The crypto industry is struggling to find its place. This is currently most evident at Binance, which has just had to pay $4.3 billion to drop charges and lawsuits in the US. Binance CEO Changpeng Zhao had to resign and is to go to prison, say the prosecutors. In Europe, MEXC, a crypto exchange from Asia, is currently in the crosshairs of regulators, as are its partners such as MoonPay, Simplex, and Banxa. MEXC lost its Estonian license last week.

The Blockchain & Crypto Disruption

In a recent development that could set a precedent for the entire cryptocurrency industry, the US authorities’ decisions and findings, particularly the penalties and the resignation of the Binance CEO, Changpeng Zhao, should be viewed as a benchmark. This scenario underscores the need for other crypto exchanges and their partners to align with the regulatory framework established for the traditional FIAT money system.

Historically, the blockchain-based crypto scene has been perceived as a disruptive evolution of the FIAT system. Consequently, many in the crypto world argue that the financial laws and regulatory provisions developed for the FIAT system are not directly applicable to cryptocurrencies and digital assets. They propose that a new set of regulations is required for this emerging monetary system. However, even in the new crypto world, it should not be possible for terrorists and cybercriminals to use the system. Or is that irrelevant in the new world?

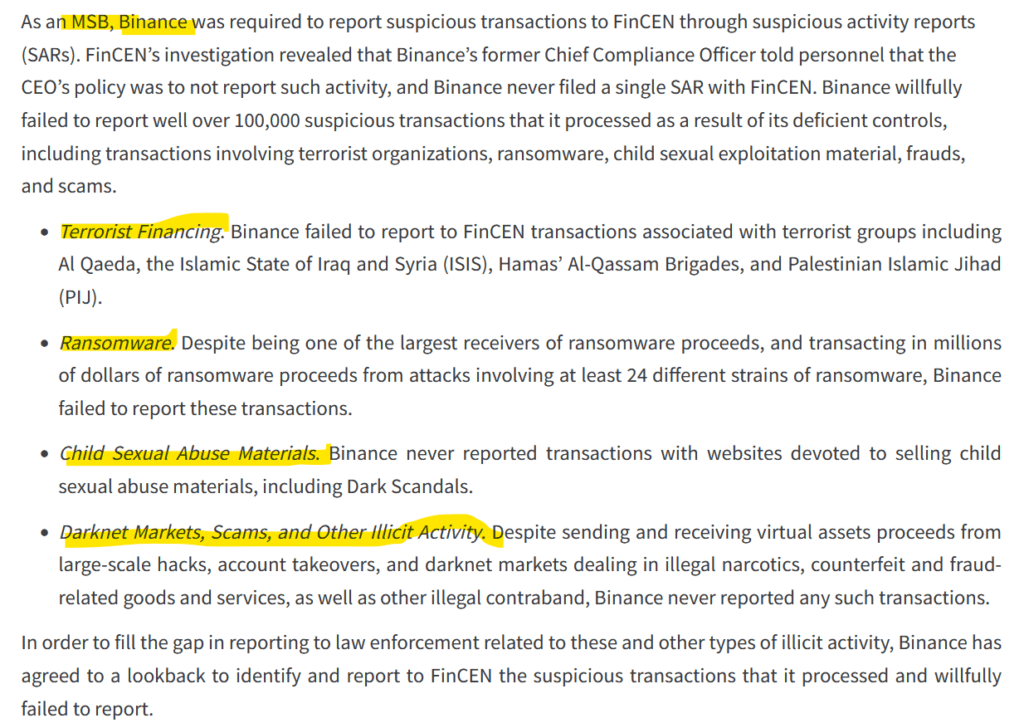

However, a critical issue arises when crypto companies, like Binance or MEXC, engage in transactions involving consumers’ FIAT money. These exchanges and crypto payment processors often do not apply proper KYC/AML procedures and thus fail to rigorously scrutinize the origins of the FIAT funds being converted into crypto assets. Investigations by US authorities have revealed that this lax approach has enabled cybercrime organizations and terrorist groups to use crypto exchanges as channels to bypass the traditional FIAT system, essentially facilitating money laundering.

For those interested in how FinCEN has evaluated Binance’s activities, please read the FinCEN Consent Order here.

What About Advcash et al.?

The case of Binance is particularly illustrative. Until recently, Binance partnered with Advcash, a Russian-controlled payment processor based in Belize, operating globally without authorization. Advcash has been a conduit for laundering substantial funds from questionable sources, and it has played a role in circumventing Western sanctions against Russia. Advcash‘s involvement with various crypto exchanges has been pivotal for these platforms to access the FIAT system.

Read our Advcash reports here.

We reviewed MEXC again on November 22, 2023, and found that the above FIAT Payment processors continue to facilitate payments for MEXC.

Given these developments, European regulators should consider emulating the approach of US supervisory authorities. The actions taken by the US against Binance highlight the necessity of stringent regulatory compliance for crypto entities, especially those dealing with FIAT currencies. This approach ensures that the emerging digital asset space does not become a haven for illegal activities and remains in line with global financial regulations.

Cautionary Tale

The Binance example serves as a cautionary tale and a guideline for how the crypto industry must evolve to responsibly integrate into the global financial ecosystem.

As with the trial against FTX, the global crypto scene has learned a lot from the results that have now come to light; above all, however, we are learning what not to do if you don’t want to be prosecuted by the authorities and go to prison. As unpleasant as the authorities’ actions against the companies and individuals concerned are, they are important for the industry’s future development.