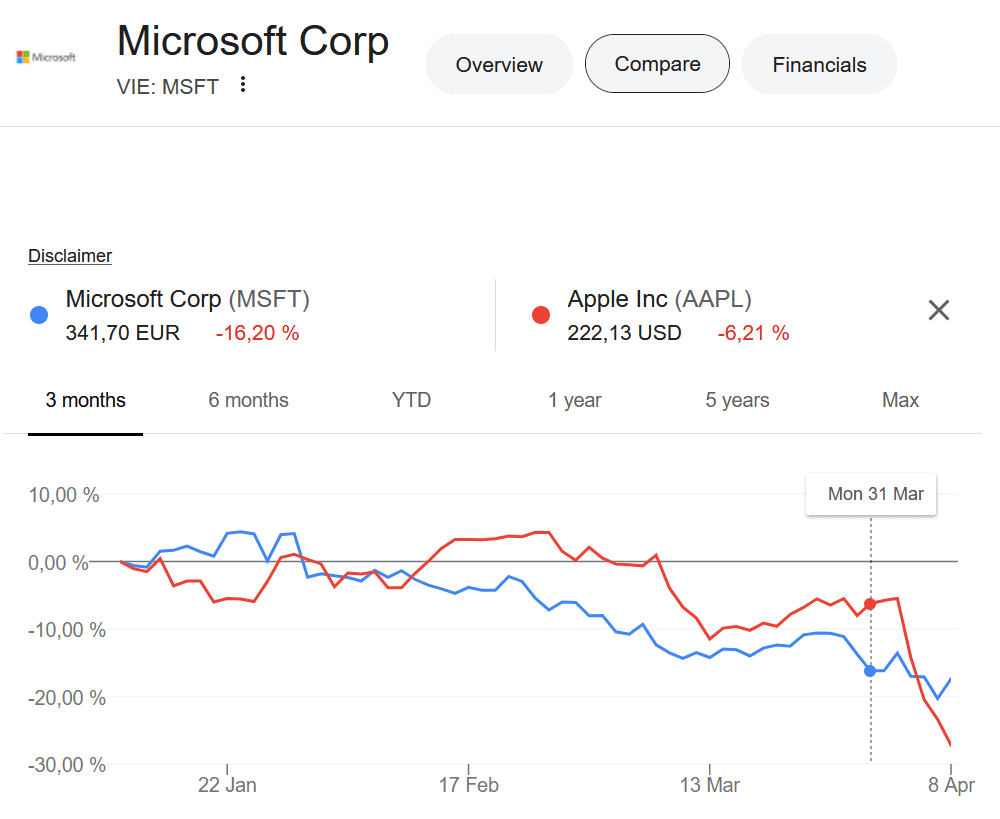

Microsoft has reclaimed its position as the world’s most valuable public company, with a market capitalization of $2.64 trillion as of April 8, 2025, surpassing Apple‘s $2.59 trillion valuation. This shift follows a four-day selloff that erased 23% of Apple’s value, compared to Microsoft‘s milder 7% decline over the same period. The Nasdaq Composite fell 13% during this tariff-driven market rout.

Context Behind the Shift

Apple‘s heavy reliance on Chinese manufacturing (90% of iPhones) and exposure to retaliatory tariffs from China (34%) and other countries like India (26%) and Vietnam (46%) have made it particularly vulnerable. Analysts warn iPhone prices could rise by $350 in the U.S., threatening demand in Apple’s largest market. Meanwhile, Microsoft‘s enterprise-focused cloud services and software offerings face less direct tariff pressure, though rising hardware costs for Azure data centers remain a concern.

Technical and Strategic Factors

- Apple: Faces critical support near $180 after breaching multiple resistance levels. Analysts highlight $196–$200 and $209 as key price recovery thresholds.

- Microsoft: Maintains stronger institutional confidence, with JPMorgan ($450 target) and Morgan Stanley ($460 target) citing cloud growth resilience.

Broader Market Impact

The “Magnificent Seven” tech stocks collectively lost $1.8 trillion in value during the two-day tariff selloff. While Microsoft now leads, its position remains precarious—the company briefly held the top spot in early 2024 before being overtaken by Apple and Nvidia (now third at $2.35T). The ongoing trade war has pushed Goldman Sachs‘ recession probability estimate to 35%, up from 20%.

This leadership change underscores how geopolitical trade policies are reshaping tech valuations, favoring companies with diversified revenue streams and lower hardware dependency.