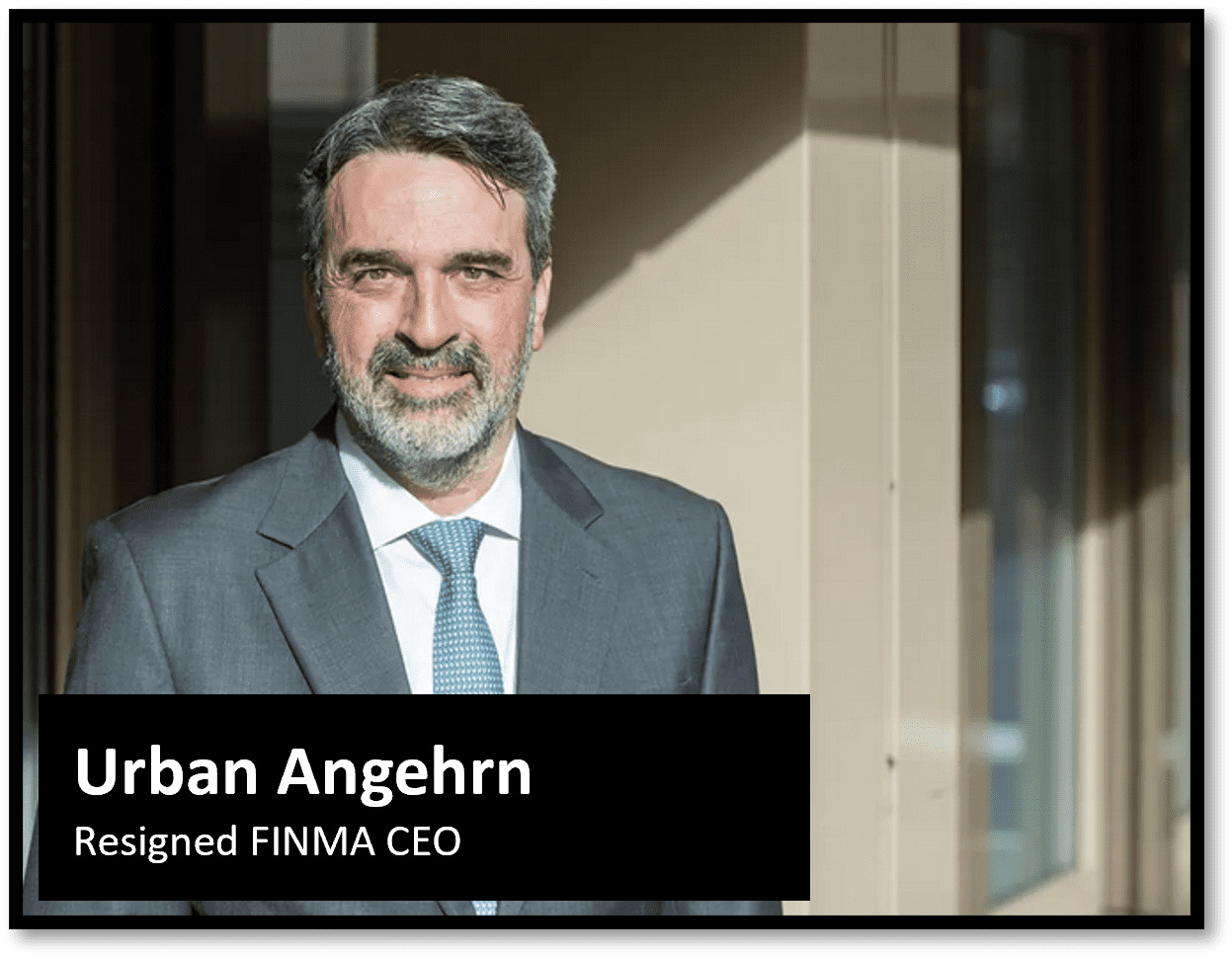

The collapse of Credit Suisse is also having an impact on the Swiss regulator FINMA. The regulatory authority surprisingly announced that its CEO, Urban Angehrn, will resign by the end of the month. This decision comes roughly half a year after FINMA faced significant scrutiny for not averting the downfall of Credit Suisse. Angehrn, who has been at the helm since November 2021, cited health concerns as the primary reason for his departure.

In a statement, Angehrn expressed, “Leading FINMA and contributing to the enhancement of the Swiss financial sector was a profound challenge, one I embraced wholeheartedly.” Under his leadership, Angehrn played a pivotal role during the crisis involving Credit Suisse and its subsequent acquisition by UBS in March 2023, an event termed by FINMA as its most challenging phase.

Angehrn acknowledged his role’s intense and constant pressures, which he believes impacted his health. During his tenure, he also managed risks associated with the Russian invasion of Ukraine, supervised the licensing of the initial thousand portfolio managers and trustees by FINMA, and oversaw multiple enforcement actions.

Birgit Rutishauser, the deputy CEO, will take on the role of interim CEO. Angehrn will be available to assist Rutishauser, ensuring a smooth transition, especially concerning UBS and Credit Suisse matters. The search for a new FINMA CEO has commenced.

In his farewell note, Angehrn expressed gratitude, saying, “Handing over this responsibility is challenging, but it’s a rational decision. My heartfelt thanks go out to my team and the board for their unwavering trust. Our collective achievements at FINMA wouldn’t have been possible without the dedicated team.“