Charlie Javice, the U.S. fintech entrepreneur embroiled in a high-profile legal battle with JPMorgan over the acquisition of her college financial aid startup Frank, is set to face trial in October 2024. Amidst accusations of defrauding the banking giant out of $175 million, Javice has maintained her innocence, pleading not guilty and securing her release on a $2 million bond earlier this April. Allegedly, prosecutors are basing the charges solely on incomplete records from JPMorgan.

The Frank Case presided over by U.S. District Judge Alvin Hellerstein in New York, has seen a new development as the judge ordered prosecutors to compel JPMorgan Chase to surrender additional evidence potentially favorable to Javice’s defense.

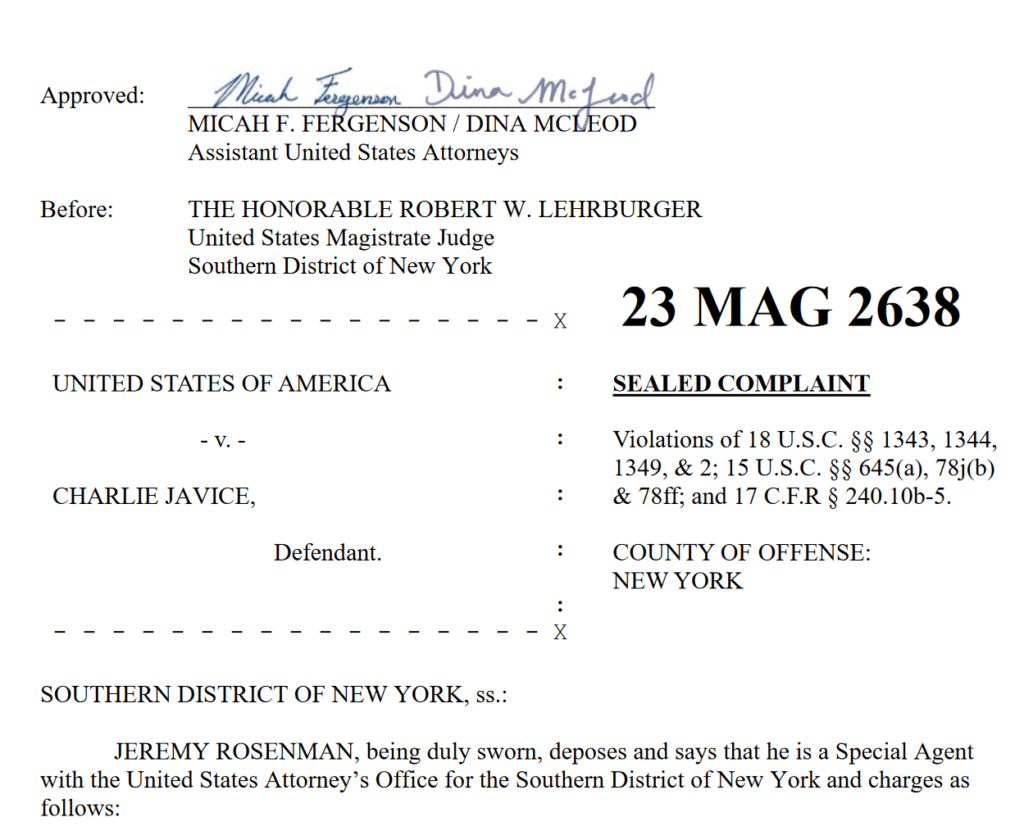

Javice, once celebrated on the Forbes “30 Under 30” list in 2019 for her groundbreaking work with Frank, stands accused of inflating her company’s customer numbers to secure a lucrative acquisition deal with JPMorgan Chase. U.S. prosecutors allege that she claimed Frank boasted over 4 million customers, a stark contrast to the reality of only a few hundred thousand. The indictment, detailing charges of securities fraud, wire fraud, bank fraud, and conspiracy, paints a picture of a deliberate attempt to mislead one of the world’s leading financial institutions.

In a twist, Javice has fired back, accusing JPMorgan of withholding crucial documents that could potentially exonerate her. A recent court filing by Javice’s legal team alleges a “deliberate inaction” on the part of the U.S. government and JPMorgan, arguing that thousands of documents, including internal assessments of the Frank acquisition and communications between JPMorgan employees, have been unjustly kept from the defense. This filing casts a shadow of doubt over the proceedings, suggesting that the evidence currently presented against Javice may be a “cherry-picked set of documents” that fails to tell the whole story.

Javice, who founded Frank in 2017 and saw it acquired by JPMorgan in 2021, had benefited significantly from the deal, receiving over $21 million for her equity stake and an additional $20 million as a retention bonus. However, the current legal maelstrom threatens to overshadow her accomplishments, jeopardizing her once-promising career.

As the trial date approaches, the FinTech and legal communities alike watch closely, eager to see how this complex case will unfold. With allegations of fraud, counterclaims of evidence suppression, and a high-stakes trial on the horizon, the saga of Charlie Javice and JPMorgan Chase continues to captivate and confound, serving as a cautionary tale of ambition, innovation, and the potential pitfalls of high-profile business deals.