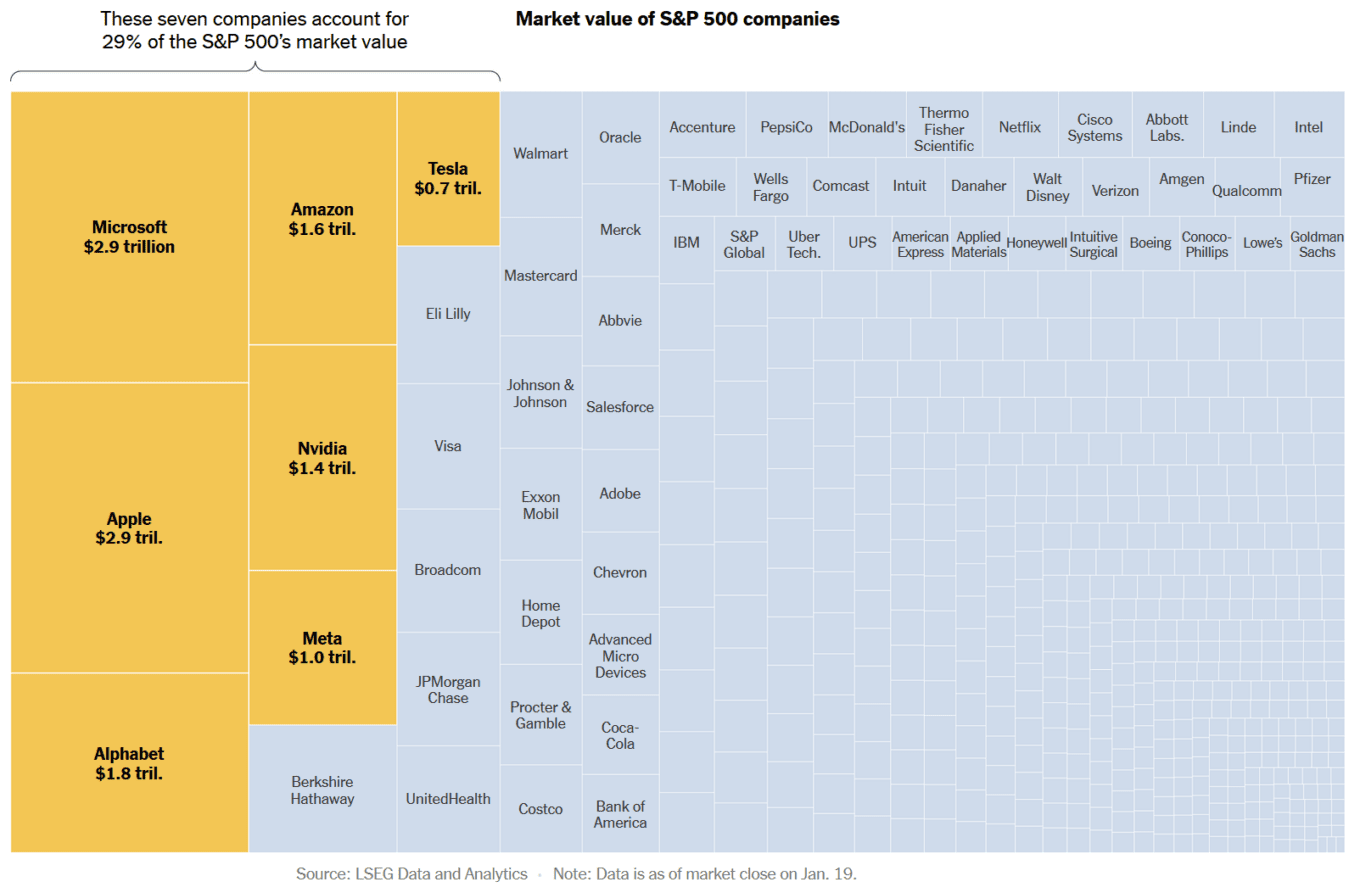

A recent NYT article highlights the significant influence of seven major technology companies, dubbed the “Magnificent Seven,” on the recent surge of the S&P 500 index. These companies – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – have collectively seen their value soar by nearly 117% since the S&P 500’s low point in October 2022 propelled the index to new heights.

This development emphasizing the outsized impact of these tech behemoths due to their large market capitalizations. The S&P 500, being a market-cap-weighted index, reflects the dominant role of its largest constituents. This has resulted in the movements of these seven stocks greatly influencing the overall index. While Tesla has not reached its past highs, it has surged over 64 percent in the last twelve months, contributing significantly to the S&P’s rally.

Interestingly, these seven tech giants were not the highest performers in the index. Companies like Royal Caribbean and General Electric saw even larger percentage gains, but their smaller size meant they had less impact on the S&P 500’s overall movement.

Among the Magnificent Seven, performance varied: Nvidia soared by an impressive 417%, while Amazon saw a relatively modest 38% gain. Despite these differences, the collective influence of these companies has been undeniable in driving the index upwards.

This dominance of a few large companies raises questions about the broader health of the market. While a rising S&P 500 typically indicates positive market sentiment, the concentration of gains in a handful of stocks can obscure underlying market turbulence. The scale of dominance by the current tech giants is unprecedented. Notably, despite a crisis among US banks last March causing many individual stock prices to fall, the S&P 500 ended the month higher, fueled largely by advancements in artificial intelligence and its implications for tech profitability.

Recently, this dynamic has shown signs of shifting, with over half of the index’s companies surpassing their January 2022 peak levels. Analysts are divided on interpreting this trend: some view it as an indication of a broader market rally, while others see it as a potential precursor to a downturn, especially given the slowing economy.