The alarming rise in online romance scams has caught the attention of the U.S. banking industry, prompting calls for a collaborative effort from the federal government and social media platforms to stem the tide of financial devastation. Organized criminal gangs, primarily based in Southeast Asia, have been exploiting the emotional vulnerabilities of Americans, leading to billions of dollars in losses annually through sophisticated romance scams.

Erin West, Deputy District Attorney in Santa Clara County, California, estimates that romance scams resulted in losses between $30 billion and $50 billion in 2022 alone. The emotional and financial aftermath of these scams is profound, often resulting in lost marriages, careers and significant shifts in financial status for the victims.

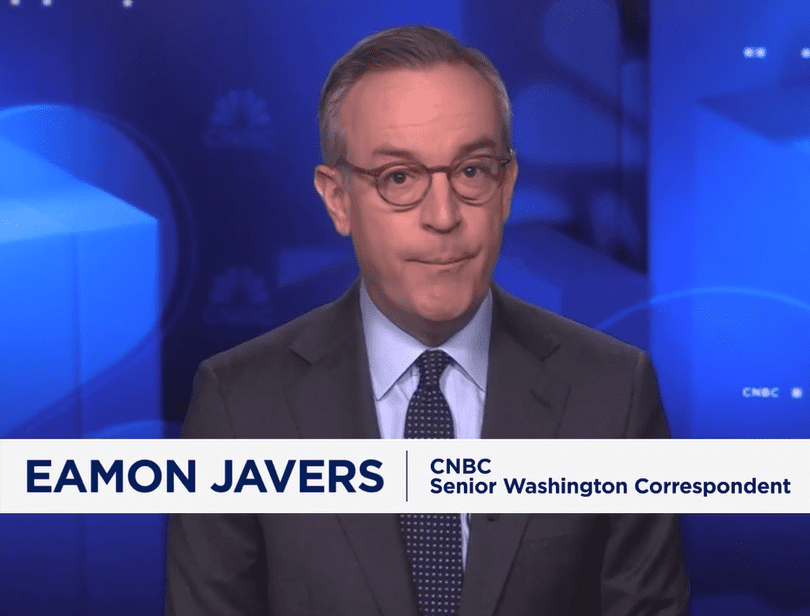

Paul Benda, Executive Vice President for Risk, Fraud, and Cybersecurity at the American Bankers Association, emphasized the urgent need for intervention in an interview with CNBC. He highlighted the role of social media companies in shutting down fraudulent accounts and the importance of law enforcement in prosecuting offenders to prevent further victimization.

The pandemic has only fueled the proliferation of these scams, with criminals posing as potential romantic partners to establish connections with lonely individuals across the country. The scam typically evolves from innocuous conversations to requests for money, exploiting the victims’ trust and emotional investment.

Despite the banking sector’s efforts to flag suspicious activities, the current regulatory framework limits their ability to protect customers effectively. Banks are legally obliged to provide customers access to their funds, even when transactions could lead to financial ruin. As a result, bank employees often find themselves in the heart-wrenching position of witnessing customers drain their life savings, unable to intervene beyond offering warnings.

The experts advocate for regulatory changes that would enable financial institutions to communicate about at-risk customers, potentially preventing victims from unknowingly funding fraudsters. However, banks generally do not reimburse customers for losses stemming from romance scams, as the transactions are made voluntarily, further complicating efforts to protect individuals.

The banking industry’s plea for a united front against romance scams underscores the complexity of combating these crimes. It calls attention to the need for enhanced cooperation among social media platforms, law enforcement, and regulatory bodies to safeguard Americans from the financial and emotional devastation wrought by these predatory schemes.