Even with Western sanctions against Russia in place, money laundering remains a significant global concern, posing risks to financial institutions and various sectors, including real estate, luxury yachts, and private jets. Money launderers often target these high-value assets to conceal the origins of illicit funds. This report explores the risks associated with money laundering activities in these sectors and suggests mitigation strategies.

Risks in Real Estate

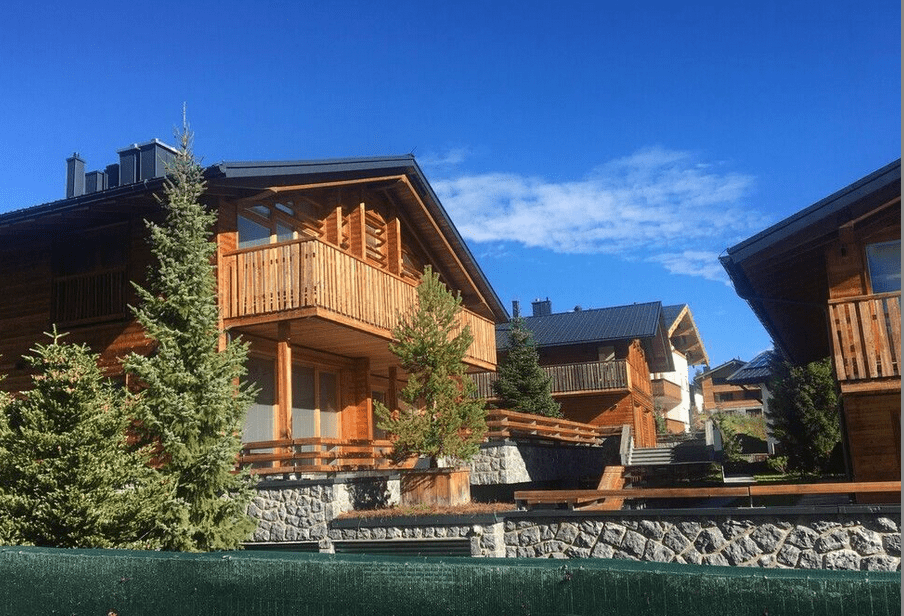

High Transaction Values and Cash Payments

Real estate transactions often involve substantial sums of money, making them attractive for money launderers. The ability to purchase properties with cash, sometimes through shell companies or intermediaries, enables the concealment of illicit funds. These transactions can be complex and opaque, complicating the traceability of the funds’ origins.

Lack of Transparency and Beneficial Ownership

Properties can be acquired through anonymous companies or trusts, obscuring the true ownership and allowing criminals to hide their identity. This lack of transparency makes it challenging for authorities to track and link property ownership to illicit activities.

Market Stability and Liquidity

Real estate markets, particularly in high-demand urban areas, offer a stable investment for laundered money. The liquidity of these markets means properties can be sold relatively quickly, facilitating the conversion of illicit funds into legitimate assets.

Risks in Yachts

High Value and Mobility

Luxury yachts are high-value assets that provide an attractive option for money laundering. Their mobility allows owners to move them across jurisdictions, evading local regulatory scrutiny and complicating enforcement efforts.

Complex Ownership Structures

Yachts are often registered under flags of convenience or through complex ownership structures involving multiple jurisdictions. This layering makes it difficult to determine the true owner and the origin of the funds used for purchase.

Since the Western sanctions came into force and the resulting confiscation of luxury yachts, we have seen that it is not easy to determine the actual ownership of a yacht. The ultimate beneficial owners (UBO) are often impossible to determine due to multiple companies nesting via trustees and company service providers.

Read more about the seized Alfa Nero superyacht and the ownership issue.

Underutilized Regulatory Oversight

The yacht industry has historically faced less regulatory scrutiny compared to financial institutions. This regulatory gap allows money launderers to exploit the industry, often through luxury brokers and intermediaries who may not be adequately trained or motivated to detect suspicious activities. The builders, brokerages and other companies that comprise the industry have almost entirely avoided regulatory and legal scrutiny, Yehuda Shaffer, former director of Israel’s financial intelligence unit, or FIU, told ACAMS moneylaundering.com.

Risks in Private Jets

Ease of Cross-Border Movement

Private jets offer rapid and private cross-border travel, which can be exploited to transport illicit funds or assets. The ability to quickly move assets internationally complicates regulatory oversight and enforcement.

Complex Leasing and Financing Arrangements

Private jets are often acquired through intricate leasing and financing arrangements. These complex financial structures can obscure the origins of the funds, making it challenging for regulators and law enforcement to trace illicit money.

Discreet Transactions

The acquisition and operation of private jets involve a high degree of privacy and discretion, often facilitated by specialized service providers. This level of confidentiality can be exploited to conduct transactions without attracting attention.

Mitigation Strategies

Enhanced Due Diligence

Implementing enhanced due diligence (EDD) procedures is crucial. This includes verifying the identity of beneficial owners, scrutinizing the sources of funds, and ensuring compliance with anti-money laundering (AML) regulations.

International Cooperation and Information Sharing

Strengthening international cooperation and information-sharing mechanisms among regulatory bodies can enhance the detection and prevention of money laundering. Collaborative efforts can help track assets across borders and identify suspicious patterns.

Regulatory Reforms and Training

Regulatory reforms aimed at increasing transparency in ownership and transactions within these sectors are essential. Training for industry professionals on AML practices can improve their ability to identify and report suspicious activities.

Technology and Data Analytics

Leveraging technology and data analytics can enhance the detection of money laundering activities. Tools such as blockchain for property registries and data analytics for transaction monitoring can provide greater transparency and traceability.

Conclusion

Real estate, luxury yachts, and private jets present significant money laundering risks due to their high value, mobility, and complex ownership structures. Effective mitigation requires a combination of enhanced due diligence, international cooperation, regulatory reforms, and technological advancements. By addressing these risks comprehensively, regulators and industry stakeholders can better safeguard these sectors from money laundering activities.