Trump Media & Technology Group, the parent company of Truth Social, has experienced a significant decline in its market value, shedding billions and dampening the initial excitement that surrounded its public debut. This development has raised eyebrows across the financial and regulatory sectors, highlighting the volatile nature of the stock and its impact on the broader tech and social media landscape.

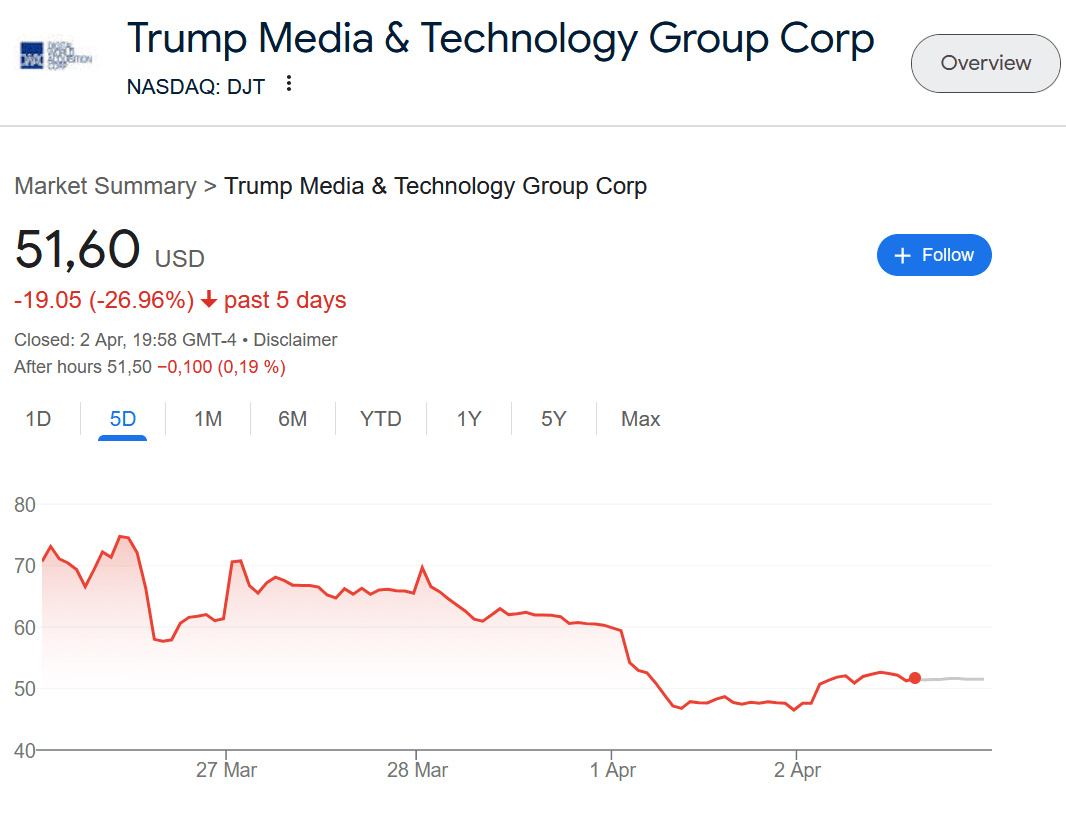

At the peak of its trading frenzy in its debut week, Trump Media & Technology Group boasted a market valuation of approximately $10 billion. However, a stark decline ensued, with the company’s shares plummeting by over 20% on a single Monday, erasing around $2 billion from its market value and bringing it down to about $6.5 billion. In the course of Tuesday, the share price recovered somewhat and rose by more than 6%.

This downturn has notably affected former President Donald J. Trump‘s majority stake in the company, which fell to approximately $3.7 billion from over $6 billion. Despite this setback, the company’s shares remained above their value prior to the merger with a public shell company, a move that initially propelled its market value to its peak.

The financial disclosures from Trump Media & Technology Group have come under scrutiny, especially considering the company’s relatively modest business size. A recent filing revealed that the company generated just $750,000 in revenue in the fourth quarter of the previous year, culminating in a full-year total of $4.1 million and recording a $58 million loss in 2023. These figures stand in stark contrast to the company’s briefly attained $10 billion market valuation.

The primary revenue source for Trump Media & Technology Group is advertising on Truth Social, a platform that has become a central hub for Trump to communicate with supporters and critique various adversaries. Despite its financial performance, the platform has been pivotal in maintaining Mr. Trump’s visibility and engagement with his base.

Market observers have closely watched Trump Media as it has become one of Wall Street’s most “shorted” stocks, indicating a widespread anticipation of its value decline. The company’s stock has also seen a surge in derivatives trading, suggesting that investors are preparing for continued volatility.

One aspect of Trump Media’s corporate governance that is attracting attention is the board’s decision not to alter a lockup provision that restricts Trump from selling stock or leveraging his shares as loan collateral for six months post-trading commencement. This decision is particularly relevant given Trump’s need to post a $175 million bond as part of a civil fraud penalty appeal in New York state.

Moreover, the company’s governance structure designates it as a “controlled company,” largely due to Trump’s substantial ownership stake. This classification, coupled with a board composition that includes Trump family members and former administration officials, underscores the intertwined nature of the company’s business and political dynamics.

As Trump Media & Technology Group navigates these turbulent waters, the broader implications for tech and social media regulation, market stability, and investor confidence remain critical areas of interest. The unfolding situation exemplifies the challenges and uncertainties facing companies at the intersection of technology, media, and politics, marking a significant case study in the volatile realm of public market debuts.