Mythology also knows these individuals who, driven by their own hubris, want to get too close to the sun and then crash with burnt wings. The comparison with Icarus is probably the most apt one you can find for FTX founder Sam Bankman-Fried (SBF). Just 18 months ago, he was the US crypto mogul that politicians and celebrities bowed down to. Today he sits in jail waiting for his trial. A perfect fall from grace.

Revoked Bail And Other Humiliations

The court recently revoked SBF‘s release on bail after SBF violated probation conditions. He disclosed personal writings of his ex-lover and coworker, Caroline Ellison to a journalist from The New York Times. Ellison, previously the CEO of SBF‘s hedge fund, Alameda Research, is among three ex-close associates who have plead guilty and consented to be witnesses against him during the trial.

His legal team has requested the judge to grant him access to the courthouse five days weekly to examine evidence, contending that without this, he won’t be able to sufficiently prepare for his trial on October 2, 2023. However, the judge just agreed to let SBF consult with his attorneys at the courthouse, providing him with an internet-connected laptop for approximately six and a half hours on the upcoming Tuesday.

The U.S. prosecutors allege that SBF misappropriated billions from FTX client accounts to offset Alameda‘s deficits, acquire extravagant properties, and contribute over $100 million to U.S. political campaigns, aiming to advocate for crypto-supportive policies. While SBF has recognized oversight lapses at FTX, he refutes any claims of fund embezzlement. SBF has pleaded not guilty to the charges!

Allegedly, SBF‘s attorneys might introduce an advice-of-counsel defense during the trial. He claims that guidance from the Fenwick & West law firm led him to assume his actions were legitimate.

The SBF & FTX Story In A Nutshell

- Sam Bankman-Fried (SBF) was born in 1992, studied at the Massachusetts Institute of Technology (MIT) and became a trader at Jane Street Capital.

- FTX began within Alameda Research, a quantitative cryptocurrency trading firm and liquidity provider founded by SBF, Caroline Ellison, and other former employees of Jane Street in 2017, in Berkeley, California.

- In 2019 by SBF and Gary Wang established the crypto exchange FTX in Antigua and Barbudawith its main office located in the Bahamas. It reached its zenith in July 2021, FTX raised $900 million at an $18 billion valuation from over 60 investors, including Softbank, Sequoia Capital, and other firms. At this time, it boasted over a million users and ranking as the third-largest crypto exchange by trading volume.

- From November 11, 2022, FTX entered Chapter 11 bankruptcy proceedings within the US legal framework. The public’s apprehension grew after a CoinDesk article in November 2022 highlighted that a significant chunk of Alameda Research‘s assets, another company in the FTX network, was in FTX‘s proprietary token (FTT). This disclosure led Binance‘s CEO, Changpeng Zhao, to declare Binance‘s intention to offload its FTT holdings, triggering a surge in FTX customer withdrawals. FTX struggled to fulfill these withdrawal requests.

- Although Binance initially expressed interest in acquiring FTX to facilitate asset recovery for its customers, they retracted their offer a day later due to concerns over mismanaged client funds and ongoing investigations by U.S. agencies.

- On December 12, 2022, the Bahamian authorities detained SBF on financial misconduct charges, acting on a request from the US government.

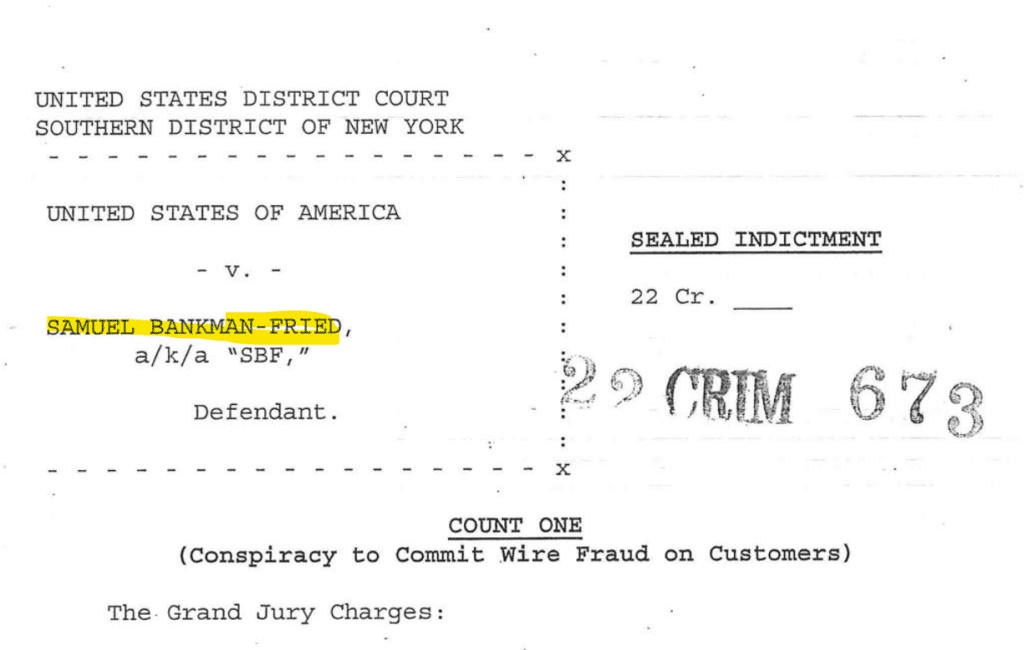

- On December 22, 2022, the U.S. Department of Justice charged SBF in an Eight-Count Indictment with Fraud, Money Laundering, and Campaign Finance Offenses

John J. Ray III currently helms FTX as its CEO, with expertise in salvaging funds from defunct companies. Reflecting on FTX‘s prior leadership, Ray commented, “I’ve never witnessed such a profound lapse in corporate governance or such a glaring lack of reliable financial data in my entire career.” He further emphasized the unparalleled nature of the situation.