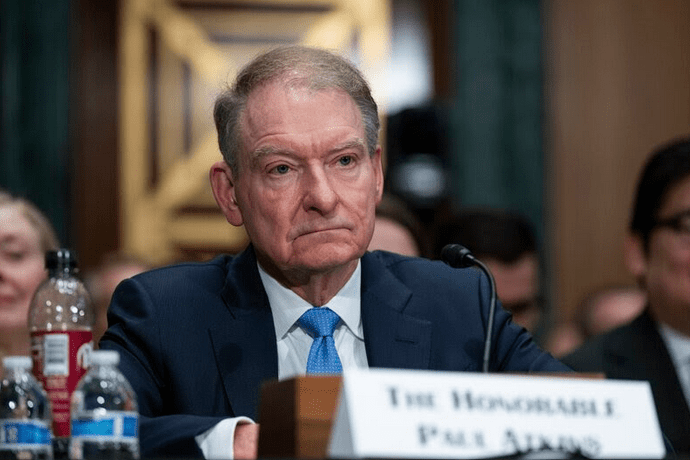

The U.S. Securities and Exchange Commission (SEC) has entered a new chapter with the swearing-in of Paul S. Atkins as its 34th Chairman, a move widely anticipated to mark a dramatic pivot in how the agency approaches crypto and DeFi regulation. For years, the financial industry—especially the burgeoning digital asset sector—has bristled under the SEC’s “Regulation by Enforcement” strategy. Now, with Atkins at the helm, expectations are high for a more collaborative, innovation-friendly regulatory regime.

Paul Atkins: A Crypto-Friendly Leader for a New SEC

Paul Atkins, nominated by President Donald J. Trump and confirmed by the Senate on April 9, 2025, brings a wealth of experience from both traditional finance and the digital asset sector. His prior leadership at Patomak Global Partners, where he developed best practices for digital assets, and his tenure as a director at BATS Global Markets, signal a deep understanding of both market structure and technological innovation.

Atkins has publicly pledged to move away from ambiguous, enforcement-driven tactics that have dominated the SEC’s approach under his predecessor, Gary Gensler. Instead, he promises a “rational, coherent, and principled” framework for digital assets, aiming to foster innovation and reduce regulatory uncertainty. This stance is a stark contrast to the Gensler era, which saw a surge in enforcement actions against major crypto players and a reliance on decades-old securities laws to police the sector.

From Gensler’s Enforcement to Atkins’ Clarity: What Changes?

| Approach | Gary Gensler (2021–2024) | Paul Atkins (2025–) |

|---|---|---|

| Core Philosophy | Regulation by Enforcement | Collaborative, Guidance-Driven |

| Crypto Regulation | Old TradFi rules (e.g., Howey Test) apply | Push for clear, tailored frameworks |

| Enforcement Actions | Aggressive lawsuits, market intermediaries | Judicious enforcement, focus on clarity |

| Industry Feedback | Uncertainty, legal gray zones | Welcomed by crypto/DeFi as pro-innovation |

| Task Force Initiatives | Expanded Cyber & Crypto Unit | New Crypto Task Force for sensible policy |

Under Gensler, the SEC insisted that existing securities laws—such as the Howey Test—were sufficient for regulating crypto, often lumping tokens and NFTs with traditional stocks and bonds. This approach led to high-profile lawsuits, confusion, and a chilling effect on innovation. Critics argued that the Howey Test, designed for mid-20th-century investment schemes, was ill-suited for the complexities of decentralized finance and modern crypto assets.

Atkins, by contrast, is expected to champion regulatory clarity and practical disclosure requirements. His leadership is likely to accelerate the SEC’s shift away from punitive enforcement and toward a framework that supports capital formation and investor protection without stifling innovation.

Signals of Change: Crypto Task Force and Industry Optimism

Even before Atkins’ swearing-in, the SEC had begun to pivot. Acting Chair Mark Uyeda launched a new Crypto Task Force in January 2025, focusing on crafting sensible regulations rather than ramping up enforcement. Commissioner Hester Peirce, known as “crypto mom,” was tapped to lead this initiative, further signaling the agency’s intent to embrace innovation while maintaining market integrity.

Industry leaders and crypto advocates have welcomed Atkins’ appointment. Coinbase’s Chief Legal Officer and Paradigm’s VP of Government Affairs have both expressed optimism for a new era of regulatory clarity and constructive engagement.

A New Era for Crypto and DeFi?

With Paul Atkins at the helm, the SEC appears poised to end the era of “Regulation by Enforcement” and open the door to a more predictable and innovation-friendly environment for digital assets. The expectation is clear: Atkins will prioritize clear rules, practical registration processes, and a regulatory framework that recognizes the unique features of crypto and DeFi—potentially making the U.S. the best and most secure place in the world to invest and do business.