The recent arrest of Joshua “Josh” Cartu in Russia has reignited interest in one of the most notorious financial fraud cases of the past decade—the binary options scheme orchestrated by the Cartu Brothers, centered around the Irish company GreyMountain Management (GMM). Tens of thousands of victims worldwide are still seeking justice and the return of their lost funds, which allegedly financed the extravagant lifestyles of the Cartu Brothers.

The Genesis of the Scheme

Despite the vast scale of their fraudulent operations, the brothers have yet to be held accountable in a meaningful way by any court. This report revisits the story of the Cartu Brothers, their involvement with GMM, and the ongoing quest for justice on behalf of their victims.

Joshua Cartu, the mastermind among the three Canadian-Israeli brothers, built a career around exploiting financial loopholes and regulatory blind spots. Growing up in a middle-class family in St. Catharines, Ontario, Josh was not the typical entrepreneurial prodigy. He was a socially awkward youth who dropped out of high school and began his career washing cars at his father’s dealership, Toronto Life remarks.

In the 2000s, Josh moved to Cyprus and became involved with Playtech, an Estonia-based gambling software company. This experience laid the foundation for his later ventures into the binary options industry, where he and his brothers—David and Jonathan—would create a global network of fraudulent trading platforms under the umbrella of GMM.

The Rise of GreyMountain Management

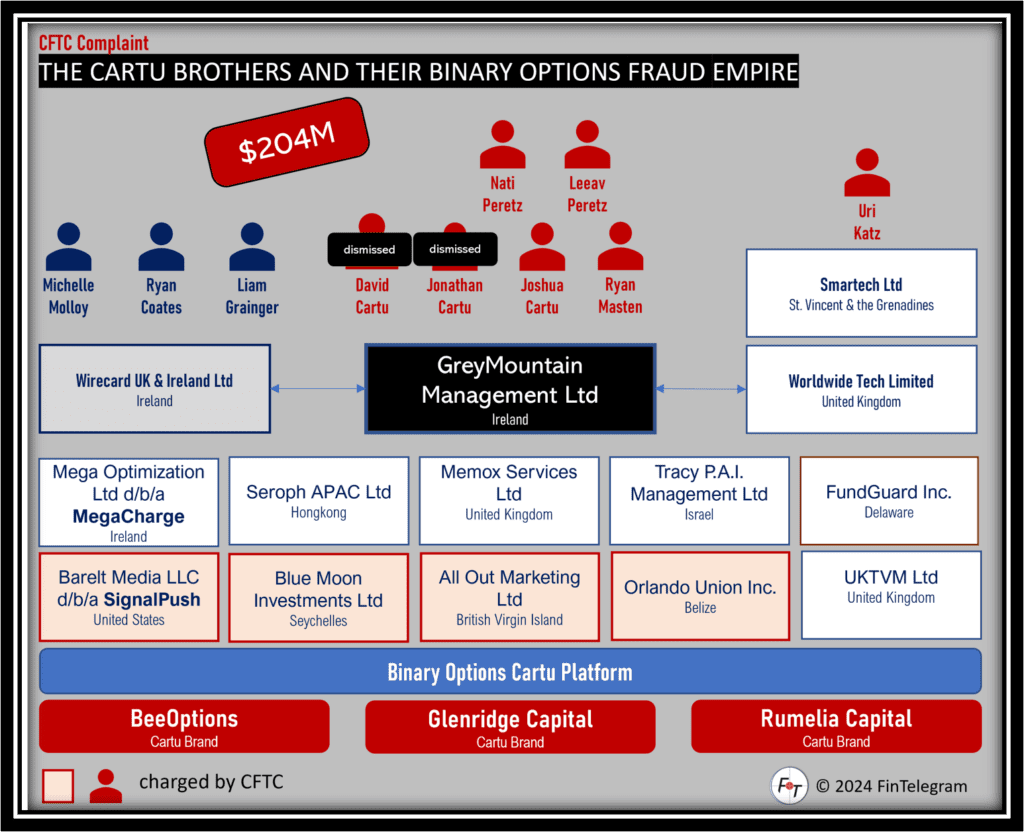

Founded in Ireland, GreyMountain Management Ltd (GMM) became a key player in the binary options industry, serving as both an operator and a payment processor for various fraudulent platforms. The Cartu Brothers, with Josh at the helm, used GMM to facilitate the operations of their binary options schemes, including BeeOptions, Glenridge Capital, and Rumelia Capital. These platforms lured unsuspecting investors with promises of high returns, only to siphon off their money into offshore accounts controlled by the Cartu Brothers.

GMM‘s role was crucial in the Cartus’ operations. The company processed hundreds of millions of dollars through its payment channels, working closely with Wirecard Ireland to facilitate transactions. Despite its significant role in the fraudulent activities, GMM was conspicuously absent from many legal actions, including the U.S. Commodity Futures Trading Commission’s (CFTC) fraud complaint filed in September 2020 against the Cartu brothers and their associates.

Legal Battles and Court Findings

The fraudulent activities of the Cartu Brothers did not go unnoticed. In 2020, the CFTC filed a lawsuit against Joshua Cartu, David Cartu, and Jonathan Cartu, along with their Israeli associates Leeav Peretz and Nati Peretz, accusing them of operating illegal binary options schemes that defrauded investors of millions of dollars. However, despite the extensive evidence against them, the Cartu Brothers have managed to evade serious legal consequences, largely due to jurisdictional challenges and the complexity of their operations.

One of the most significant legal developments came in October 2022, when the Irish High Court found that David Cartu and Jonathan Cartu were shadow directors of GMM and held them personally liable for the losses suffered by investors, including those like Bill Powers, a 71-year-old retiree who lost $124,000 to Glenridge Capital. The court’s ruling exposed the depth of the Cartu brothers’ involvement in GMM’s operations, revealing that they had siphoned off significant sums of money, leaving GMM with just €600,000 to fulfill its obligations.

The Irish directors of GMM, Ryan Coates and Liam Grainger, were also found liable for their roles in the fraud. The court criticized them for their “complete dereliction of duty,” highlighting that they had been negligent in their oversight of the company, allowing the Cartu brothers to operate their schemes with impunity.

The Lavish Lifestyle of the Cartu Brothers

While their victims faced financial ruin, the Cartu Brothers enjoyed a life of luxury, flaunting their wealth on social media and in the company of celebrities. Josh Cartu, in particular, cultivated an image of a successful entrepreneur and racecar driver, sharing glimpses of his extravagant lifestyle with his 600,000 Instagram followers. His posts featured private jets, supercars, and exotic vacations, all funded by the money stolen from thousands of investors.

The Cartu Brothers‘ opulent lifestyle, however, was built on deception. Behind the façade of success, they were running one of the most extensive financial frauds in recent history, preying on individuals who trusted them with their life savings. Despite their public personas, the reality was that they were orchestrating a sophisticated scam, manipulating software to ensure that even when clients placed winning bets, it appeared as though they had lost, allowing the brothers to pocket their funds.

The Disappearance of Funds and the Quest for Justice

To this day, the whereabouts of the funds stolen by the Cartu Brothers remain largely unknown. Investigators believe that the money has been funneled into offshore accounts, making it difficult for authorities to recover and return it to the victims. Despite the efforts of regulators and law enforcement agencies across multiple countries, the Cartu brothers have managed to evade significant legal repercussions.

The Irish High Court’s ruling, which held the Cartu Brothers David and Jonathan personally liable for investor losses, marked an important step towards justice. However, the fact that they have not yet faced criminal charges or been forced to return the stolen funds is a glaring injustice. The victims of their schemes are still waiting for compensation and closure, while the Cartu Brothers continue to live in luxury.

Conclusion

The arrest of Joshua Cartu in Russia may signal a turning point in the pursuit of justice, but much work remains to be done to hold the Cartu Brothers accountable and recover the funds stolen from their victims. According to the Russian media, the next detention hearing will take place on August 24, 2024. It will be interesting to see whether Cartu will be released on bail or perhaps extradited. The latter would be a minor miracle due to the Western sanctions against Russia.

As this case unfolds, FinTelegram will continue to monitor developments and advocate for the rights of those who have been defrauded. The Cartu Brothers’ ability to evade justice for so long is a unique scandal that underscores the need for stronger international cooperation in tackling financial fraud and bringing perpetrators to justice.