The UK regulator FCA concludes a two-year probe as Monzo posts its first annual profit. The FCA has dropped its criminal investigation into Monzo regarding potential anti-money laundering (AML) rule breaches but continues to investigate the matter as a civil case. This could still lead to fines. This decision of the regulator comes after a two-year inquiry that initially raised the possibility of criminal prosecutions against the app-only bank.

The FCA launched its probe in 2021, scrutinizing potential breaches of AML and financial crime regulations dating back to October 2018. However, Monzo‘s latest disclosure reveals that the criminal aspect of the investigation has been dropped, a significant relief for the bank.

Monzo’s Financial Turnaround

The announcement coincides with Monzo‘s first annual profit, marking a major milestone for the bank after nearly a decade of operations. The online lender reported a £15.4 million profit for the year ending March, a stark contrast to the £116 million loss reported the previous year. This turnaround is largely attributed to higher interest rates, which have boosted the bank’s profit margins on its products.

Monzo‘s customer base expanded significantly last year, with 2.3 million new customers joining, making it the seventh-largest bank in the UK. Deposits surged by 88% to £11.2 billion, driving a near-tripling of revenues to £880 million.

The Fraud Statistics

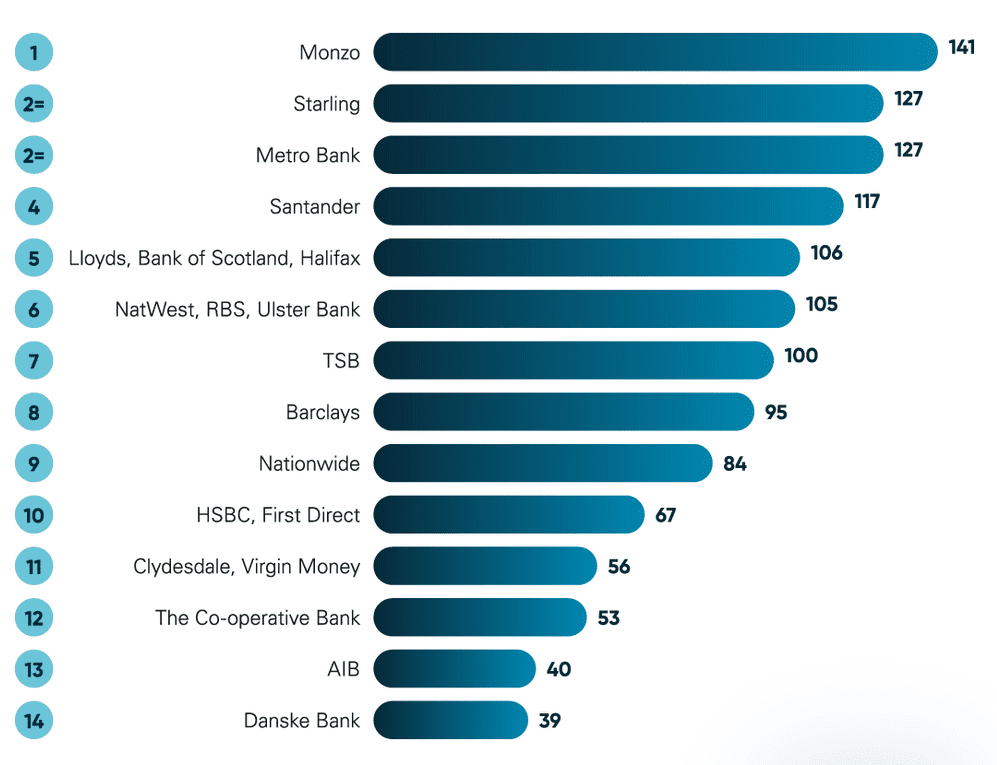

However, according to statistics on bank customers’ susceptibility to authorized push payment (APP) fraud, Monzo is well ahead of Starling Bank and Metro Bank. For every million consumer transactions that Monzo and Starling sent in 2022, 141 and 127, respectively, were reported as APP fraud payments. According to 2022 data published by the Payment Systems Regulator.

In 2022, Monzo and Starling are also among the lowest-scoring firms for reimbursing victims of APP fraud.

Leadership and Growth

Founded in 2015 by entrepreneur Tom Blomfield, Monzo aimed to challenge traditional high-street banks with its app-only model. Blomfield stepped down in 2021, succeeded by TS Anil, a former Visa and Standard Chartered executive.

Anil emphasized the bank’s evolution from its early image as a millennial-focused app to a comprehensive banking service for all demographics. “Our median age is well into the 30s, and we have customers in their 90s banking with Monzo,” he said, highlighting the bank’s broadening appeal.

Anil expressed confidence in Monzo‘s continued profitability, noting a significant increase in customers using Monzo as their primary bank. Nearly a quarter of its nine million customers now consider Monzo their main financial institution.

Despite the positive financial news, Monzo also reported an increase in credit losses and arrears. This is expected as a larger balance sheet and more extensive lending typically result in higher impairments. Notably, Monzo lends out only about 15% of its deposits, compared to nearly 80% for traditional high street banks.

Expansion Plans

In March, Monzo raised an additional £340 million, led by Google’s growth fund, CapitalG, to further its growth. The bank plans to open a new office in Dublin, aiming to establish a foothold in the EU and expand services into European markets such as France and Germany.