robert Schimanko and Thomas Limberger, both previously linked to controversial financial operations, joined the board of Benko’s foundations before the collapse.

- Schimanko has a history of involvement in financial scandals such as the Manhattan Investment Fund (MIF) and Madoff, while Limberger played a key role in Russian-linked corporate takeovers during his time at Oerlikon and Von Roll. Both have apparently had an intensive business relationship since the Oerlikon takeover, resulting in the partnership in SilverArrow Capital Group.

- Both are currently associated with the SilverArrow Capital Group and the World Economic Council (WEC)—entities increasingly seen as shells for financial engineering. Schimanko is the founder, Chairman and CEO of Prime Capital Management AG, which is part of the SilverArrow Capital Group (Source: SEC filing).

- Schimanko and Limberger are directors of Pluto Fund Management Ltd and Pluto Fund Ltd in Saint Vincent and The Grenadines. The fund is part of the SilverArrow Capital Group.

Short Narrative:

The collapse of Rene Benko’s Signa empire is no longer just an Austrian real estate crisis—it is now a continental financial scandal with global echoes. According to the Swiss investigative platform Inside Paradeplatz, Arthur Eugster, a titan of Switzerland’s coffee machine industry, has admitted to prosecutors that he lost CHF 650 million in the now-bankrupt Benko empire. His blind trust in Benko—who is currently in pre-trial detention—highlights not only reckless investment decisions, but also the effectiveness of Benko’s inner circle in manipulating elite investors.

Read more about the SilverArrow Capital Group here.

The Question: Why?

FinTelegram’s ongoing investigations into the toxic ecosystem surrounding Signa’s collapse have identified two men deeply embedded in this story: Robert Schimanko, an Austrian financier operating out of Switzerland, and Thomas Limberger, a German national and a former Swiss corporate executive. Both have quietly joined the boards of the INGBE Stiftung and Laura Privatstiftung just before the empire imploded. Allegedly, Schimanko’s connections to Rene Benko go back to at least 2008. So, it’s been a long time, not fresh love.

This would not be the first time that Schimanko and Limberger have appeared in connection with murky financial operations. Schimanko was named in connection with the $400 million Manhattan Investment Fund fraud, and has had prior links to Bernie Madoff’s Austrian feeder networks, yet somehow always escaped indictment. Limberger, meanwhile, was CEO of Oerlikon during its controversial restructuring funded by Russian oligarch Viktor Vekselberg—another chapter of post-Soviet wealth movements through Swiss corporate shells.

What role did these two play in Benko’s late-stage asset-shuffling and foundation maneuvering? Were Swiss private investors like Eugster and Tanner set up to inject funds into a collapsing structure orchestrated by shadow directors with a history of financial engineering?

Forensic Risk Analysis: Why This Matters in the Benko-Signa Collapse

The employment and registration history revealed in an SEC filing positions Schimanko at the intersection of Swiss capital structures, offshore secrecy vehicles, and failed real estate schemes. This supports several red-flag connections:

1. SilverArrow & Signa: A Hidden Nexus

- SilverArrow Capital Group, through its Swiss and U.S. arms, is deeply intertwined with Thomas Limberger, who joined Benko’s INGBE Foundation alongside Schimanko just before Benko’s arrest.

- The role of SilverArrow in potentially channeling funds or advising asset protection maneuvers remains unclear but suspicious given the group’s history of operating across opaque jurisdictions.

2. St. Vincent-Based Pluto Fund: Possible Asset Shielding Vehicle

- The Pluto Fund’s location in St. Vincent and the Grenadines, known for lax oversight, raises questions about asset routing and laundering risks—particularly in the context of a billion-euro real estate collapse.

- Schimanko’s control over both the fund and its management company gives him complete oversight of fund flows—a potential tool for covert transfers, creditor evasion, or last-minute asset stripping.

Actionable Intelligence:

Given the size of Eugster’s losses and the recurring names of financial fixers involved, Swiss and Austrian prosecutors must investigate the inner workings of Benko’s advisory and foundation structures—especially the roles played by Schimanko and Limberger. Their longstanding patterns of activity and proximity to scandals suggest they may have acted as gatekeepers, enablers, or facilitators within the toxic final months of the Signa collapse.

Call for Information:

If you have inside information on the role of Robert Schimanko, Thomas Limberger, or SilverArrow Capital in the Benko and Signa case, FinTelegram urges you to reach out confidentially. We offer full whistleblower protection and may reward critical intelligence through our Whistle42 program.