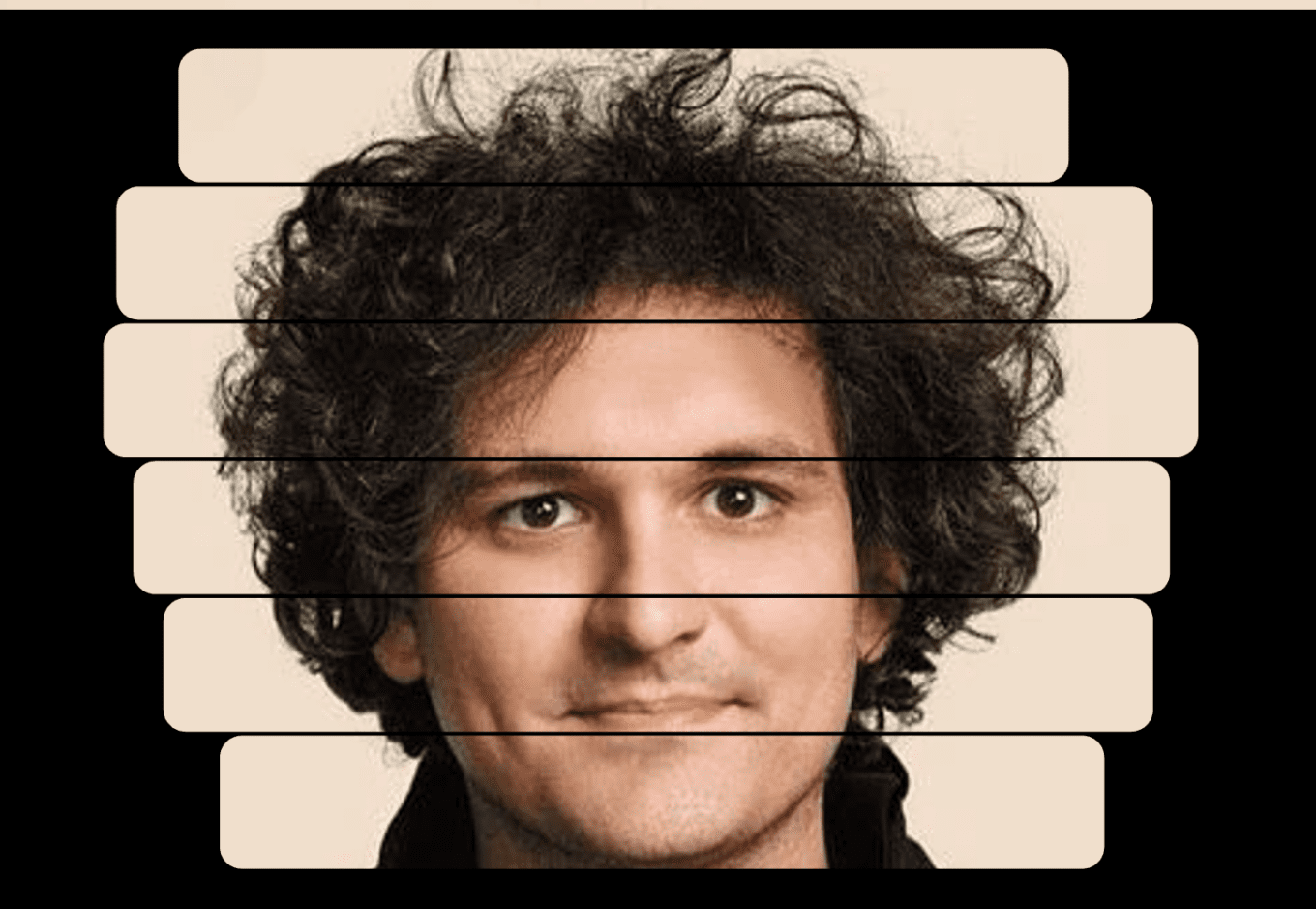

U.S. prosecutors have recommended a substantial prison sentence of 40-50 years for Sam Bankman-Fried (SBF), the disgraced founder and former CEO of FTX, one of the previously largest crypto exchanges globally. This recommendation was presented to a federal judge for the sentencing scheduled for March 28. The prosecution’s stance starkly contrasts with the defense’s plea for a mere 6-year sentence, which prosecutors have deemed “woefully inadequate.”

SBF‘s fraudulent activities, which have captured widespread attention, involved deceptive practices, including lying to investors, fabricating documents, and funneling illegal political donations, according to the Southern District of New York’s Department of Justice. The prosecutors emphasized that the gravity of Bankman-Fried’s actions, which affected thousands and undermined the integrity of the U.S. political system, necessitates a sentence that reflects the unprecedented scale of his fraud. Additionally, they proposed a financial penalty exceeding $11 billion, alongside orders for forfeiture, to account for the monumental losses incurred.

This historic case has prompted prosecutors to draw comparisons to other notable financial crimes, citing the example of Bernie Madoff, who received a 150-year sentence for a Ponzi scheme involving $13 billion in losses. The recommendation for SBF’s sentence and financial penalties underscores a determined effort by the U.S. government to address and deter future financial wrongdoings decisively.

The proposal for SBF‘s penalty includes the forfeiture of substantial assets, comprising funds from various bank and crypto exchange accounts and proceeds from the sale of significant assets like Robinhood shares. This strategy aims to recoup some of the vast sums misappropriated during SBF‘s tenure at FTX and its affiliated entity, Alameda Research.

Further intensifying the case against SBF, prosecutors highlighted allegations and testimonies from his trial that painted a picture of deliberate illegal conduct. Notably, testimonies from SBF‘s former close associates, including Alameda Research‘s CEO Caroline Ellison and FTX‘s Chief Technology Officer Gary Wang, revealed instances of bribery and unauthorized financial maneuvers, further substantiating the need for a stern judicial response.