In a recent special report published by Rachel Wolcott of Thomson Reuters Regulatory Intelligence, significant concerns have been raised regarding Payrnet Ltd, an FCA-regulated e-money institution (EMI) and a subsidiary of the Embedded Finance platform Railsr. The report highlights serious client money safeguarding and compliance failures tied to the bankrupt Lithuanian EMI, UAB Payrnet, then part of the bankrupt Railsbank Technology group.

Background and Regulatory Breaches

According to the special report, Payrnet Ltd (website) held client money and provided services for UAB Payrnet, a breach of EU regulations, that prohibit one EMI from safeguarding customer funds for another. This was confirmed by the Bank of Lithuania, which closed UAB Payrnet in June 2023 due to significant client money and anti-money laundering (AML) compliance failures.

Bankruptcy proceedings for UAB Payrnet commenced in November 2023, and the firm was referred to the Lithuanian Financial Crimes Investigation Service for further investigation.

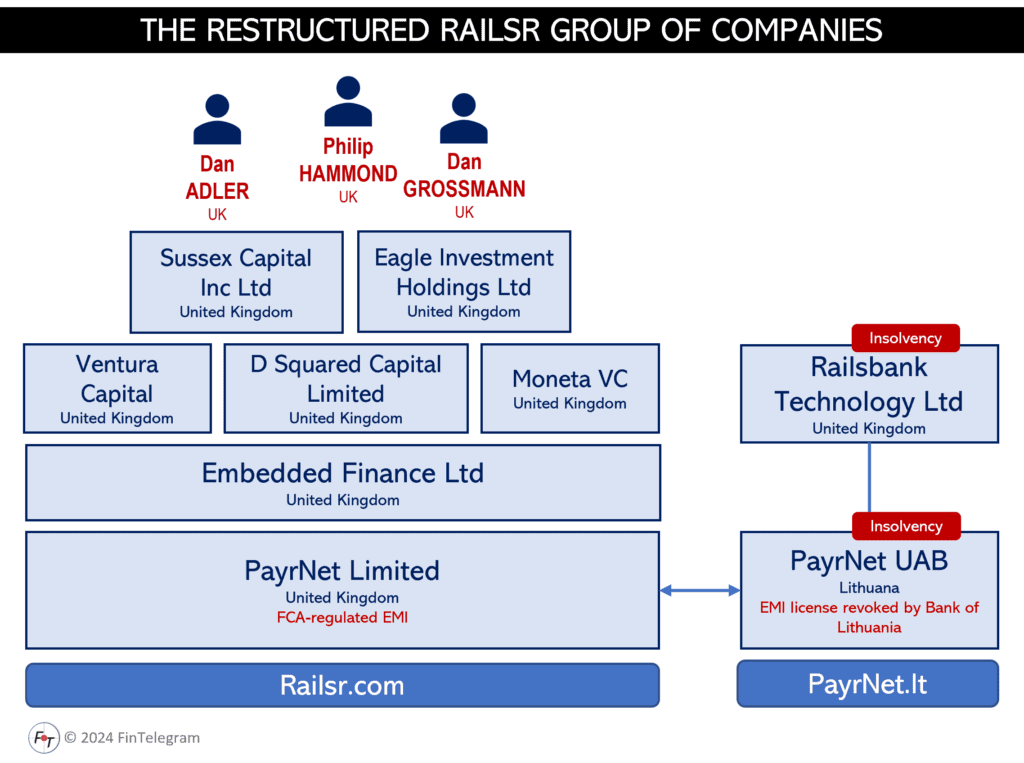

Background: In March 2023, the Railsr Group was restructured and recapitalized. Apparently, the problems surrounding the Lithuanian PayrNet prompted this restructuring. A consortium led by D Squared Capital took over Railsr Group. Moneta VC and Ventura Capital were also part of this consortium. PayrNet is now a wholly owned subsidiary of Embedded Finance Limited, chaired by Philip Hammond, the former Conservative Chancellor of the Exchequer. Embedded Finance Ltd was established and led by Dan Adler as a director. Together with Matthew Grossman, he controls the new Railsr Group via several legal entities and limited partnerships.

Mismanagement of Funds

Following the structuring in 2023, PayrNet d/b/a RailsR is controlled by Embedded Finance Ltd under the chairmanship of Philip Hammond. The new findings of the Lithuanian administrator will not please the new owners of the FCA-regulated PayrNet.

The Lithuanian administrator’s report detailed that from March 1 to March 3, 2023, Payrnet Ltd should have transferred €15.425 million of client funds to UAB Payrnet. However, only €180,000 was transferred. This discrepancy indicates severe mismanagement and potential misuse of client funds. Additionally, Payrnet Ltd used UAB Payrnet client funds to meet MasterCard obligations, which was a clear violation of safeguarding rules.

Inadequate Compliance and Internal Controls

The Bank of Lithuania’s inspection revealed that UAB Payrnet had inadequate internal controls and manual processes for calculating safeguarded funds. These processes failed to meet regulatory standards, leading to a significant shortfall in safeguarded funds. Notably, Payrnet’s auditors, BKL Audit, could not confirm the completeness and valuation of safeguarded funds, further underscoring the compliance failures.

Intercompany Relationships and Financial Implications

An intercompany services agreement between Payrnet Ltd and UAB Payrnet indicated a commercial relationship wherein Payrnet Ltd provided payment services for UAB Payrnet. The agreement, signed in December 2022, formalized an oral agreement from January 2021. However, this arrangement contradicted legal provisions prohibiting the holding of safeguarded client funds in another EMI’s accounts.

At the time of Railsbank Technology‘s pre-pack administration in March 2023, Payrnet Ltd potentially held UAB Payrnet client money, forming part of the asset pool to be distributed by UAB Payrnet‘s administrators. The administrator’s report noted that some clients with agreements with UAB Payrnet had their funds held in Payrnet‘s accounts, complicating the verification of these funds.

Ongoing Investigations and Regulatory Actions

The Bank of Lithuania’s findings have prompted further scrutiny from the Lithuanian Financial Crimes Investigation Service. Approximately €126 million in claims have been submitted in UAB Payrnet‘s bankruptcy case, primarily from end users. The administrator has struggled to verify these claims due to insufficient data in UAB Payrnet‘s accounting systems.

Despite returning over 96.5% of safeguarded funds to customers, UAB Payrnet’s mismanagement left a small number of customers facing difficulties retrieving their funds. The firm’s internal controls and financial accounting processes were severely lacking, leading to significant compliance breaches.

Conclusion and Implications

FinTelegram has previously reported on the challenges faced by Railsr and Payrnet, including regulatory scrutiny and compliance issues. The findings in the Thomson Reuters report further emphasize the need for stringent oversight and robust internal controls within fintech companies. Payrnet‘s persistent regulatory breaches and financial mismanagement underscore the risks associated with inadequate compliance frameworks.

As regulatory bodies continue to investigate and address these issues, FinTelegram remains committed to informing and protecting investors and customers within the cyberfinance sector. The ongoing scrutiny of Payrnet serves as a critical reminder of the importance of rigorous compliance and transparent financial practices in maintaining trust and integrity in the fintech industry.