The former CEO of the Maltese financial regulator MFSA, Joseph Cuschieri, was a disgrace to the authority. The unjust dismissal of former MFSA COO Reuben Fenech by then-CEO Joseph Cuschieri has led to a damage payment of almost €414,000. Under the leadership of Cuschieri and his team, the Maltese financial regulator has lost its reputation and has become a symbol of the failure of financial market supervision.

Key Points:

- Malta Financial Services Authority (MFSA) ordered to pay €414,000 in damages to former COO Reuben Fenech.

- Fenech was unfairly dismissed in 2019 by then-CEO Joseph Cuschieri.

- The Tribunal ruled the dismissal was “premeditated” and in violation of established procedures.

Short Narrative:

The Industrial Tribunal in Malta has ruled in favor of former MFSA COO Reuben Fenech, awarding him nearly €414,000 in compensation after being unjustly dismissed by former CEO Joseph Cuschieri in 2019. The Tribunal found that Cuschieri acted arbitrarily and failed to follow proper disciplinary procedures, which violated Fenech’s employment rights. Despite receiving positive performance appraisals just months before, Fenech was dismissed without warning. The Tribunal concluded that the dismissal was preplanned and tarnished Fenech’s career.

The Cuschieri Legacy

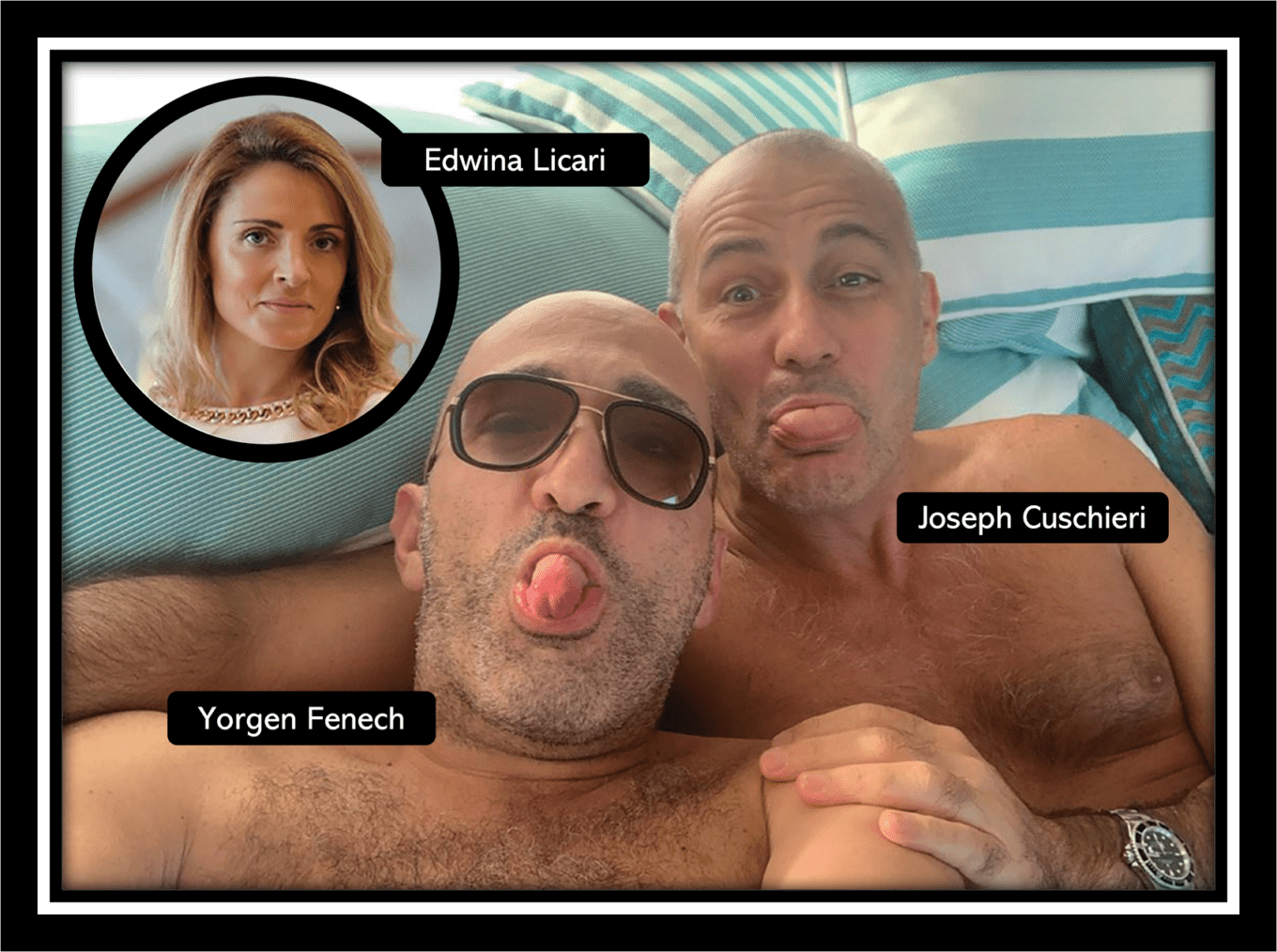

Joseph Cuschieri was appointed as CEO of the MFSA in 2018, “handpicked” by the former Malta prime minister Joseph Muscat. He had to resign from his post in 2020 after the revelations around his “Yorgen Fenech-Connection” came to light. As can be seen in the picture above, Cuschieri maintained a friendly relationship with Yorgen Fenech that was also riddled with conflicts of interest and favoritism.

Read our reports on Joseph Cuschieri here.

An internal ethics investigation has confirmed that Cuschieri violated both MFSA and European Central Bank guidelines by accepting a 2020 trip to Las Vegas with Maltese businessman Yorgen Fenech, who is implicated in the murder of journalist Daphne Caruana Galizia. The trip, which included MFSA General Counsel Edwina Licari, involved luxury accommodation at Caesars Palace, with Fenech covering the costs of flights and stay.

Compliance Insight:

A country’s financial system cannot function without a properly functioning regulator, as Malta’s now-abolished greylisting reflected. The MFSA is an example worldwide of a regulator’s failure. This latest MFSA case highlights the importance of following transparent and objective disciplinary processes, particularly for high-ranking officials in regulatory bodies. Arbitrary dismissals can have long-lasting consequences for both the individuals involved and the institution’s reputation.

The MFSA’s failure to adhere to its own Staff Handbook in the dismissal of Fenech raises concerns about governance within the regulatory body. The Tribunal’s decision underscores the need for strict adherence to established employment procedures to avoid legal disputes and damage to institutional integrity.

Call for Information:

If you have information about problems and abuses in financial regulators or feel that you have not been treated correctly by them, please report it to us using Whistle42, our whistleblower system.