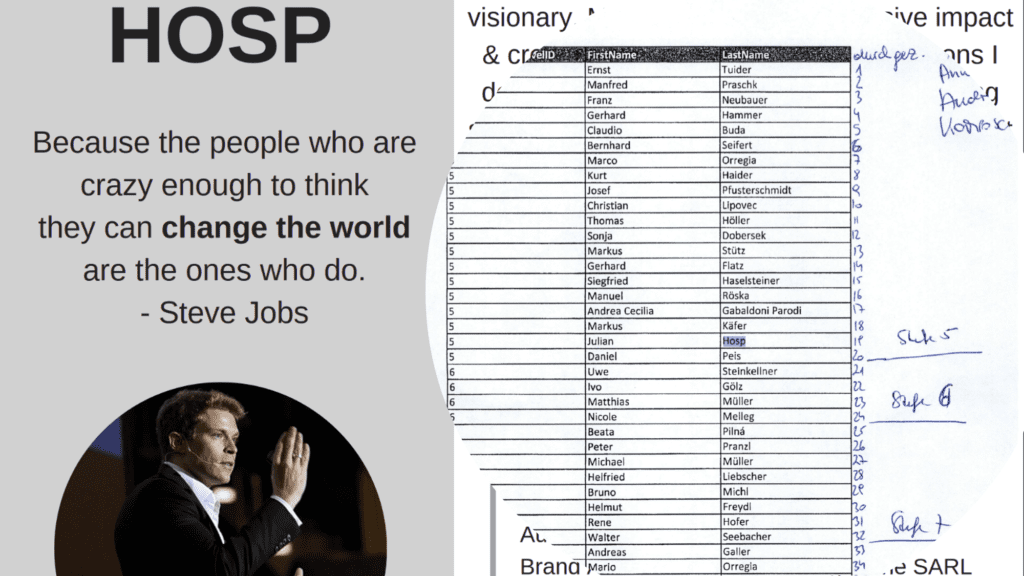

Austrian national and Singapore resident Julian Hosp, a crypto entrepreneur already tarnished by his association with the defunct crypto venture TenX, is now embroiled in a contentious legal battle concerning his latest enterprise, Cake, as well as its associated crypto platform, DeFiChain (DFI). Tech in Asia has uncovered documents indicating a rift between Hosp and co-founder U-Zyn Chua, highlighting disputes over financial management, the company’s future, and allegations of misuse of company funds.

As CEO of Cake, Hosp’s financial practices have come under scrutiny. He is accused of using company funds to cover personal expenses, such as his nanny’s salary—who was officially listed as a “senior editor” drawing a monthly paycheck of $8,400—and using company accounts to promote his personal website and external ventures like NAS Academy. These revelations came to light particularly as the company faced financial cutbacks, with Chua uncovering these discrepancies during an internal audit in the fall of 2023.

Read our reports on Julian Hosp here on FinTelegram.

This financial impropriety has led to a severe devaluation of DeFiChain, which has plummeted by 99% from its peak in December 2021. The ongoing conflict has also raised questions about the remaining company reserves, reportedly worth up to $100 million.

Amidst the turmoil, Chua sought to liquidate Cake, while Hosp allegedly attempted to negotiate to take full control of the company, offering Chua $32.5 million in the fall of 2023—an offer he retracted the following day. The legal disputes have further escalated to the point where Chua has pressed criminal charges, with Singaporean authorities revoking the work visa of the nanny falsely employed as a senior editor.

Hosp has responded to these allegations with ambiguity, stating only that he is cooperating with the authorities. His legal team argues that his promotional expenses were part of a broader advertising strategy meant to benefit Cake indirectly through Hosp’s public persona. However, these justifications have done little to alleviate the concerns of investors and stakeholders.

In addition to the legal quagmire, Julian Hosp‘s prior involvement with the Lyoness Ponzi scheme and the collapse of TenX raises concerns about a pattern of financial misconduct. This backdrop may have informed Chua’s expectations and preparedness for the fallout following Hosp’s departure from Cake.

As the court battle continues, with potential further liquidation proceedings looming, the future of Cake and DeFiChain remains uncertain. The case not only impacts the company’s stakeholders but also paints a grim picture of Julian Hosp’s business practices, challenging his public image as an upstanding entrepreneur.

Conclusion: A Repeated Pattern of Controversy

Julian Hosp‘s career is marred by repeated controversies, from his days at TenX to his current challenges at Cake. These instances highlight a pattern of questionable financial decisions and management practices that have left investors and partners disillusioned. The ongoing legal disputes and potential liquidation of Cake will likely provide more insights into the depth of the issues at hand, signaling caution for future dealings with projects associated with Hosp.