With its new status as a Qualified Entity under EU Directive 2020/1828, EFRI escalates its battle against cybercrime, scam brokers, and the financial institutions that enable them.

Excerpt

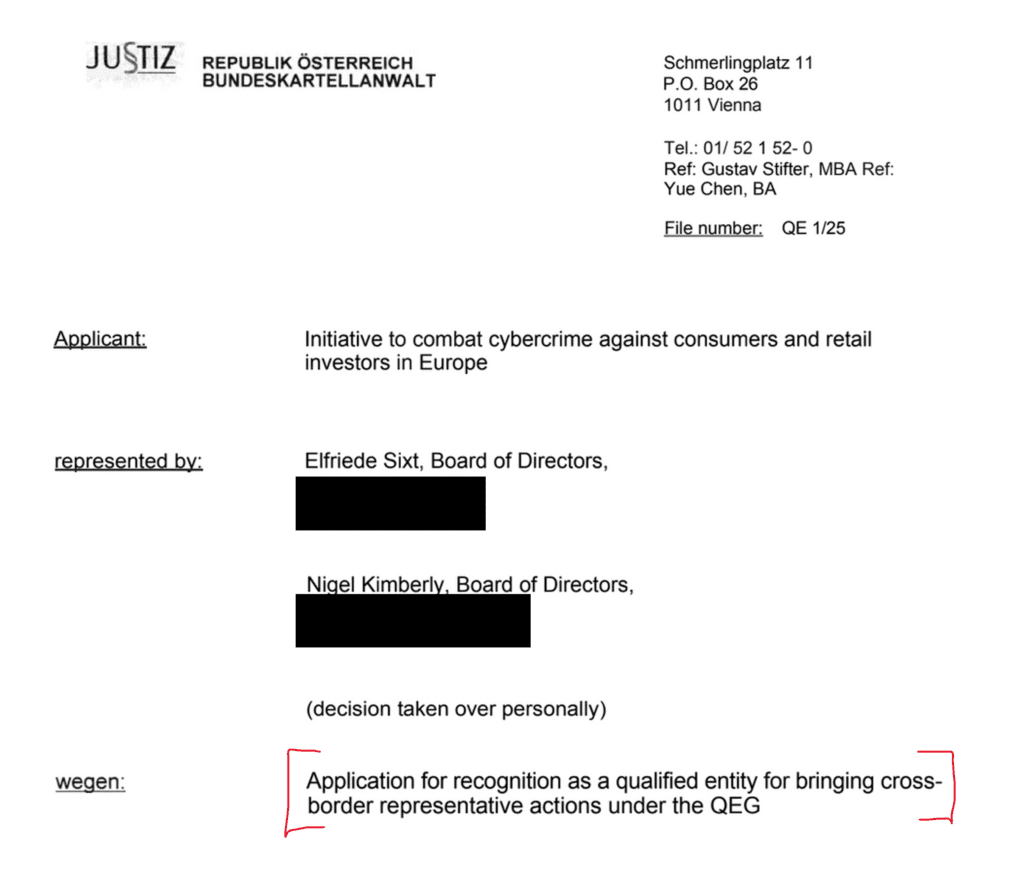

The European Funds Recovery Initiative (EFRI) has reached a new milestone in the fight against cybercrime and financial fraud. Effective March 31, 2025, EFRI has been recognized as a Qualified Entity (QE) under Directive (EU) 2020/1828 by Austrian authorities—empowering it to file collective redress actions across the European Union. This is more than a legal upgrade. It’s a formal declaration of war on cybercriminals, fraudulent brokers, and their most dangerous enablers: banks and payment processors in the FIAT and crypto sectors.

Key Points

- EFRI recognized as Qualified Entity under Directive (EU) 2020/1828—can file injunctions and redress actions EU-wide.

- Approval granted in Austria, effective across all EU Member States.

- EFRI to target scam-facilitating payment processors, such as Payvision, Kobenhavn Andelskasse, and others.

- Millions in victim funds already recovered through EFRI-backed legal actions.

- Collective actions offer financial redress for thousands of scam victims across Europe.

- EFRI will demand “cease and desist” agreements and escalate to legal proceedings when ignored.

- First collective cases already in preparation.

📖 Narrative: A New Chapter in the Fight Against Cybercrime

Since 2017, EFRI has operated where law enforcement often falls short—on the frontlines of digital financial warfare, tracking stolen funds and demanding accountability not just from the scammers, but from the banks and payment processors that enabled them.

EFRI’s role in bringing down Israeli cybercriminal Gal Barak and his vast web of call center scams was a watershed moment. With the help of EFRI’s persistent victim advocacy, Barak and more than a dozen associates were sentenced to prison in multiple jurisdictions. Millions in stolen funds were traced and reclaimed—often from the very financial institutions that claimed ignorance.

Now, with its newly granted Qualified Entity status, EFRI gains real teeth. It can force companies to stop illegal conduct through injunctions and claim damages on behalf of victims through redress actions—a European-style class action. The era of impunity for financial crime facilitators is over.

Injunctions and Redress: Tools of Legal Warfare

Under Article 8 of the EU Directive and §5 of Austria’s QEG, EFRI can now compel companies to cease illegal practices such as:

- Misleading financial advertising

- Operating fraudulent investment schemes

- Supporting known scammers with financial infrastructure

EFRI will first seek cease-and-desist agreements—but will not hesitate to bring cross-border litigation against non-compliant entities. These measures go beyond symbolic warnings. They carry the full weight of enforceable EU consumer protection law.

With redress actions, EFRI can now formally demand compensation from companies that caused financial harm—particularly financial crime enablers in FIAT and crypto sectors who ignored fraud red flags for years while profiting from scam operations.

A Voice for the Voiceless: Victims of Online Investment Fraud

EFRI has always stood for the small investor, the defrauded pensioner, the single mother tricked by scam brokers, and the many whose complaints were ignored by complicit or indifferent regulators.

This recognition as a Qualified Entity isn’t just a legal upgrade. It’s an official validation of EFRI’s tireless work and a signal that victims finally have a powerful institutional ally. With the opt-in or opt-out redress mechanisms now available, thousands of victims across the EU can be part of collective actions that would have been impossible individually.

Actionable Insight: The Beginning of the End for Scam Enablers

FinTelegram has long warned about licensed or illegally operating payment processors and crypto exchanges that serve scam operators while hiding behind technical compliance. With EFRI’s enhanced powers, we expect a legal storm to hit repeat offenders in the coming months.

EFRI’s first targets are already in its crosshairs. The message is clear: if you’ve enabled scams, you’re next.

Call for Information: Join the Resistance Against Financial Crime

FinTelegram and EFRI are calling on:

- Victims of investment fraud (past and present)

- Former insiders of scam brokers and PSPs

- Regulatory watchdogs and law enforcement allies

👉 Share your evidence. Submit your case. Join our mission to expose and dismantle the cyber-financial crime infrastructure across Europe.