The billion-dollar cyberfraud industry in Southeast Asia is booming, fueled by organized crime syndicates exploiting the latest in AI and cryptocurrency. The UNODC report notes that these criminal networks are outpacing government efforts to regulate and combat their operations. Urgent reforms and enforcement are needed to prevent further damage.

Key Points:

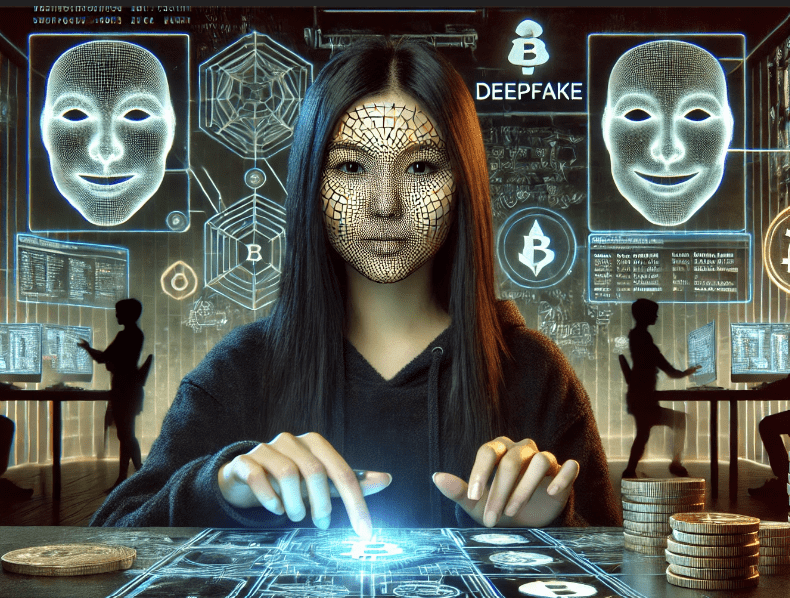

- Southeast Asia’s cybercrime industry is rapidly expanding, with crime syndicates integrating advanced technologies like AI, deepfakes, and malware into their operations.

- The UNODC report highlights new underground markets and crypto-based money laundering methods, enabling billions of illicit proceeds to flow unregulated through virtual asset service providers (VASPs).

- Cyber-enabled fraud, human trafficking for forced criminality, and casino-related money laundering are key drivers of this growing threat.

Short Narrative:

Organized crime syndicates in Southeast Asia are evolving at an alarming rate, adopting cutting-edge technologies like AI, deepfakes, and malware to boost their cyber-enabled fraud operations. According to a new UNODC report, these criminals have also established a service-based economy that fuels everything from crypto-based money laundering to underground markets. The region is now a critical testing ground for transnational crime, with billions in illicit proceeds being laundered through underregulated virtual asset service providers and online gambling platforms. FinTelegram has been following the rising cybercrime activities in Southeast Asia, noting the severe lack of regulatory oversight in key sectors like online gambling and crypto.

Actionable Insight:

- Expect cybercriminals to increasingly exploit AI-driven tools like deepfakes to enhance scams and fraud schemes. Stay alert to these emerging trends.

- Governments and regulators need to close the gaps in oversight of VASPs and online gambling platforms that have become hotbeds for money laundering and cyber-enabled fraud.

Much like companies operating in the formal economy, the way in which transnational organized crime groups and cybercriminals alike have developed services and products that are sold to other criminal actors has represented one of the most significant developments to take within the regional threat landscape over past decades. This has led to a thriving criminal service economy and promoted specialization within it, in turn lowering the barrier to entry across a range of cyber and cyber-enabled crimes as well as other crime types. (UNODC report).

Compliance Insight:

The UNODC report exposes the weaknesses in Southeast Asia’s financial and regulatory systems, particularly concerning VASPs and online casinos. These platforms are being leveraged by organized crime to funnel billions in illicit funds into the financial system without scrutiny. Moreover, human trafficking for forced criminality compounds the problem, with victims coerced into participating in scam operations. This convergence of traditional organized crime with advanced technology presents a significant challenge for compliance teams and regulatory bodies alike, requiring immediate action.

Call for Information:

If you have any information on illicit crypto transactions or underground markets operating in Southeast Asia, contact FinTelegram to contribute to ongoing investigations.