Dr. Ozan Ozerk is often portrayed in the media—most recently in a flattering Türkiye Today profile—as a visionary Turkish entrepreneur reshaping global finance through his fintech ventures, most notably OpenPayd, European Merchant Bank (EMBank), and Ozan Elektronik Para. But as regulatory actions mount and his companies increasingly surface in investigations tied to high-risk payments, scam facilitation, and money laundering, a different picture emerges—one far removed from polished PR interviews and well-lit headlines.

The Public Image: A Fintech Visionary with Global Reach

The timing of the Türkiye Today article (March 26, 2025) is notable. It follows the OCCRP “Scam Empire” investigation and a damning ruling from Malta’s financial arbiter, which held OpenPayd liable for misdirecting funds to crypto exchanges used by scammers. With this backdrop, one must ask: is Ozan Ozerk’s media push part of a broader reputation management campaign to deflect attention from growing regulatory scrutiny?

Ozerk presents himself as a global fintech innovator. His achievements as a fintech entrepreneur are indeed impressive:

- A former medical doctor turned fintech mogul.

- Founder of OpenPayd (UK), EMBank (Lithuania), and Ozan Elektronik Para (Türkiye).

- Advocates for blockchain, stablecoins, and real-time FX settlement.

- Promotes Türkiye as a fintech bridge between Europe and Asia.

- Positions himself as an expert on regulatory evolution, especially in crypto.

According to Türkiye Today and other outlets, OpenPayd handles over $100 billion in annual payments, holds 60 licenses globally, and operates across 100+ countries. He praises Türkiye’s financial infrastructure, touting its superiority even to advanced economies, and positions himself as a thought leader on blockchain’s future in FX trading.

The Complex Corporate Web of Ozan Ozerk

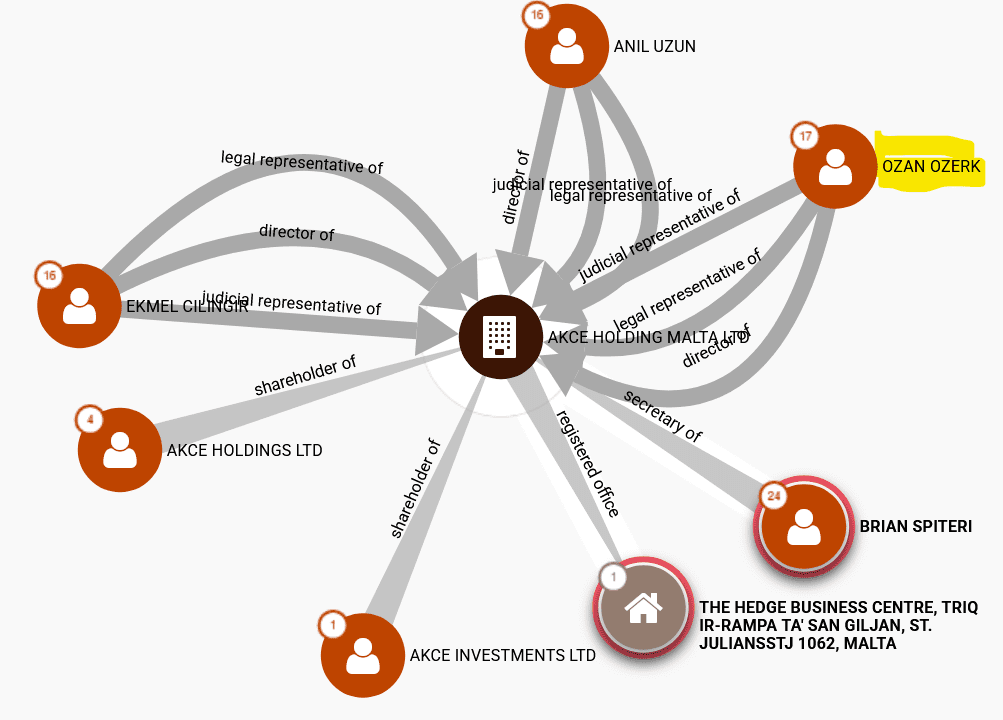

Ozan Ozerk, the co-founder behind OpenPayd, has deep roots in the online gambling and payment facilitation sectors. His extensive corporate network spans multiple jurisdictions and regulatory regimes, raising transparency and governance questions.

Key Points

- Origins in Gambling & Payment Facilitation: Ozan Ozerk’s early business ventures were linked to the online gambling and casino industry.

- Malta-Based Foundations: He established the Akce Group in Malta, which subsequently founded EMBank in Lithuania (2018).

- Akce Holding Status: According to Northdata, Akce Holding Malta Ltd has since been liquidated.

- Offshore Connections: Ozerk and his former business partner Anil Uzun are listed in the ICIJ Offshore Leaks Database.

- OpenPayd Evolution: Together, Ozerk and Uzun co-founded ClearSettle and SettleGo Solutions, the latter of which later became OpenPayd.

- Dispute & Separation: The Ozerk-Uzun partnership ended in a dispute before Ozerk took over and rebranded SettleGo.

- Corporate Residency: Ozerk claims Cypriot citizenship and lists the UK as his residence in Companies House filings.

- Current Corporate Structure:

- SettleGo Solutions Ltd (UK FCA-regulated)

- OpenPayd Financial Services Malta Ltd (MFSA-regulated)

- OpenPayd Services Ltd (formerly Akce Fintech Services Ltd)

- All operate under OpenPayd Holdings Ltd.

- OZAN Ecosystem:

- Ozan Limited (UK FCA-licensed EMI)

- Ozan Elektronik Para A.Ş. (licensed EMI in Turkey)

- Both under SuperApp Holdings Ltd, controlled by Ozerk.

- Shared Address: The majority of these companies list The Bower, 207-211 Old Street, London as their registered office.

The Shadow Network: A Pattern of Risk Exposure and Regulatory Gaps

But behind the headlines lies a more troubling narrative—one that FinTelegram has consistently reported since 2021.

1. OpenPayd’s Role in Scam-Facilitated Payments

FinTelegram and OCCRP have exposed how OpenPayd is repeatedly linked to crypto exchanges and payment processors used in fraudulent investment schemes. In its 2025 “Scam Empire” report, OCCRP identified OpenPayd as a key payment facilitator in a network that funneled money from thousands of victims into sham trading platforms.

Times of Malta together with reporting partners OCCRP and Amphora Media, has previously revealed how OpenPayd appears in a global investment scam money trail that has seen victims from all walks of life and dozens of countries fall prey to professional fraudsters. Source: Times of Malta (link)

In March 2025, Malta’s Financial Arbiter ordered OpenPayd to compensate an elderly UK victim, after her funds were misappropriated through OpenPayd’s virtual IBAN system, which obscured fund ownership and accountability. This was not an isolated incident—OpenPayd has been named in multiple complaints, previously dismissed only on technical grounds.

🛑 The pattern:

- Victims are guided to invest via crypto platforms.

- Funds are routed through OpenPayd-linked virtual IBANs, appearing in their names.

- The money is credited instead to central crypto exchange accounts, controlled by scammers.

- OpenPayd claims it has no responsibility—until courts say otherwise.

2. Dubious Partnerships & Enabling High-Risk Processors

Ozan Ozerk’s companies have been connected to:

- CurrencyRock / Insirex (Lithuania) – exposed for funneling funds to fraud schemes.

- Blue Whale Tech Inc. / Cratos – a Canadian crypto PSP used by Georgian call center scams.

- Hasbix Analytics (Czech Republic) – flagged for processing scam victim funds.

In every case, OpenPayd provided banking-as-a-service infrastructure or accounts, acting as a crucial bridge between scam operations and the regulated banking world.

Blockchain Evangelism or Diversion Tactic?

In his Forbes articles and media appearances, Ozerk has championed blockchain’s ability to revolutionize cross-border payments, pointing to a “stablecoin sandwich” model for FX.

While technically sound, this narrative can also be seen as a convenient distraction—painting OpenPayd as forward-looking while ignoring the mounting compliance failures in its core operations.

A Fintech Founder in Crisis Management Mode?

The Türkiye Today article reads more like a reputational whitewash than a balanced profile. It omits:

- The Malta ruling against OpenPayd

- The OCCRP investigation naming Ozerk’s company as part of scam payment flows

- FinTelegram’s multi-year record of reporting on OpenPayd’s high-risk dealings

Instead, it amplifies Ozerk’s vision, leadership, and optimism, while sidestepping the darker realities of his companies’ roles in financial harm.

Time for UK and EU Regulators to Step In?

Given OpenPayd’s license in Malta, global reach, and its headquarters in London, FinTelegram questions whether the FCA and other EU regulators can continue to ignore the evidence:

- ✅ A Maltese ruling that directly blames OpenPayd for fraud loss

- ✅ Ongoing use of OpenPayd by known scam crypto platforms

- ✅ A business model built on white-labeling infrastructure to high-risk clients

It is no longer enough to claim that OpenPayd only services corporate via its financial infrastructure services platform. If those corporate clients are fraud factories, then OpenPayd is a willing conduit.

Call for Information

FinTelegram invites whistleblowers, insiders, and former OpenPayd partners to share information on:

- Internal compliance failures

- High-risk client onboarding practices

- Cross-border coordination between OpenPayd, EMBank, and Ozan Elektronik Para