Part of FinTelegram DeFi Series

Excerpt:

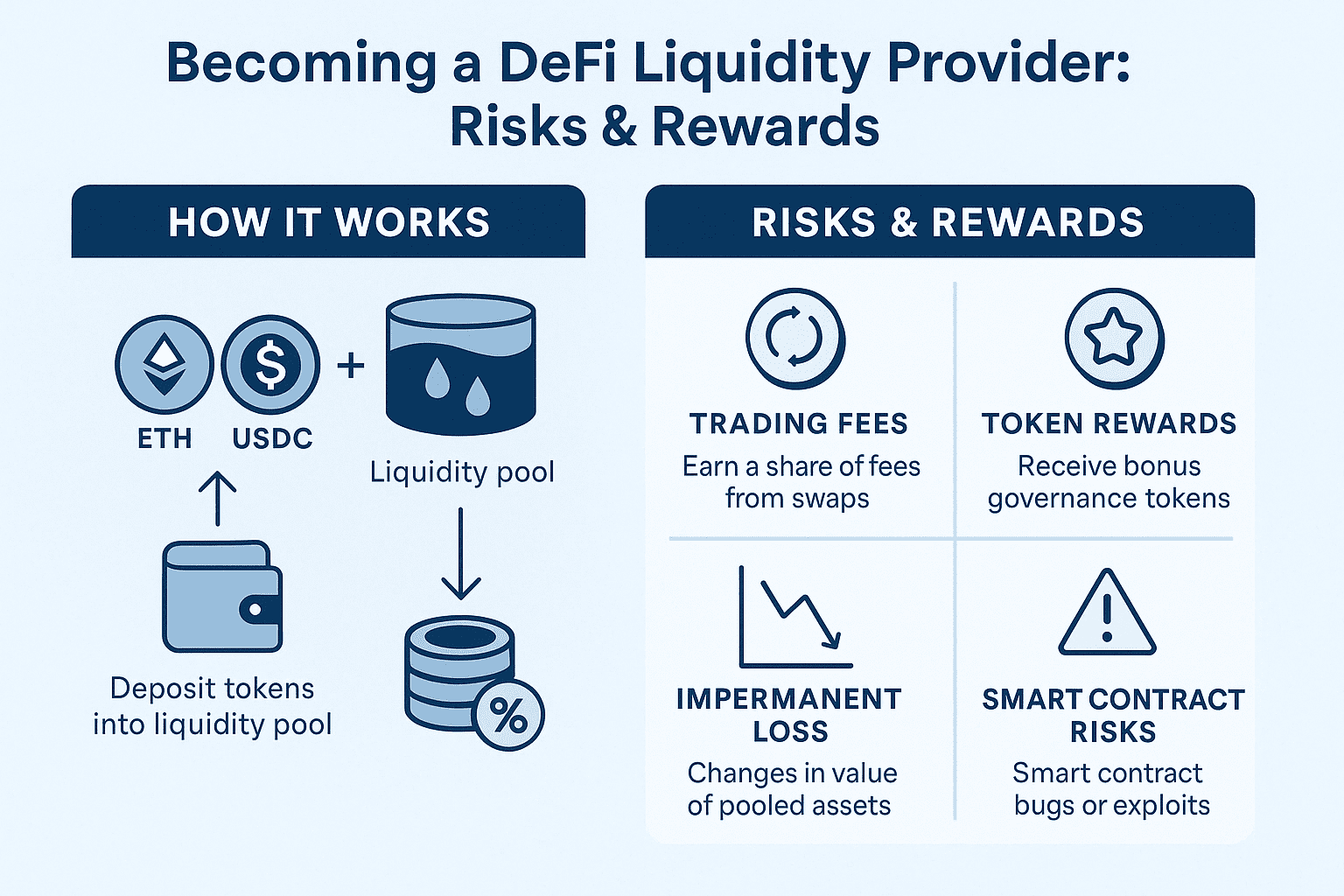

Liquidity Providers (LPs) are the silent engines that power DeFi markets, enabling decentralized exchanges, lending, and yield farming to function without intermediaries. But while LPs can earn trading fees and token rewards, they also expose themselves to risks like impermanent loss and smart contract exploits. In this third part of our FinTelegram DeFi Series, we explain who liquidity providers are, how liquidity pools work, and what dangers hide beneath the surface.

Key Points:

- Liquidity Providers (LPs) deposit crypto assets into liquidity pools that enable decentralized trading and lending.

- In return, LPs earn fees (e.g., from swaps) and/or token incentives.

- Impermanent loss is a major hidden risk for LPs.

- DeFi’s flexibility means anyone can become an LP—but without protection or guarantees.

- Smart contract exploits can drain pools and LP funds without recourse.

Short Narrative:

Imagine walking into a marketplace where you provide the goods, set no prices yourself, and earn a fee every time someone trades. That’s the role of a Liquidity Provider (LP) in DeFi.

At decentralized exchanges like Uniswap, Curve Finance, or Balancer, liquidity providers deposit token pairs (e.g., ETH and USDC) into automated liquidity pools. These pools allow users to trade instantly based on smart contract algorithms, not centralized order books.

In return for supplying liquidity, LPs earn:

- A share of the trading fees (typically 0.3% per swap on Uniswap V2)

- Bonus rewards in governance tokens (e.g., UNI, CRV)

The Catch: Impermanent Loss and Risks

Impermanent loss happens when the price ratio of deposited tokens changes compared to when they were deposited. If a user provided ETH and USDC when ETH was worth $1,000, but ETH later rises to $2,000, they could end up with less ETH than if they had simply held it.

Other major risks:

- Smart Contract Vulnerabilities – Bugs or exploits can drain entire pools.

- Oracle Manipulation – Wrong price feeds can create profitable attacks on pools.

- Protocol Bankruptcy – Poorly designed tokenomics (e.g., over-rewarding LPs) can cause collapses.

Examples of Liquidity Pools:

- Uniswap V3: Concentrated liquidity lets LPs choose the price range they want to cover.

- Curve Finance: Specializes in stablecoin swaps with minimal impermanent loss.

- Balancer Pools: Allow for customizable token ratios beyond 50/50 splits.

Key Concepts Introduced:

- Liquidity Pool

- Impermanent Loss

- LP Token (proof of deposit in a pool)

- Concentrated Liquidity

- Smart Contract Risk

Actionable Insight for Readers:

Before becoming a liquidity provider:

- Understand which tokens you’re pooling—and how volatile they are.

- Study the fee structure and expected volume of the platform.

- Check if the protocol is audited and actively maintained.

- Use impermanent loss calculators (example tool) to model outcomes.

Providing liquidity isn’t passive income—it’s active risk-taking.

Call for Information:

Are you aware of hidden vulnerabilities, insider LP dumps, or liquidity mining programs that overpromise and underdeliver?

👉 Report anonymously at Whistle42.com!