The CFD broker IC Markets is challenging a €200,000 fine imposed by CySEC in July 2024. The company’s CEO, Andrew Budzinski, has hinted at divesting from Cyprus and expanding operations elsewhere, possibly in Dubai. While Cyprus has long been a popular hub for forex and CFD brokers, changing regulatory landscapes and shifting industry trends are putting pressure on its status as a financial center.

Key Points

- CySEC imposed a €200,000 fine on IC Markets in July 2024. In Sept 2024, IC Markets received another €50,000 fine.

- IC Markets is disputing the ruling, claiming CySEC based its decision on testimony from a disgruntled former employee without considering other evidence.

- IC Markets‘ CEO, Andrew Budzinski, has implied the company will likely divest from Cyprus and expand operations elsewhere, possibly in Dubai, TradeInformer reports.

- The IC Markets case move could set a precedent for other brokers to follow suit.

Short IC Markets Narrative

IC Markets has increasingly conducted its operations through offshore entities in recent years, using these structures to engage with retail clients in Europe and the EU. This approach has resulted in warnings from financial regulators in several jurisdictions. Most recently, IC Markets was issued an additional fine of €50,000, following a previously reported fine of €200,000 in July 2024, indicating significant regulatory compliance issues. Given this context, it would not be unexpected if IC Markets were to consider exiting Cyprus.

Read our IC Markets reports here.

The Cyprus Legacy

Cyprus has historically faced challenges as a financial regulator, particularly during the rise of binary options, which were once touted as a FinTech innovation. Numerous binary options platforms, primarily operated by Israeli entities, established themselves in Cyprus, where regulatory oversight by CySEC was often considered lenient. Many of these platforms engaged in fraudulent activities, resulting in hundreds of thousands of victims globally. This has led to numerous legal actions, including convictions and prison sentences in Europe and North America, with some cases still ongoing.

Following the ban on binary options, the focus of the FinTech industry in Cyprus shifted to online brokers, payment processors, and the cryptocurrency sector. Cyprus has since emerged as a significant hub for high-risk payment services and potential money laundering activities, particularly attracting Russian schemes, which were further supported by the now-defunct Golden Passport program.

Meanwhile, Dubai has surpassed Cyprus as a preferred jurisdiction for high-risk payment processors and crypto service providers, largely due to its lack of extradition agreements with many regions, including the EU and the U.S. This has made Dubai increasingly attractive to operators in the crypto payment space, including those facilitating investment scams, illegal trading platforms, and unregulated gambling services.

Key Data IC Markets

| Brand | IC Markets |

| Domains | www.icmarkets.eu, www.icmarkets.com/global (offshore) www.icmarkets.com/intl (offshore) www.icmarkets.sc www.icmarkets.ru www.icmarketsgroup.com |

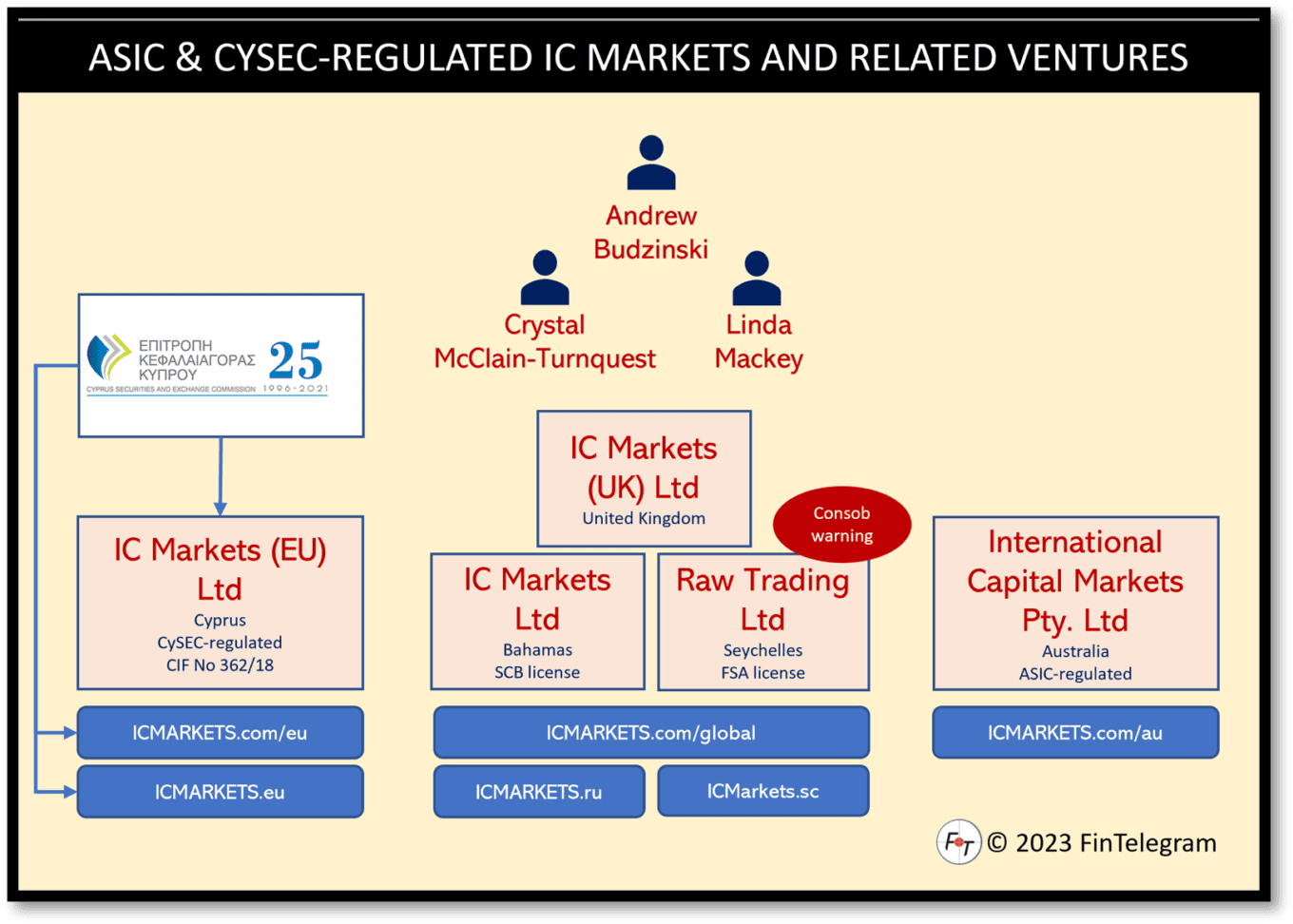

| Legal entities | Raw Trading Ltd (Seychelles) IC Markets (EU) Ltd (Cyprus) IC Markets (UK) Ltd (UK) IKBK Holdings Ltd (Cyprus) IC Markets Ltd (Bahamas) International Capital Markets Pty Ltd (Australia) |

| Related individuals | Andrew Budzinski (LinkedIn) Linda Mackey (LinkedIn) Crystal McClain-Turnquest (LinkedIn) Edward Anderson Rodney Martenstyn Mark Payne Andrew Rapp |

| Regulatory regimes | IC Markets (EU) Ltd with CySEC license no 362/18 Raw Trading Ltd with FSA Seychelles license no SD018 IC Markets Ltd Securities Commission of the Bahamas, license no SIA-F212 International Capital Markets Pty Ltd with ASIC license no 335692 |

| Leverage | Up to 1:500 |

| Payment processors | SettleGo Solutions Ltd (OpenPayd), JPMorgan Clear Bank, Citibank N.A. Neteller, Skrill, Rapid Transfer Sofort (Klarna) |

| Warnings | Consob, UK FCA I, UK FCA II |

Share Information

If you have any information about IC Markets, its activities or partners, please share it with us through our whistleblower system, Whistle42.