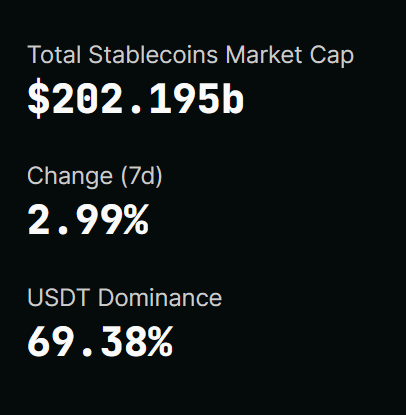

The stablecoin sector has smashed through the $200 billion market cap milestone, fueled by surging demand across crypto markets, payments, and remittances. Key players like Tether and Circle are leading the charge, while innovative yield-bearing tokens are reshaping the landscape. Asset manager Bitwise sees the stablecoin market growing to $400 billion next year.

Key Points:

- Market Milestone: Stablecoin market cap exceeds $200 billion, growing by $10 billion in just two weeks.

- Tether Leads: USDT hits a record $139 billion, driven by a 12% growth after Abu Dhabi recognition.

- Circle’s USDC Growth: Market cap rises 9% to $41 billion, bolstered by a Binance partnership.

- Real-World Use Cases: Stablecoins increasingly used for payments, remittances, and savings in struggling economies.

- Innovation in Yield-Bearing Tokens: Ethena’s USDe surges 90%, reaching $5 billion through innovative yield strategies.

Short Narrative:

The stablecoin sector is rewriting the rules of crypto dominance, crossing the $200 billion market cap threshold and smashing previous bull cycle records. Tether’s USDT leads the charge with $139 billion in supply, thanks to a 12% surge after gaining regulatory recognition in Abu Dhabi. Meanwhile, Circle’s USDC has climbed to $41 billion, fueled by a strategic partnership with Binance.

Beyond crypto trading, stablecoins are gaining traction as a preferred medium for payments and remittances, particularly in emerging markets facing financial instability. Innovative tokens like Ethena’s USDe are also fueling growth, attracting investors with a 90% surge driven by yield farming strategies.

Actionable Insight:

Investors and stakeholders in the crypto ecosystem should monitor the stablecoin sector’s rapid growth, as it signals expanding adoption across markets and use cases. Yield-bearing tokens like USDe are reshaping the competitive landscape, presenting both opportunities and risks. Regulatory developments, such as Abu Dhabi’s recognition of Tether, may further drive institutional confidence in the space.

Call for Information:

Have insights on emerging stablecoin projects or regulatory developments? Share your information with FinTelegram and help us uncover the next big story in crypto!