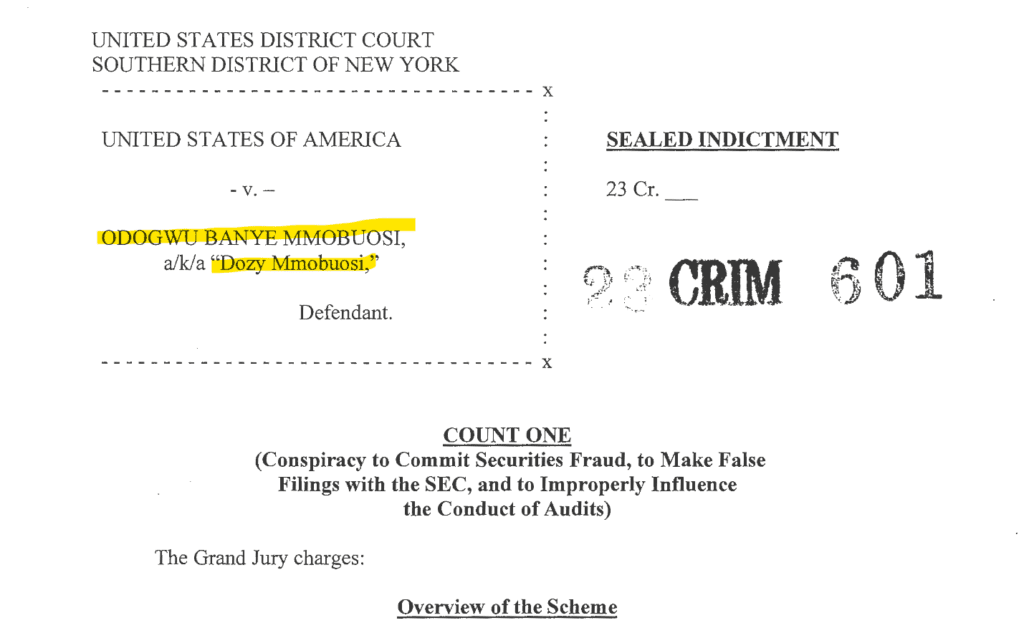

Damian Williams, the U.S. Attorney for the Southern District of New York, and James Smith, the Assistant Director in Charge of the New York Field Office of the FBI, have unveiled an Indictment charging Odogwu Banye Mmobuosi, also known as Dozy Mmobuosi, with securities fraud, making false filings with the U.S. SEC, and conspiracy charges. Mmobuosi is still at large.

The SEC Charges

In December 2023, the SEC announced charges against Mmobuosi Odogwu Banye and three affiliated U.S.-based entities of which he is the CEO – Tingo Group Inc., Agri-Fintech Holdings Inc., and Tingo International Holdings Inc. – in connection with an alleged multi-year scheme to inflate the financial performance metrics of these companies and key operating subsidiaries to defraud investors worldwide.

Tingo Group’s fiscal year 2022 Form 10-K filed in March 2023 reported a cash and cash equivalent balance of $461.7 million in its subsidiary Tingo Mobile’s Nigerian bank accounts. In reality, those same bank accounts allegedly had a combined balance of less than $50 as of the end of fiscal year 2022. According to the SEC’s complaint, Defendants also fabricated the customer relationships that formed the basis of their purported businesses.

The SEC alleged that Mmobuosi siphoned hundreds of millions of investors’ money for his personal benefit.

In June 2023, NASDAQ-listed shares in Tingo Group plunged in value after a report from short-seller Hindenburg Research said the company was an “exceptionally obvious scam.”

The DOJ Indictment

The DOJ investigation comes to the same conclusion as the SEC and speaks of a massive fraud scheme. The indictment reveals a substantial scheme orchestrated by Mmobuosi to inflate the financial statements of Nigerian companies Tingo Mobile and Tingo Foods, misrepresenting their profitability and cash reserves. Mmobuosi is currently at large.

According to the unsealed indictment and court filings, Mmobuosi orchestrated the fraudulent scheme from at least 2019 through 2023. The strategy involved falsely representing Tingo Mobile and Tingo Foods as operational and highly profitable businesses, leading to their sale to U.S.-listed companies, including Tingo Group and Agri-Fintech Holdings.

This false representation resulted in Tingo Group and Agri-Fintech issuing financial statements that portrayed Tingo Mobile and Tingo Foods as cash-rich, revenue-generating entities, contrary to their actual status. Mmobuosi then allegedly misappropriated cash from Tingo Group and Agri-Fintech, profiting from well-timed sales of their shares at inflated prices.

Odogwu Banye Mmobuosi, 45, a Nigerian national, faces charges of conspiracy, securities fraud, and making false filings with the SEC. These charges carry maximum sentences of five years, 20 years, and 20 years in prison, respectively. The charges underscore the severity of the alleged offenses and the potential legal consequences for Mmobuosi.

Share Information

If you have any information about this case, please let us know via our whistleblower system, Whistle42.