Tether, the world’s leading stablecoin issuer, has shocked the crypto and financial world by investing in StablR, an EU stablecoin issuer run by former Payvision COO Gijs op de Weegh. This move raises serious questions about Tether’s due diligence processes and ethical commitments, as StablR’s leadership is tied to one of Europe’s most notorious financial scandals involving cybercrime facilitation. Crypto investors and stablecoin users should proceed with caution.

Key Points:

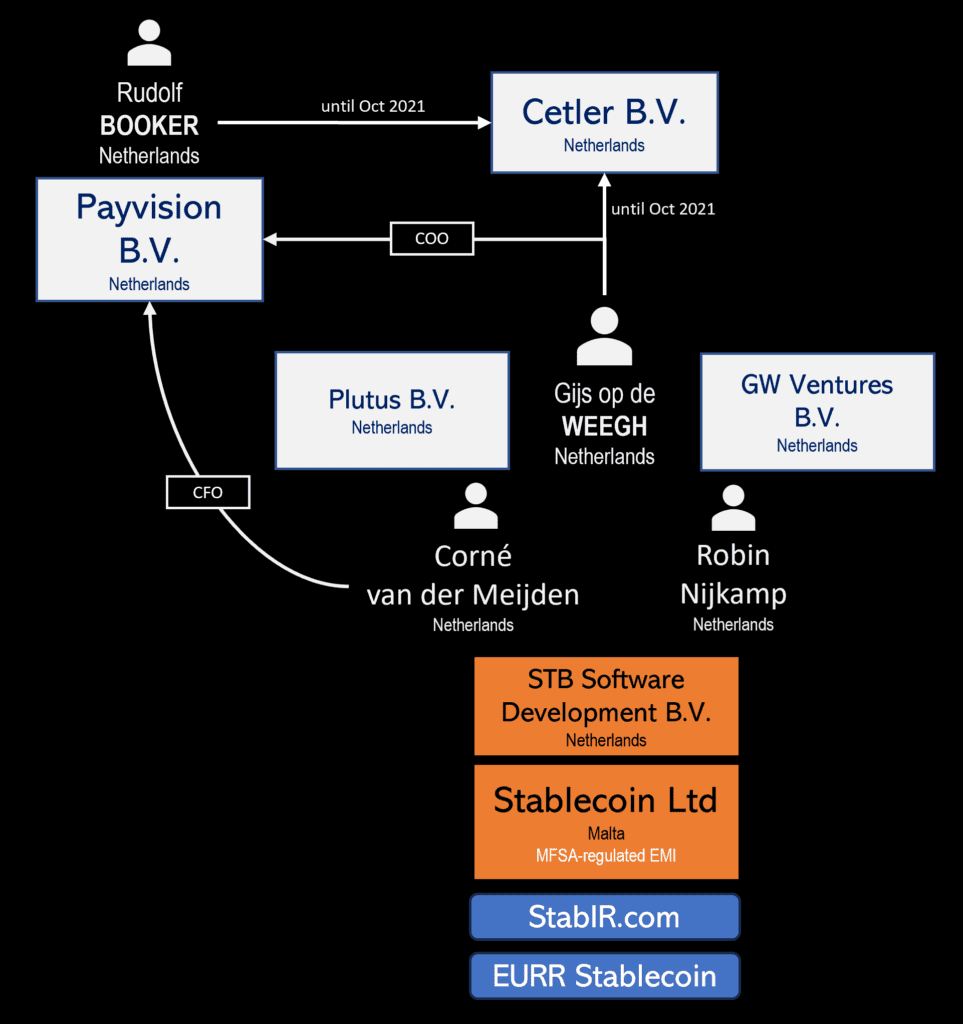

- Tether announced an investment in StablR, issuer of EURR and USDR stablecoins, run by Gijs op de Weegh, a former Payvision executive.

- Payvision, under Gijs op de Weegh and CEO Rudolf Booker, was exposed as a key facilitator of cybercrime, including clients such as Uwe Lenhoff and Gal Barak, both convicted of serious financial crimes.

- ING, which acquired Payvision in 2018 for €360 million, was forced to shut it down in 2021 after FinTelegram’s warnings proved accurate: most Payvision transactions were tied to cybercrime, porn, and gambling.

- Victims of Payvision-facilitated fraud are pursuing lawsuits against ING and Payvision, costing ING hundreds of millions in potential damages.

- StablR’s leadership under op de Weegh raises concerns about regulatory oversight under the EU’s MiCA framework and Tether’s investment ethics.

Narrative:

Tether’s investment in StablR is not just another business move—it’s a shocking decision that casts a dark shadow over its already controversial reputation. StablR, founded by Dutchman Gijs op de Weegh, represents a troubling nexus between the crypto world and a sordid history of financial scandals.

As COO of Payvision, op de Weegh played a pivotal role in enabling some of Europe’s most infamous cybercriminals. Payvision’s client roster included Uwe Lenhoff and Gal Barak, whose fraudulent schemes destroyed countless lives and stole millions from victims. Despite clear warnings from FinTelegram about Payvision’s activities, ING acquired the company in 2018, only to shutter it three years later when its complicity in facilitating criminal enterprises became undeniable.

The fallout was devastating. ING is now embroiled in lawsuits from fraud victims and faces massive compensation liabilities. How, then, can regulators deem op de Weegh “fit and proper” to lead StablR, a stablecoin issuer in a sector deemed critical to financial stability under the EU’s MiCA regulations?

Read our Payvision reports here.

Equally baffling is Tether’s decision to align itself with such a figure. As a company that has long been mired in controversy over transparency and regulatory compliance, this investment raises serious questions about Tether’s due diligence process. The partners did not disclose any details of the investment or the cooperation.

Recently, the Financial Times described Tether as the “criminal’s go-to cryptocurrency,” and this investment underlines this provocative statement.

Actionable Insight:

Crypto investors and stablecoin users must tread cautiously. The involvement of a figure like op de Weegh in StablR and Tether’s association with such a project underscore the persistent risks in the stablecoin market. Regulatory bodies should urgently review whether StablR’s leadership aligns with MiCA’s stringent requirements.

Call for Information:

Have you encountered irregularities or concerns regarding Tether, StablR, or their leadership? FinTelegram invites whistleblowers to share their insights confidentially. Your information can help shine a light on questionable practices in the crypto and financial industries.