On Dec 10, 2023, the cryptocurrency market experienced a massive sell-off, resulting in $735 million in liquidations within a single hour—one of the largest in recent crypto history. Bitcoin led the liquidations with $283 million, followed by Ethereum at $168 million, with various altcoins also affected. This event highlighted the volatile nature of crypto markets and the risks of leveraged trading.

Market Dump Analysis

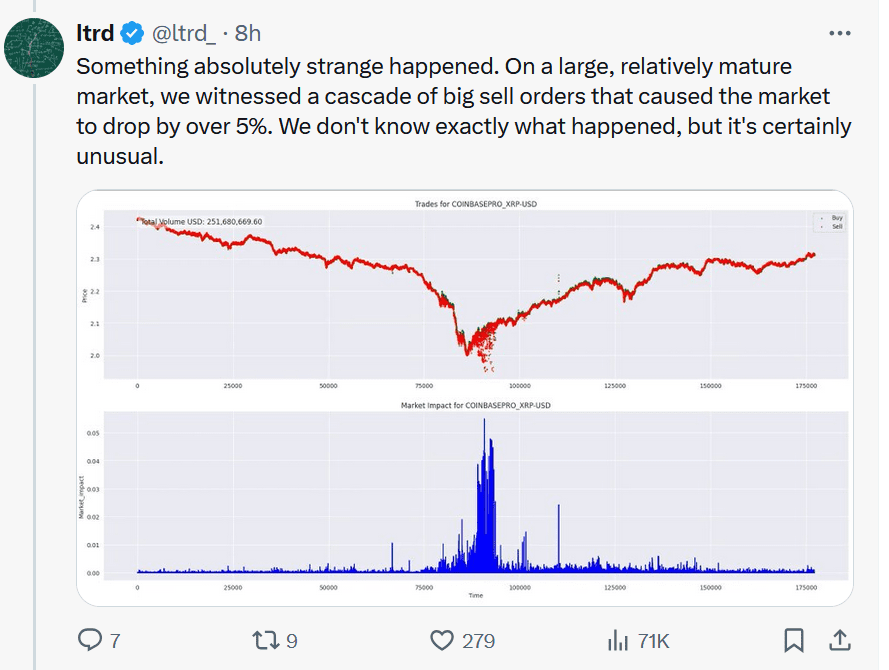

The scale of the dump and its widespread impact across multiple cryptocurrencies underscored the interconnectedness of digital assets. The market analyst who reported this expressed a bearish outlook, suggesting the potential for a further market decline. In one post, he wrote: “We observed something crazy—Coinbase traders began selling aggressively almost an hour before the mega dump.” He continued to analyze that this dump impacted the BTC differently (see chart left). Moreover, after the drop, they saw strong buying pressure generated on ETH.

This significant event serves as a stark reminder of the unpredictability in cryptocurrency trading and the importance of risk management for investors and traders in this space. This dump event was particularly notable for its scale and impact across multiple cryptocurrencies.

Scale of the Dump

- The total liquidation amounted to $735 million within just one hour.

- This figure represents one of the largest liquidation events in recent crypto history.

Affected Cryptocurrencies

The dump affected various cryptocurrencies, with Bitcoin (BTC) being the most prominent:

- Bitcoin saw $283 million in liquidations.

- Ethereum (ETH) experienced $168 million in liquidations.

- Other altcoins also saw significant liquidations, though specific figures for individual altcoins weren’t provided in the post.

Market Dynamics

Leverage and Liquidations

The post highlights the role of leveraged positions in amplifying market movements:

- Many traders use leverage to increase their potential gains (and risks).

- When prices move sharply, these leveraged positions can be forcibly closed (liquidated), further exacerbating price movements.

Market Sentiment

The author of the post, @ltrd_, expresses a bearish outlook:

- They suggest that the market might experience further downward pressure.

- The phrase “blood in the streets” is used, which is often a metaphor for extreme market fear and panic selling.

Interpretation

- Market Volatility: This event underscores the highly volatile nature of cryptocurrency markets, where large price swings can occur rapidly.

- Overleveraging Risks: The massive liquidations highlight the dangers of excessive leverage in crypto trading, especially during periods of high volatility.

- Potential for Further Decline: The author’s bearish sentiment suggests they believe this dump might not be an isolated incident, but potentially the beginning of a larger downtrend.

- Market Interconnectedness: The widespread impact across various cryptocurrencies demonstrates how closely linked different digital assets can be in terms of market movements.

- Trading Opportunity: For some traders, such extreme events might be viewed as potential buying opportunities, following the adage “buy when there’s blood in the streets.” However, this strategy carries significant risks.

It’s important to note that cryptocurrency markets are highly unpredictable, and this analysis should not be considered financial advice. Investors and traders should always conduct their own research and consider their risk tolerance before making any financial decisions.