Norway’s Socialist Left Party (SV), led by Kirsti Bergstø, has ignited a firestorm with its controversial “Wall of Shame.” This bold initiative aims to publicly shame alleged tax offenders, including crypto entrepreneur Fredrik Haga, whose case highlights the complex intersection of politics, tax policy, and the volatile world of digital assets. Even Elon Musk weighed in, calling the situation “crazy.”

Key Points

- The Wall of Shame: Kirsti Bergstø’s “Wall of Shame” names wealthy individuals accused of tax avoidance, blending politics with public pressure.

- Fredrik Haga’s Case: Haga, co-founder of Dune Analytics, was assessed for unrealized crypto gains valued at 200M NOK ($18.7M) by Norwegian authorities, though he claims his holdings were worth just 2M NOK ($187,000).

- Public Shaming Fallout: This political strategy oversimplifies complex tax issues and raises ethical concerns over the use of public platforms to enforce compliance.

- Elon Musk’s Reaction: Musk’s comment, “Wow, this is crazy,” brings global attention to the debate, emphasizing its wider implications for crypto taxation.

Short Narrative

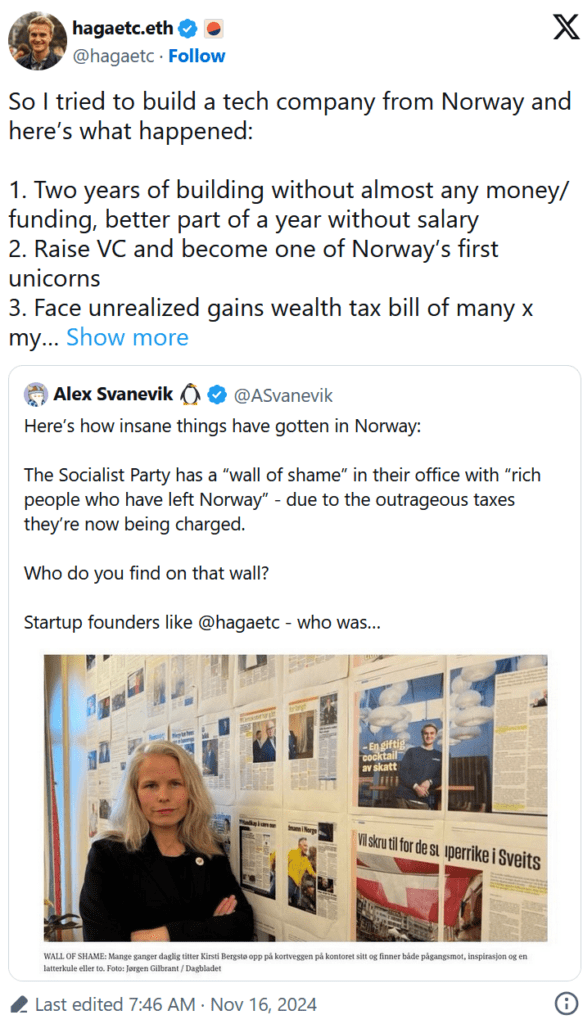

Kirsti Bergstø, leader of Norway’s Socialist Left Party, has turned tax compliance into a spectacle with her “Wall of Shame,” a public display of alleged tax avoiders meant to “give her strength” in her political mission. Among the names featured is Fredrik Haga, a Norwegian crypto entrepreneur forced to leave the country after a staggering tax dispute over unrealized cryptocurrency gains.

Haga’s case highlights a glaring mismatch in crypto valuation practices. While the Norwegian Tax Administration pegged his holdings at 200M NOK, Haga insists they were only worth 2M NOK. This discrepancy led to his inclusion on the Wall of Shame, sparking outrage in Norway and beyond. Even Elon Musk weighed in, tweeting his disbelief at the situation.

While Bergstø’s strategy may rally support for her party’s tax agenda, it raises troubling questions. Should complex tax disputes be resolved in the public eye? Does this kind of public shaming cross ethical boundaries? And how can traditional tax systems accurately address the volatile nature of digital assets?

Actionable Insight

Crypto investors and entrepreneurs should take note: Norway’s handling of Haga’s case signals the potential for heightened scrutiny and political weaponization of tax enforcement. Those operating in the digital asset space must push for clearer tax guidelines and fair valuation standards to avoid similar conflicts.

Notably, Frederik Haga was one of the more than 30 richest Norwegians to flee the country from 2021 to 2022. The Financial Times reported Norway’s wealth exodus as business leaders voiced concerns about the country’s tax policy. These stories evidently motivate Kirsti Bergstø, and she included them on her “Wall of Shame.”

Call for Information

Have insights into cryptocurrency tax policies or cases involving unrealized gains? Share your perspective with FinTelegram as we investigate the implications of Norway’s “Wall of Shame” and its impact on global crypto regulations.