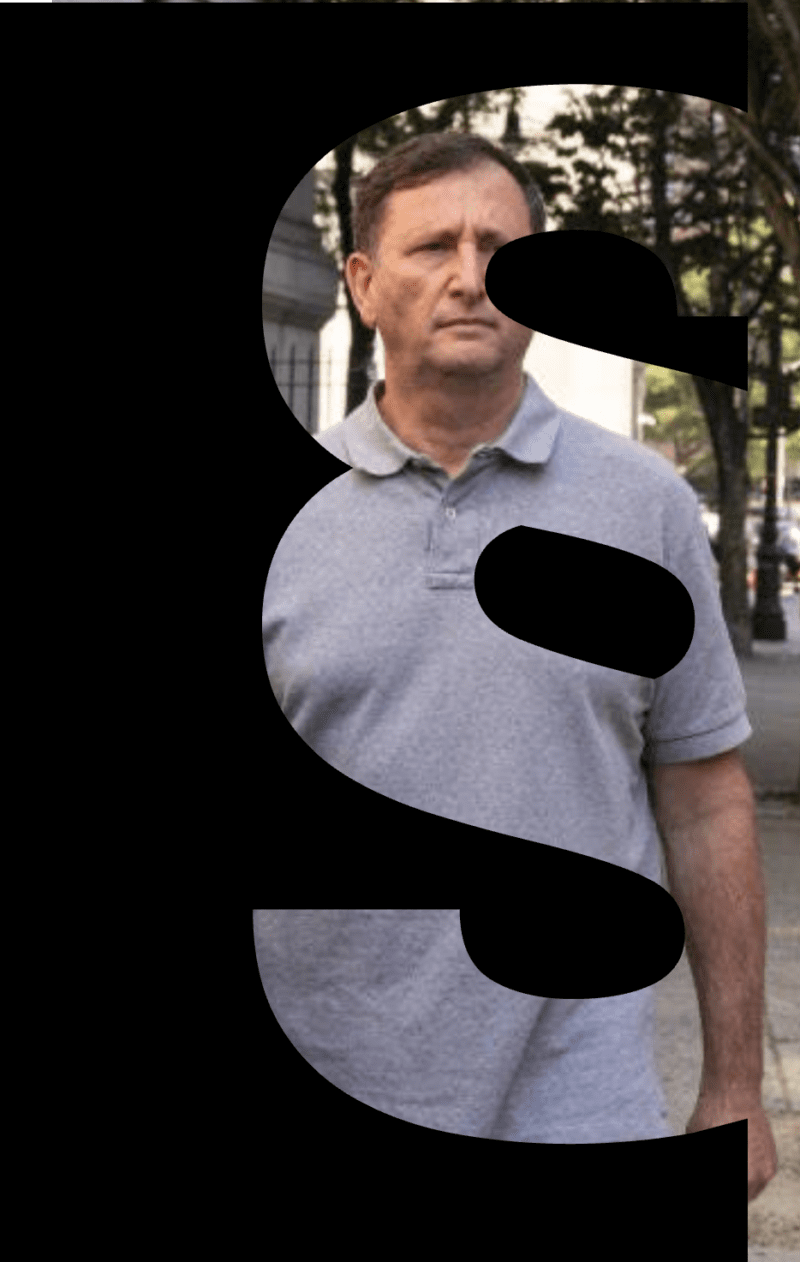

Alex Mashinsky, 59, the founder and former CEO of crypto lender Celsius Network, has recently pleaded guilty to fraud charges in the U.S. Prosecutors have said Mashinsky also personally reaped approximately $42 million in proceeds from selling his holdings of the Cel token. His trial is scheduled for April 2025. This report will provide context, explain the Celsius Network case, and offer background on the crypto winter of 2022.

Alex Mashinsky: Background and Career

Alex Mashinsky, born in 1965, is a Soviet-born Israeli-American entrepreneur and business executive with a history of founding and leading technology companies. Prior to Celsius Network, Mashinsky was involved in various ventures, including:

- VoiceSmart: One of the first firms to offer telecommunications switches for Voice over IP call routing

- GroundLink: An on-demand limousine and car service booking platform

- Transit Wireless: A company providing Wi-Fi services in public transportation

Mashinsky gained a reputation as a “brash, confident serial entrepreneur with a constant stream of big ideas,” according to the Wall Street Journal.

The Celsius Network Case

Founding and Growth

In 2017, Mashinsky founded Celsius Network, a cryptocurrency lending platform that offered high-interest rates on cryptocurrency deposits and allowed users to borrow against their crypto holdings. The platform grew rapidly, attracting 1.7 million registered users and managing approximately $6 billion in assets by the time of its bankruptcy filing.

Celsius encouraged customers to “unbank” themselves and offered interest rates as high as 18.6% on cryptocurrency deposits. Mashinsky became known for his critical stance against traditional banking, often wearing T-shirts with slogans like “Banks are not your friends” and hosting weekly YouTube livestreams called “Ask Mashinsky Anything.”

Collapse and Bankruptcy

In June 2022, Celsius indefinitely paused all transfers and withdrawals due to “extreme market conditions.” On July 13, 2022, the company filed for Chapter 11 bankruptcy, revealing a $1.2 billion deficit in its balance sheet. At the time of filing, Celsius owed $4.7 billion to its users, who were listed as unsecured creditors.

Legal Proceedings

On July 13, 2023, Celsius Network agreed to a $4.7 billion settlement with the Federal Trade Commission (FTC). On the same day, Mashinsky was arrested and charged with committing securities, commodities, and wire fraud, as well as securities manipulation. Initially pleading not guilty, Mashinsky has now indicated his intention to plead guilty to two counts of fraud. US district judge John Koeltl in November denied a motion by Mashinsky to dismiss two criminal counts ahead of his trial, which had been scheduled for April 8, 2025 at 11:30 with a max sentence of 30 years.

Crypto Winter 2022: Context and Impact

The term “crypto winter” refers to a period of prolonged decline in cryptocurrency values and trading activity. The crypto winter of 2022 was characterized by several key events and factors:

- Market Decline: The global cryptocurrency market capitalization fell by 65% year-over-year, with Bitcoin and Ethereum experiencing significant price drops from their November 2021 highs.

- Stablecoin Failures: The collapse of stablecoins like TerraUSD and Luna in May 2022 contributed to market instability.

- Exchange Collapses: High-profile bankruptcies, including FTX in November 2022, further eroded investor confidence.

- Macroeconomic Factors: Inflation, recession fears, and potential regulatory changes added to the overall market uncertainty.

- Industry-wide Impact: Cryptocurrency exchanges and related companies faced layoffs and financial difficulties due to reduced trading volumes and asset values.

The crypto winter of 2022 played a significant role in Celsius Network‘s downfall, as the company cited the collapse of cryptocurrency trading prices as a primary factor in its bankruptcy filing.