Vienna, April 9, 2025 – As FinTelegram previously reported, the pre-trial detention of Austrian real estate magnate Rene Benko has been extended by another two months. But while Benko remains in custody, the investigators’ attention is increasingly drawn to a suspiciously well-funded foundation in Liechtenstein — and to the opaque network surrounding the SilverArrow Capital Group and the World Economic Council (WEC).

Explosive Developments: Gold Bunker in Vaduz

Austrian prosecutors have confirmed that on March 11, 2025, during Benko’s detention, the INGBE Stiftung (Foundation) in Liechtenstein sold more than 360 kilograms of gold valued at around €30 million. The proceeds were transferred to a private bank account in Liechtenstein. This sale and its timing have triggered alarm bells in Vienna. According to the Austrian prosecutors, this supports the suspicion that Benko diverted significant sums from investor capital into his private sphere via intricate foundation structures.

Read our reports on Rene Benko here.

The INGBE Stiftung (foundation), where Robert Schimanko was appointed to the board in November 2024, has now come under intense scrutiny. In 2021, it held over €81 million in gold and liquid assets, including vaults at LGT Bank, VP Bank, and Liechtensteinische Landesbank (LLB). Even in 2022 — when Signa was already in deep trouble — the foundation reportedly held €45 million in gold and millions more in hard currencies and accounts.

Benko’s mother is a named beneficiary of the INGBE Foundation — another red flag. The prosecutors now cite a “habitual tendency to deceive” and “considerable criminal energy” in their argument for extending Benko’s detention.

SilverArrow Capital and the WEC: The Shadow Network

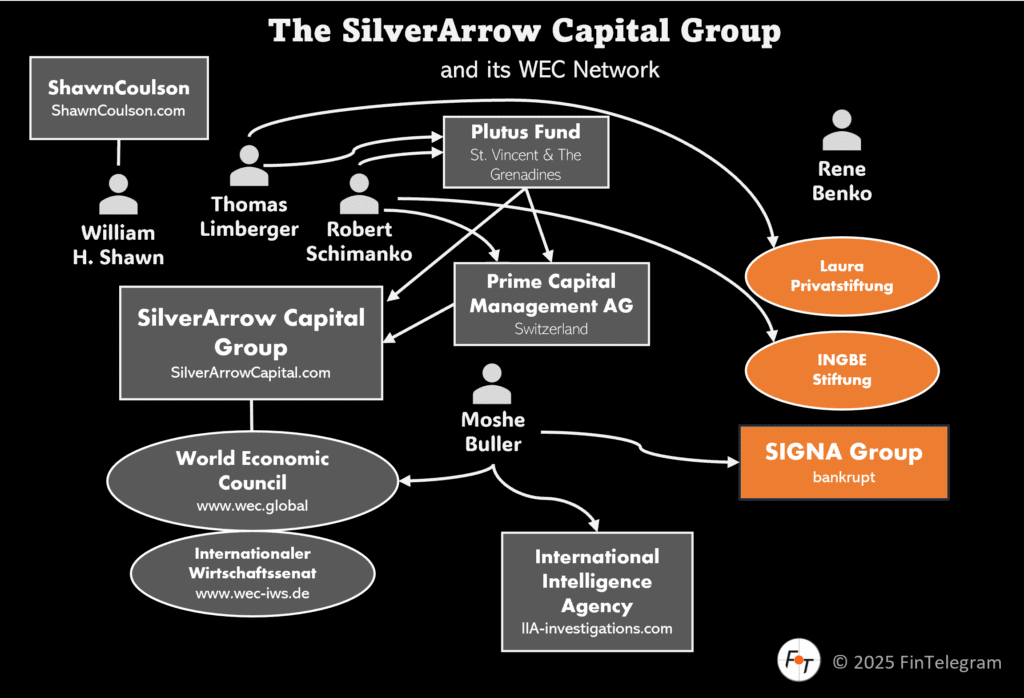

The spotlight has also returned to the SilverArrow Capital Group and the World Economic Council (WEC). Both Schimanko and Thomas Limberger — his long-time associate — are partners in SilverArrow and serve as board members of the WEC. Limberger was appointed to the board of the Laura Privatstiftung in the same month Schimanko joined the INGBE Stiftung. These dual appointments to two Benko-linked foundations — just weeks before his arrest — appear increasingly suspicious.

WEC presents itself as a global business platform, yet operates not as a non-profit NGO, but as a private Austrian GmbH. Its overlapping personnel and corporate ties to SilverArrow further complicate the picture. According to FinTelegram’s investigations, this interconnected network of foundations, advisory firms, and elite councils may have played a key role in shielding assets — and possibly in facilitating their discreet relocation.

Schimanko, who resides in Switzerland, is a former M&A banker with a controversial track record. As previously uncovered by FinTelegram, he was involved with M&A Privatbank, a Vienna-based institution that had ties to the Madoff scandal. He also reportedly acted as Benko’s personal buyer at post-insolvency auctions, acquiring items like a motorboat.

Risk of Flight and Further Offenses

The prosecutors have now officially cited the risk of absconding as a new reason for continued detention. According to the WKStA, Benko could easily flee via private jet, with ample funds parked offshore. The court application emphasized that Benko is no longer rooted in Austria — and that his lifestyle could be sustained abroad via the INGBE Stiftung’s assets.

In addition, the WKStA continues to believe there is a risk of further criminal acts. Their latest findings describe Benko as someone who shows “remarkably little respect for other people’s assets” and is “habitually prone to deception”. His systematic concealment of control over the Signa Group and its foundations is now seen as evidence of a deliberate and long-term scheme to defraud investors and shield assets.

What Comes Next?

Benko’s legal team can still challenge the latest ruling within three days. Meanwhile, the WKStA is reportedly preparing formal indictments in what is shaping up to be one of the most significant white-collar crime cases in modern Austrian history.

With millions in gold moved during his imprisonment and a complex web of offshore structures now exposed, FinTelegram will continue to track the roles of SilverArrow, the WEC, and their affiliated figures in what may be a case of strategic asset preservation masquerading as philanthropy.

Stay informed — and stay critical.