Part of: FinTelegram DeFi Series

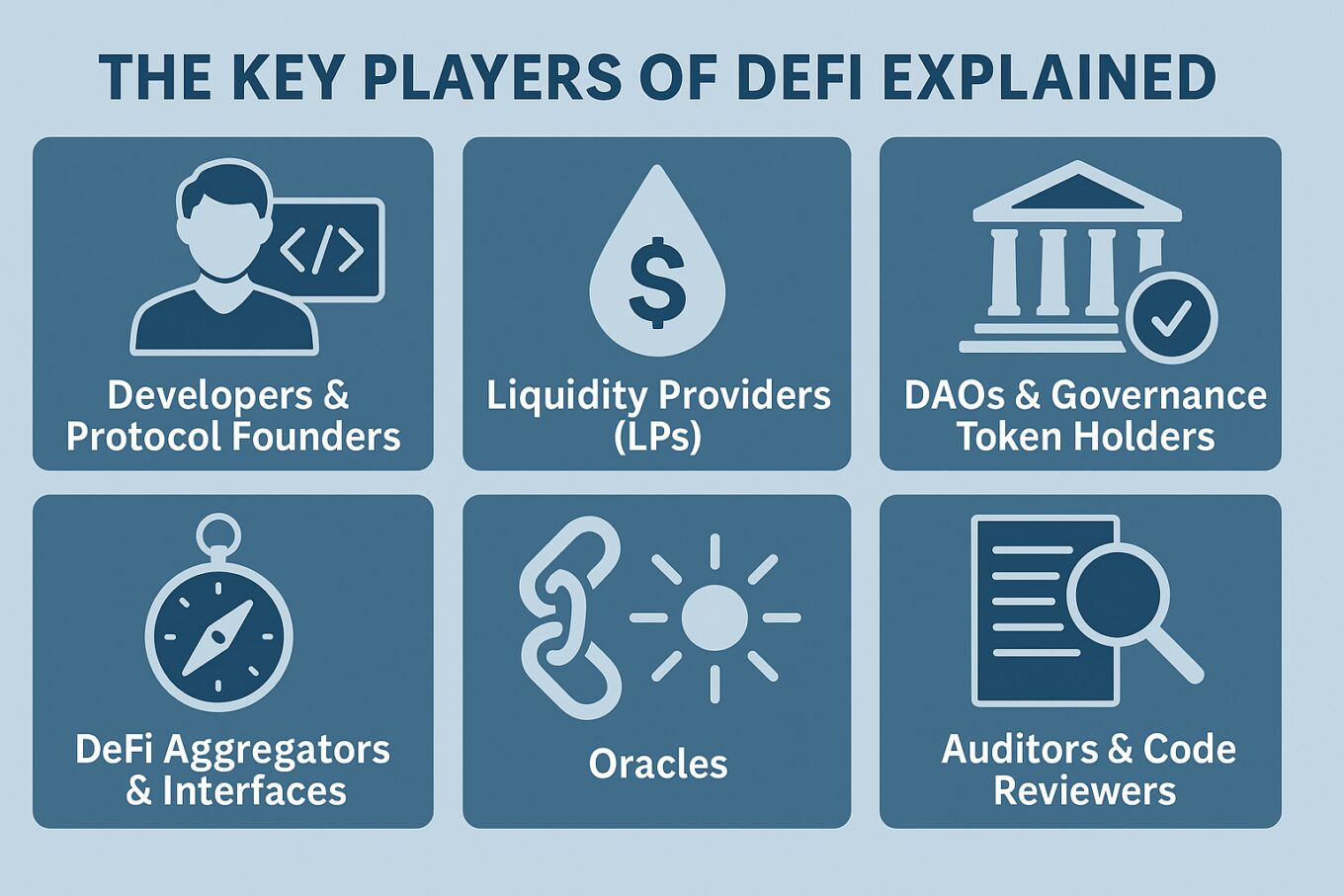

The DeFi ecosystem is not a monolith—it’s a fast-moving network of protocols, developers, investors, and platforms. In this second installment of our FinTelegram DeFi Series, we break down the key actors shaping decentralized finance, from the code-writing builders and liquidity providers to governance DAOs, oracles, and blockchain infrastructures. Understanding the roles of these players is crucial for identifying risks and opportunities in the space.

Key Points:

- The DeFi ecosystem is modular and permissionless, made up of smart contracts, protocols, and DAO governance.

- Core participants include:

- Developers & Protocol Founders (builders)

- Liquidity Providers (capital sources)

- DAOs & Governance Token Holders (voters)

- DeFi Aggregators (navigators)

- Oracles (data feeders)

- Auditors (watchdogs)

- Yield Farmers & Traders (users)

- Infrastructure players like Chainlink, Ethereum, and Layer 2 networks provide the foundation.

Short Narrative:

DeFi isn’t run by institutions—it’s run by code and communities. That said, it still needs builders, capital, rules, and data to function. Here’s a breakdown of the key players in the DeFi landscape:

1. Developers & Protocol Founders

The architects of DeFi—often pseudonymous—design and deploy the smart contracts that run platforms like:

- Uniswap (DEX)

- Aave (lending)

- Curve Finance (stablecoin DEX)

- Synthetix (synthetic assets)

Some founders, like Andre Cronje (Yearn Finance), become DeFi celebrities. Others disappear after launch.

2. Liquidity Providers (LPs)

Users who deposit tokens into liquidity pools to facilitate trading or lending. In return, theyAave,Curve Fi earn:

- Trading fees

- Governance tokens

- Yield farming rewards

But beware: LPs are exposed to impermanent loss and smart contract risks.

Learn more: FinTelegram DeFi Decoded Part 1

3. DAOs & Governance Token Holders

DAOs (Decentralized Autonomous Organizations) are the governing bodies of many DeFi protocols. Token holders vote on proposals about:

- Fee structures

- Treasury spending

- Protocol upgrades

Example:

MakerDAO Governance Portal

DAO health depends on community participation and transparency.

4. DeFi Aggregators & Interfaces

Platforms that simplify DeFi for users by aggregating services:

- Zapper – Portfolio tracker & DeFi dashboard

- 1inch – DEX aggregator

- Yearn Finance – Yield optimization

Aggregators boost efficiency but rely on underlying protocols’ security.

5. Oracles

Blockchains can’t fetch external data on their own. Oracles solve this.

- Chainlink is the market leader.

- Oracles feed price data, weather info, or event outcomes into smart contracts.

- Oracle manipulation has led to multi-million dollar DeFi exploits.

6. Auditors & Code Reviewers

DeFi projects often undergo audits from firms like:

But audits are not guarantees.

Many rug pulls and exploits happened in “audited” protocols.

7. Users, Traders, and Yield Farmers

Retail users are the lifeblood of DeFi. They:

- Provide liquidity

- Trade tokens

- Farm new tokens

- Join DAOs

But most are underinformed, and many get rekt. FinTelegram aims to change that.

Key Concepts Introduced:

- DAO (Decentralized Autonomous Organization)

- Oracle

- Aggregator

- Governance Token

- Audit Firm

Actionable Insight for Readers:

Before engaging with any DeFi project, ask:

- Who built it—and are they doxxed?

- Who governs it—and is governance active?

- Is it audited—and by whom?

- Is the data reliable—or oracle-dependent?

Understanding who’s behind the protocol is the first step to avoiding scams.

Call for Information:

Are you aware of anonymous founders, insider token allocations, fake audits, or compromised oracles?

👉 Share your info confidentially via Whistle42.com.