In the vast Israeli online trading fraud case, the Bavarian Central Cybercrime Unit announced charges against a 47-year-old Israeli national implicated in the fraudulent investment platform GetFinancial. He allegedly worked for the group as head of the analysis department and the “Trading and Education Department”, among other things. The GetFinancial case is closely linked to the family of cybercrime mastermind Gery Shalon.

Arrest and Extradition

The suspect was apprehended at Paris-Orly Airport on July 14, 2023, and subsequently extradited to Germany on December 14, 2023, following efforts by the Bamberg Public Prosecutor General’s Office. Since his extradition, the accused has been held in custody in a Bavarian prison.

Extensive Fraudulent Operations

The suspect, with no prior criminal record in Germany, is believed to have joined the criminal group’s fraudulent investment platform operations in late 2015. Operating from call centers in Israel, Georgia, the Republic of Moldova, and Armenia, the group lured unsuspecting customers into investing significant sums in fraudulent platforms, promising lucrative returns through “cybertrading.” However, the trading platforms and customer accounts were entirely fictitious, resulting in the complete loss of the victims’ investments.

The Gery Shalon Connection

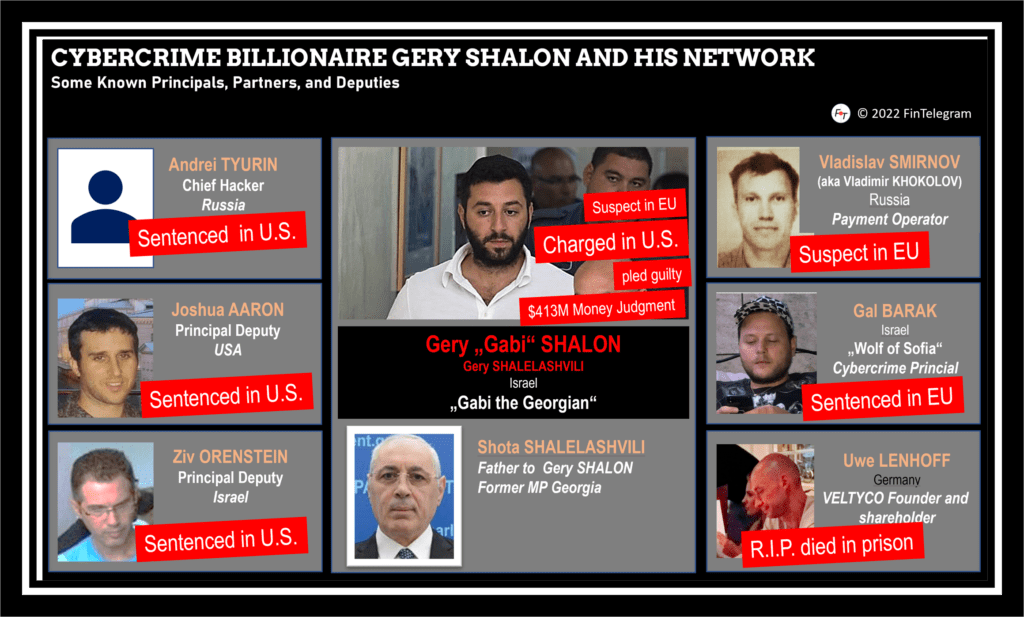

GetFinancial and the other systems were part of the cybercrime network of Georgia-born Israeli Gery Shalon. German law enforcement agencies reportedly want to talk to him urgently. Shalon’s brother-in-law, Israeli lawyer David Bar-El was arrested in Israel and is said to be among those indicted, according to insiders. FinTelegram cannot confirm this at this time.

Bloomberg recently published a comprehensive report on Shalon’s cybercrime activities. It states that Shalon, with the support of his father, former Georgian parliamentarian Shota Shalelashvili, developed extensive cybercrime activities while working as an undercover agent for the U.S. FBI as part of a plea deal.

Scope of the Fraud

The fraudulent activities have affected tens of thousands of investors in Germany alone, with numerous other victims across Europe. The estimated losses are substantial, and the actual number of cases is believed to be significantly higher than reported.

The accused allegedly held key roles within the group, including heading the analysis department and the “Trading and Education Department,” and overseeing the customer administration system. His involvement spanned several fraudulent platforms between 2017 and October 2021, including:

- SolidCFD: 41 victims in Germany, €225,000 in losses

- GetFinancial: 100 victims in Germany, just over €2 million in losses

- ProCapitalMarkets: 114 victims in Germany, nearly €2.1 million in losses

- GainFinTech: 2 victims in Germany, approximately €28,000 in losses

- MyCoinBanking: 39 victims in Germany, around €1.2 million in losses

- ProfitsTrade: 203 victims in Germany, just under €2 million in losses

- AccepTrade: 26 victims in Germany, around €7,000 in losses

- CoinsBanking: 77 victims in Germany, nearly €460,000 in losses

In total, the suspect is held responsible for losses amounting to approximately €8 million, and he reportedly received €166,000 for his activities.

Legal Proceedings and Ongoing Investigations

The suspect now faces eight counts of commercial and gang fraud, with potential prison sentences ranging from one to ten years. This indictment marks the fourth by the Bavarian Cybercrime Central Office in this case. Previously, in April and May 2023, four men and one woman stood trial and were sentenced to prison terms ranging from 2 years 6 months to 5 years 9 months.

FinTelegram will continue to monitor and report on the developments in this significant case of international cyber fraud.