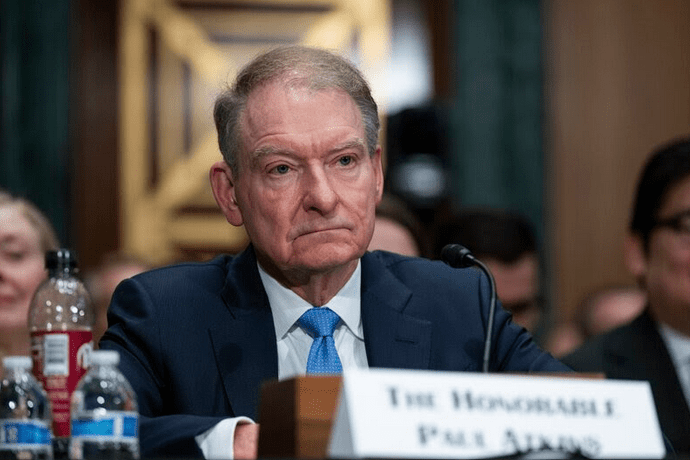

The U.S. Senate confirmed Paul Atkins as SEC Chair on April 9, 2025, in a 52–44 vote largely along party lines, marking a pivotal shift in the agency’s regulatory trajectory. A former SEC Commissioner (2002–2008) and Wall Street consultant, Atkins is poised to steer the agency toward a more industry-friendly approach amid significant operational challenges.

Key Implications

1. Regulatory Philosophy

Atkins advocates for “clear, tailored” regulations over what he views as politically motivated or overly burdensome rules. His pro-crypto stance is expected to drive a departure from the aggressive enforcement seen under Gary Gensler, with a focus on fostering innovation and addressing regulatory ambiguity in digital assets.

2. Enforcement Priorities

The SEC is anticipated to prioritize individual accountability over corporate penalties, particularly in cases lacking direct financial benefits to companies. This aligns with Atkins’ historical dissent against broad corporate sanctions during his prior tenure. High-profile crypto cases may see reduced emphasis, though fraud targeting retail investors will remain a focus.

3. Workforce and Operational Challenges

The SEC faces staff reductions of 10–15% (500–750 employees), including significant losses in enforcement and legal divisions, due to Trump-era buyout programs. These departures risk straining the agency’s capacity to handle complex investigations and respond to market volatility, including the ongoing stock market downturn linked to recent trade policy shocks.

4. Industry and Political Reactions

Stakeholders like the American Petroleum Institute have welcomed Atkins’ confirmation, emphasizing hopes for “commonsense policies” and reduced regulatory barriers. Critics, however, warn that scaled-back enforcement and staff attrition could undermine investor protections during a period of heightened market uncertainty.

Atkins’ confirmation solidifies a deregulatory shift at the SEC, balancing industry demands for clarity with the agency’s constrained resources. His leadership will likely test the SEC’s ability to adapt to evolving markets while maintaining core oversight functions.