One of the Biggest Cybercrime Scandals in History

The Payvision scandal is one of the most shocking cases of corporate complicity in global cybercrime. A Dutch payment processor, Payvision BV, actively facilitated fraud networks, laundering and distributing stolen funds for years. Despite overwhelming evidence, Dutch authorities refuse to hold those responsible accountable and continue to withhold crucial investigative reports that could help victims recover their stolen money.

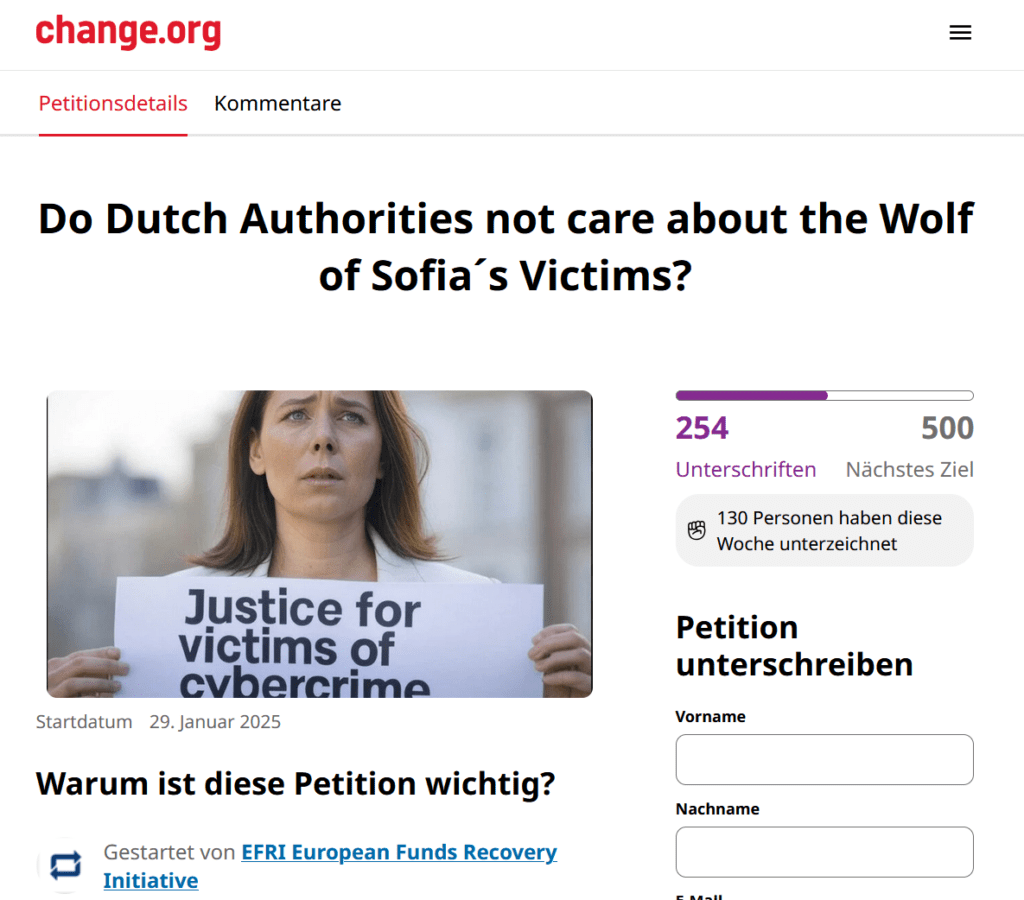

The European Fund Recovery Initiative (EFRI) has launched a petition demanding the release of these reports. FinTelegram urges all readers to support this cause by signing the petition and making a small donation to amplify its reach.

Payvision: A Gateway for Financial Crime

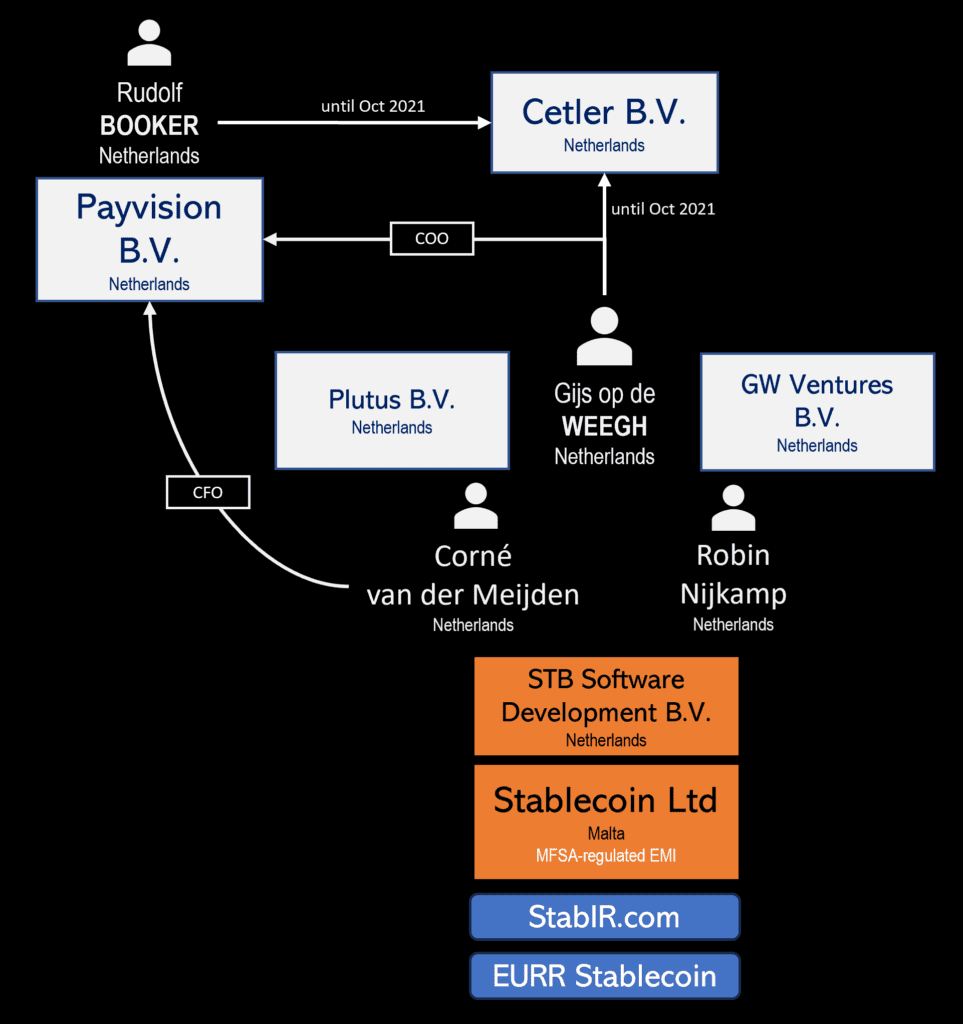

Founded in Amsterdam by Rudolf Booker, Payvision became a key financial enabler for the cybercrime masterminds Uwe Lenhoff and Gal Barak. Through their fraudulent broker platforms and gambling sites, Lenhoff and Barak stole hundreds of millions from retail investors, laundering a significant portion of the funds through Payvision.

The question of whether Payvision unknowingly facilitated these scams or actively conspired is no longer up for debate. The evidence confirms that Payvision executives, including CEO Rudolf Booker and COO Gijs op de Weegh, knowingly processed stolen funds for these criminals. Despite internal compliance warnings and public fraud alerts from financial regulators, Payvision continued handling transactions for these fraudulent platforms in exchange for high fees.

Key evidence from criminal records confirms that Payvision knowingly engaged in money laundering. Lenhoff was arrested in 2019 and died in custody under mysterious circumstances in 2020. Barak was convicted in Austria for money laundering and serious fraud and is still facing further charges in Germany.

Read our Payvision reports here.

Dutch Authorities: Complicit in the Cover-Up

Rather than taking decisive action, Dutch authorities have systematically shielded Payvision’s executives. The Dutch Financial Supervisory Authority (DNB) and the Dutch Public Prosecutor’s Office refuse to disclose vital investigative reports from DNB and KROLL, which detail Payvision’s illegal activities and compliance failures. These reports are crucial for victims seeking legal restitution against Payvision and its parent company, ING Bank NV.

A 2022 exposé by the Dutch financial newspaper FD revealed the existence of these reports, further proving that regulators were well aware of Payvision’s misconduct.

The Scandalous Role of Gijs op de Weegh – Now Operating a Licensed Stablecoin Provider in Malta

One of the most outrageous aspects of this case is that former Payvision COO Gijs op de Weegh is now operating StablR, a system-critical stablecoin provider licensed under Malta’s MFSA regulatory framework and MiCA regulation.

How is it possible that an executive directly responsible for facilitating financial fraud is now trusted with a regulated financial institution? This raises serious concerns about Malta’s financial oversight and regulatory integrity.

The Timeline of Payvision’s Crimes

- January 2018: Payvision’s compliance head Joris Greeuw (LinkedIn) warns management about fraudulent broker GPay Ltd.

- March – May 2018: Financial regulators across Europe, including Austria (FMA) and the UK (FCA), issue warnings about Lenhoff and Barak’s fraud platforms.

- Mid-April 2018: Despite compliance concerns and regulator warnings, Payvision starts processing transactions for these scams.

- June 2018: Greeuw escalates concerns but is overridden by CEO Rudolf Booker and COO Gijs op de Weegh, who approve continued processing of fraudulent transactions.

- July 2018: Payvision enters into a new agreement with Barak’s fraud platforms, ensuring a minimum €4 million monthly turnover and securing higher fees. This contract was personally signed by Gijs op de Weegh.

- January 2019: After the arrests of Lenhoff and Barak, Payvision finally terminates services for these fraud platforms.

Payvision’s Dirty Business Model: Selling Crime as FinTech Success

Despite handling more than €52.2 million in stolen funds in 2018 alone, Payvision managed to position itself as a successful FinTech, even convincing ING to acquire it for €360 million in 2017/2018. The deal was built on fraud-fueled revenues.

However, Payvision’s business was so toxic that even Dutch regulators were forced to act. Following an investigation, the DNB fined Payvision just €330,000—a laughable penalty compared to the scale of the crime. This weak enforcement is an insult to victims and proof of the Dutch authorities’ unwillingness to hold financial criminals accountable.

The EFRI Petition: Demand Justice Now!

EFRI has launched a Change.org petition demanding that the Dutch authorities release the DNB and KROLL reports that detail Payvision’s role in facilitating cybercrime. These reports could help victims pursue justice and compensation.

FinTelegram urges all readers to take action:

- Sign the EFRI petition to demand transparency and justice.

- Donate a small amount on Change.org to amplify the petition’s reach.

- Spread the word—share this article and the petition on social media.

👉 SIGN THE PETITION NOW: Change.org Petition

Victims deserve justice. The Dutch authorities must stop protecting financial criminals and start holding them accountable. Let’s make sure this scandal is not forgotten.