In the U.S., two individuals, Malone Lam and Jeandiel Serrano, have been arrested and charged with stealing over $230 million in cryptocurrency and laundering the funds through a complex web of mixers, peel chains, and VPNs. This case, led by the FBI and IRS-CI, shines a spotlight on the increasing sophistication of cybercriminals operating in the digital asset space.

Key Points:

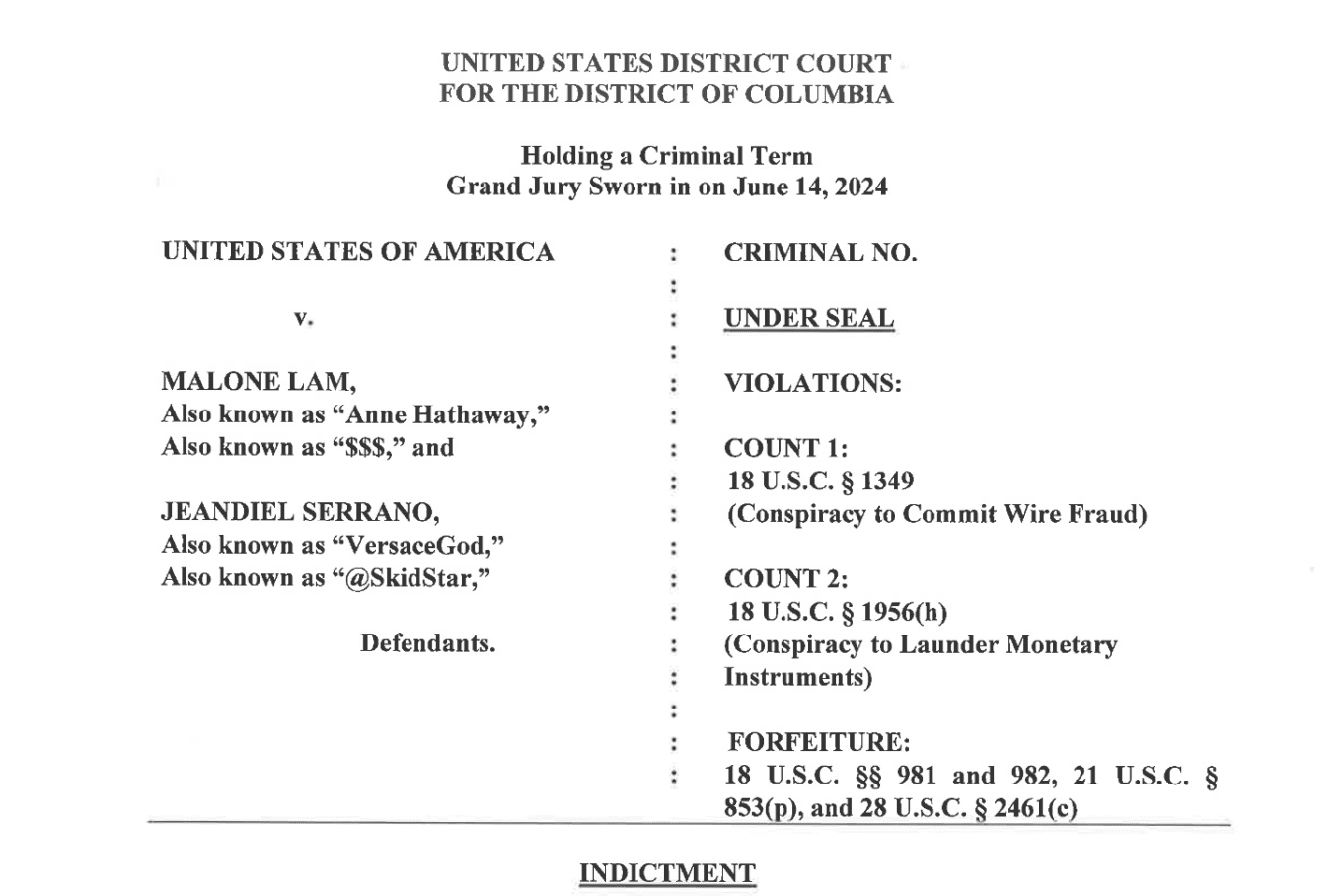

- Malone Lam (aka “Anne Hathaway” and “$$$”) and Jeandiel Serrano (aka “VersaceGod” and “@SkidStar”) were charged with conspiracy to steal and launder over $230 million in cryptocurrency.

- Lam and Serrano used sophisticated techniques, including mixers, peel chains, and VPNs, to launder stolen funds.

- They spent the proceeds on luxury items and travel across Los Angeles and Miami.

- The FBI and IRS-CI led the investigation, resulting in arrests in Florida and California.

Short Narrative:

On September 19, 2024, a U.S. federal indictment was unsealed, charging Malone Lam, 20, of Miami and Los Angeles, and Jeandiel Serrano, 21, of Los Angeles, with orchestrating a $230 million cryptocurrency theft and laundering scheme. Lam, who used online aliases “Anne Hathaway” and “$$$,” and Serrano, known as “VersaceGod” and “@SkidStar,” allegedly hacked into victim cryptocurrency accounts, transferring large sums of Bitcoin into their control. The duo then laundered the stolen funds through a web of peel chains, mixers, and pass-through wallets, hiding their identities through VPNs. The laundered funds were spent lavishly on luxury cars, nightclubs, designer goods, and rental properties in Miami and Los Angeles.

Their scheme, which started in August 2024, defrauded a Washington, D.C. victim of over 4,100 Bitcoin (worth over $230 million at the time). The arrests were made in coordination with the FBI and IRS-Criminal Investigation teams in Washington, D.C., with operational support from their Los Angeles and Miami field offices.

Compliance Insight:

This case highlights the critical need for advanced monitoring of cryptocurrency transactions and the use of AML/KYC procedures by exchanges. Criminals continue to exploit decentralized networks and anonymizing technologies like mixers and VPNs to evade detection. As cryptocurrency theft and laundering schemes become more sophisticated, regulators and financial institutions must remain vigilant in tracking illicit activities.

Blow the Whistle:

FinTelegram invites insiders with information about cryptocurrency laundering schemes or any operations involving peel chains, mixers, and VPNs to come forward. Your insights could help uncover further networks involved in laundering digital assets.