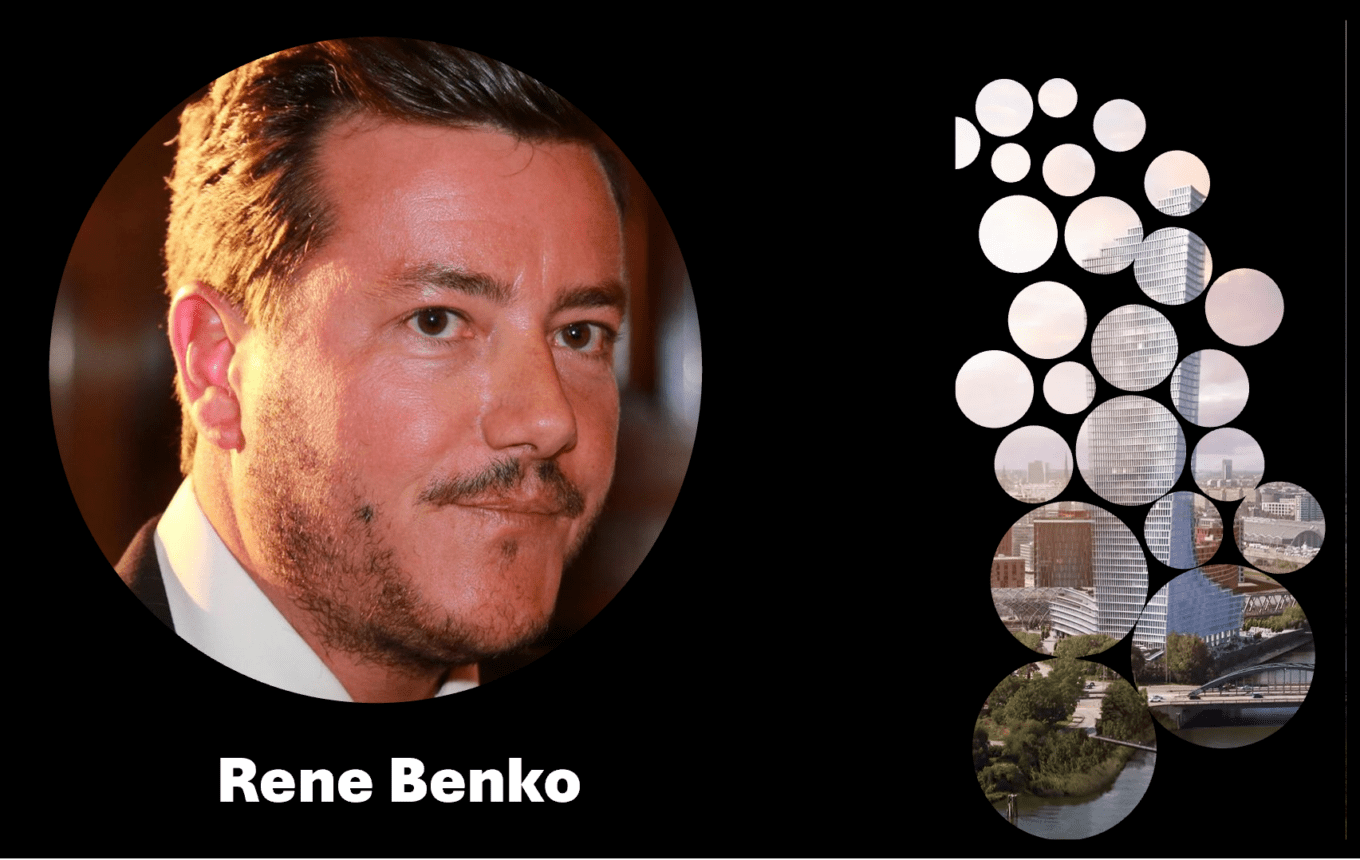

As previously highlighted by FinTelegram, the unraveling of the collapsed real estate developer Signa Group of the now disgraced tycoon Rene Benko has not only resulted in substantial financial fallout but is rapidly evolving into a significant criminal case. The recent developments following the March insolvency of Benko’s Austrian family foundations raise serious legal questions regarding potential fraudulent bankruptcy and money laundering.

Liechtenstein’s chief public prosecutor has now initiated an investigation into the financial affairs of the Austrian property tycoon, focusing on the intricate web woven between his personal financial instruments and the operations of the Signa Group. The probe is centered on the possible concealment of assets through complex trust structures in Liechtenstein, notably the Ingbe and Arual foundations, which are cleverly named after Benko’s family members and shrouded in the principality’s stringent privacy laws.

This legal scrutiny comes in the wake of the Signa Group’s collapse, once a behemoth in the European luxury real estate market with high-profile assets like London’s Selfridges and Berlin’s KaDeWe. The group’s downfall has been marked by its inability to extract any value from its principal holding companies, as declared by Signa Holding, the nucleus of Benko’s empire.

The insolvency of Benko’s family foundations, which were significant investors in Signa’s labyrinthine corporate structure, has exposed a stark discrepancy between the reported wealth of Benko and the foundations’ declared insolvency. This discrepancy has prompted creditors and investors to question the whereabouts of the fortunes once associated with Benko, igniting concerns over potential claims and the legality of asset transfers.

Further complicating matters, several investors have accused Signa of criminal misconduct, aligning with the suspicions of fraudulent activities that have long been discussed. The Austrian state prosecutor specializing in economic crime and corruption, along with Munich’s public prosecutor, are examining these allegations, with a particular focus on unexplained financial transactions between Signa-related entities and Benko’s foundations.

Dozens of criminal charges have been filed. The Austrian Public Prosecutor’s Office for Economic Affairs and Corruption (WKStA) is investigating, among other things, suspicions of serious fraud in connection with a capital procurement measure, as the WKStA has announced. Money from investors had not flowed into the agreed projects.

This case may represent a critical juncture in understanding the intersection of complex trust laws and corporate governance within Europe’s real estate sector. The ongoing investigations by multiple jurisdictions underscore the potential for this case to escalate further, possibly setting precedents in corporate transparency and accountability.

As the situation unfolds, FinTelegram remains committed to providing detailed insights into this complex case and reflecting on its broader implications for corporate conduct and regulatory oversight in the financial and real estate sectors.