Wall Street is reeling from President Donald Trump’s aggressive tariff policy announced on April 2, marking one of the most significant shifts in U.S. trade policy in over a century. The rollout of sweeping tariffs, including a universal 10% duty on all imports and targeted hikes for specific countries, has triggered widespread market turmoil, stoked fears of recession, and sent shockwaves through global financial systems.

Market Fallout

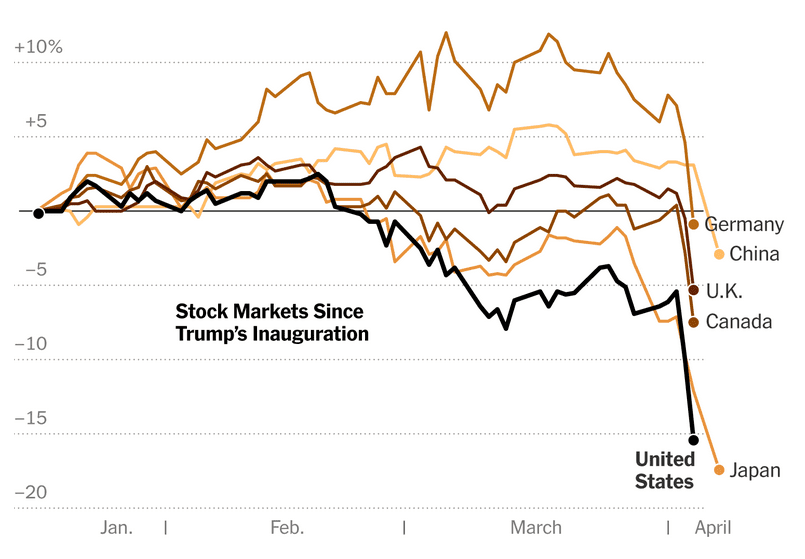

- Global Sell-Off: Financial markets have experienced historic declines. The S&P 500 and Nasdaq Composite are officially in bear market territory, with the Dow Jones suffering its steepest two-day drop in history, erasing over $6 trillion in value.

- Asian Markets: Japan’s Nikkei plunged over 8%, while South Korea’s KOSPI fell by 5%.

- Cryptocurrency Impact: Bitcoin dropped 10%, falling below $76,000.

- Commodity Prices: U.S. oil prices plummeted by 15%, reflecting broader economic uncertainty.

Economic Risks

Economists warn that the tariffs could lead to stagflation—a combination of stagnating growth and rising inflation. Key risks include:

- Recession Probability: JPMorgan has raised the likelihood of a U.S. recession in 2025 to 60%, citing reduced GDP growth and rising unemployment.

- Inflation Surge: Consumer prices are projected to rise by an average of 2.3% this year, adding $3,800 to annual household expenses.

- Supply Chain Disruptions: Tariffs on production inputs are increasing manufacturing costs for U.S. companies, further dampening economic growth.

Corporate America in Crisis

Major corporations reliant on global supply chains—such as Apple, Tesla, Boeing, and Starbucks—are among the hardest hit, with stock losses exceeding 15% in just two days[1][6]. CEOs are halting mergers, acquisitions, and IPO plans amidst heightened uncertainty[9].

Global Trade Tensions

The tariffs have sparked retaliatory measures from trading partners:

- China imposed 34% tariffs on U.S. goods within 24 hours.

- European markets suffered sharp declines, with Germany’s DAX down 2.3% and France’s CAC 40 falling by 1.6%.

Trump Administration’s Defense

Despite the turmoil, President Trump insists that the tariffs will reduce trade deficits and revitalize domestic manufacturing. His advisors argue that foreign nations are already seeking negotiations to avoid further escalation[9]. However, experts remain skeptical about these claims given the immediate economic fallout.

Investor Outlook

Wall Street strategists are bracing for prolonged volatility:

- UBS downgraded U.S. equities from “Attractive” to “Neutral” due to weaker earnings growth prospects and heightened uncertainty.

- Morgan Stanley suggests hedging equity exposure and diversifying portfolios as markets adjust to the new tariff regime.

What’s Next?

The coming weeks will be critical as global leaders respond to the tariff shock. Negotiations could mitigate some damage, but sustained tariffs risk deepening economic instability both domestically and internationally. Investors should prepare for continued volatility across equities, commodities, and currencies while exploring defensive strategies such as gold and quality bonds.