Vienna, April 2025 – The legal noose around Rene Benko, once hailed as one of Europe’s most influential real estate moguls, is tightening. The Vienna Regional Criminal Court has again extended his pre-trial detention by another two months. According to the court, there remains strong suspicion and a significant risk of the crime being committed again.

This comes after Benko’s legal team, led by star attorney Norbert Wess, unsuccessfully requested his release into electronically monitored house arrest. The court, however, remained unmoved, referring once again to the trusted individuals Benko placed in his private foundations, who have come under increasing scrutiny from both investigators and the media — including FinTelegram.

Foundation Appointments Raise Serious Questions

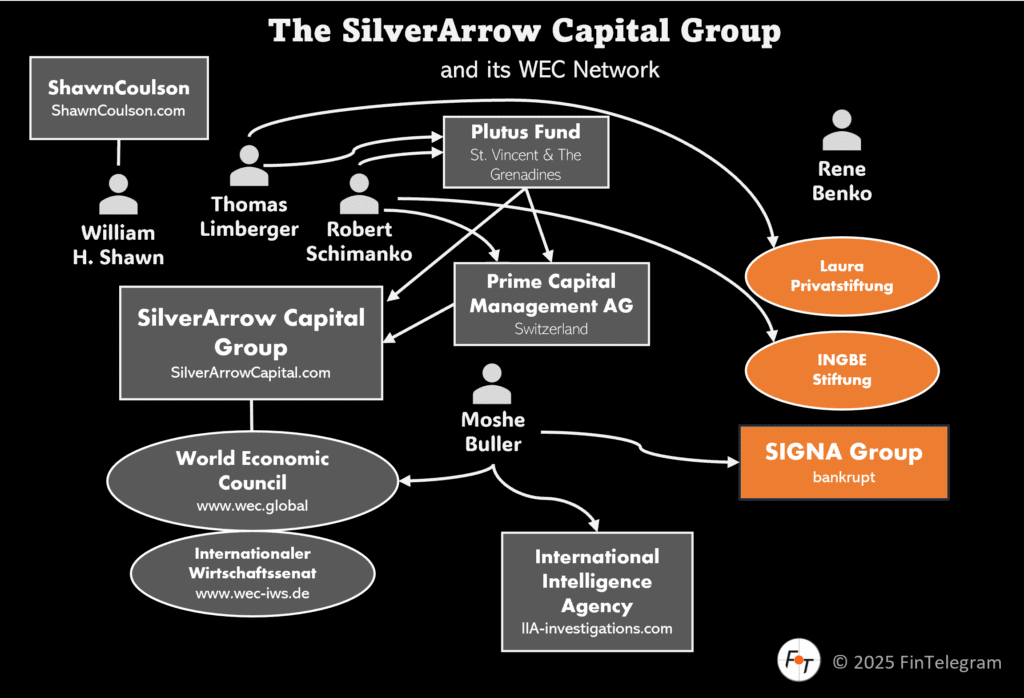

As FinTelegram previously reported, the individuals now in charge of the INGBE Foundation and the Laura Private Foundation are none other than Robert Schimanko and Thomas Limberger, both partners in the SilverArrow Capital Group and leading figures at the Vienna-registered World Economic Council (WEC). Their close association with Benko, particularly in the immediate aftermath of the Signa collapse, has sparked speculation about ongoing asset management and concealment strategies.

Read more about the secretive WEC network around Rene Benko.

According to public reports, Schimanko personally purchased luxury items — including a motorboat — on Benko’s behalf from the Signa estate, raising questions about whether such transactions were part of a broader effort to preserve or transfer wealth. Limberger, meanwhile, assumed a board position at one of Benko’s key foundations. The judge’s recent reference to “trusted associates” and foundations connected to the accused appears to allude directly to these developments.

From Innsbruck Office to Josefstadt Prison

Benko was arrested by Austrian police in January 2025 at his office in Innsbruck. He was swiftly transferred to Vienna and has since been held at Josefstadt prison. The Austrian Economic and Corruption Prosecutor’s Office (WKStA) accuses him of a range of offenses, including:

- Running a money carousel during a June 2023 capital increase at Signa Holding

- Misleading investors and diverting funds from other Signa stakeholders

- Harming creditors by managing assets past the point of insolvency

Benko has denied all allegations and remains presumed innocent. However, the investigation has reached a stage where the court deems the risk of renewed criminal activity still active.

Millions Lost, Trust Destroyed

The damage left in Benko’s wake is staggering. In Switzerland, his dealings have sparked a national financial scandal:

- Arthur Eugster, head of Eugster/Frismag, reportedly lost CHF 650 million, one of the largest personal financial losses in Swiss history.

- Julius Baer, the private banking giant, is facing fallout after suffering CHF 585.6 million in exposure to Signa-related investments — a scandal that led to the resignation of the CEO.

Investors from across Europe and the Middle East were affected, including high-profile names such as Ernst Tanner (Chairman of Lindt & Sprüngli) and the Mubadala sovereign wealth fund from Abu Dhabi.

Capital Increase or Financial Shell Game?

According to witness testimony and investigation results, the June 2023 capital increase at Signa was a mirage of confidence. Benko reportedly persuaded shareholders like Eugster and Tanner to participate, suggesting that all major backers were contributing. In reality, the Benko Family Private Foundation, which appeared to inject capital, allegedly used funds sourced directly from these same investors.

Eugster later testified: “We were misled… he simply screwed us over.” After the money was transferred, Benko reportedly ceased communication, offering no confirmation or transparency. The evidence suggests the €35.35 million in question was never actually Benko’s to invest.

The Road Ahead

Legal observers expect the WKStA to file an initial indictment soon. For now, the court has reaffirmed that Benko must remain in detention due to the continuing risk of criminal activity. The next custody review is expected in May 2025, but Benko can challenge the current decision within three days.

With more foundations, more assets, and more shadowy structures still under investigation, the Benko case is evolving into a landmark European financial scandal. FinTelegram will continue to track the role of networks such as WEC and SilverArrow Capital, which now appear to be deeply entangled in the legacy of Signa.

Stay tuned.