Category: EFRI

M

M

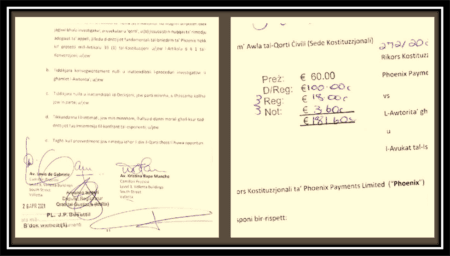

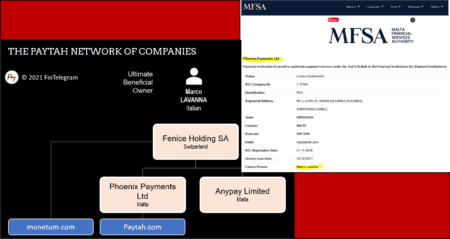

Maltese Compliance Issue – Paytah accuses MFSA of acting in violation of the constitution

The regulated Maltese high-risk payment processor Phoenix Payments Ltd d/b/a Paytah, has sued its regulator, the Malta Financial Services Authority (MFSA). Paytah accuses MFSA of being judge, jury, and executioner. The payment processor took this unprecedented step after the Maltese regulator fined it EUR 32,400 and restricted the company's license. This is not a normal civil court case. Instead, Paytah brought the claim against MFSA at the Constitutional Courts level. This is a first in Malta. Paytah has also sued MFSA for damages.

V

V

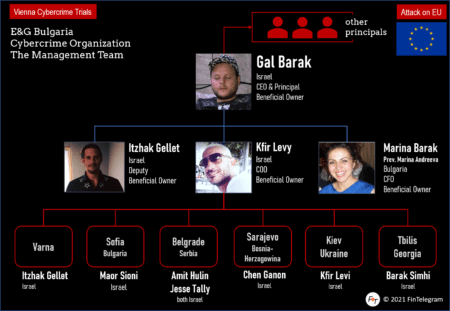

Vienna Cybercrime Trials – Gal Barak charged with giving false testimony and the Israeli fraud elite!

Gal Barak was sentenced in the Vienna Cybercrime Trials as one of the masterminds behind the cybercrime organization E&G Bulgaria to four years in prison and millions in restitution payments for investment fraud and money laundering. His Bulgarian wife Marina Barak faces the same charges and is currently on trial. Gal Barak gave false testimony at the trial of his wife and was consequently charged by the prosecution for that. As private prosecutors, the EFRI lawyer and its principal Elfriede Sixt accompany the trials representing the victims' voice!

B

B

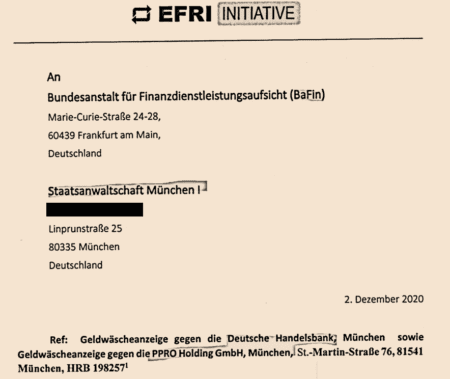

Breaking News – Criminal complaints against Payvision and its founders

Payvision and its founder and former CEO Rudolf Booker are already subjects of the criminal proceedings in Germany and Austria. Uwe Lenhoff, the alleged mastermind of a cybercrime organization, was arrested in January 2019. He was a personal friend of Booker and used Payvision for his dirty business. Rudolf Booker was introduced to Lenhoff by Amsterdam real estate investor Dirk-Jan Bakker, a partner of Lenhoff, who was found dead in his prison cell in July 2020. Criminal charges have now been filed against Payvision and its founders for money laundering and investment fraud.

F

F

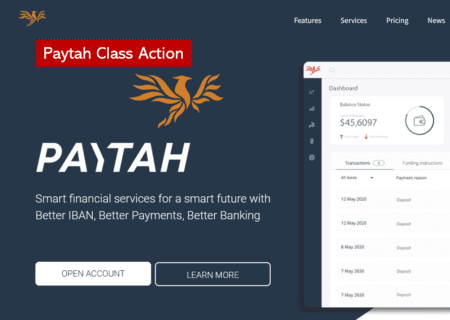

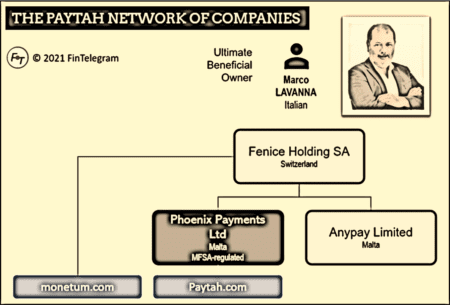

Fund Recovery – Paytah Class Action Campaign

Scam-facilitating payment processors are co-conspirators. Paytah, regulated in Malta by the MFSA, is one of these payment processors. Paytah accepted scam customers and processed their payments. Many victims of Paytah customers lost a lot of money via the payment processor's clients. The former Chief Compliance Officer has filed a complaint with the authorities because of alleged AML/KYC violations.

P

P

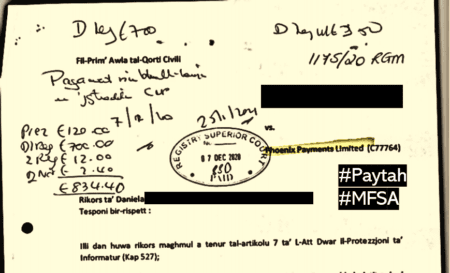

Paytah Case – Former MLRO testifies that the payment processor was involved in shabby business

Public court documents suggest that high-risk payment processor Paytah, operated by Malta-based and MFSA-regulated Phoenix Payments Ltd, was into shabby business. Marco Lavanna, the company's beneficial owner and director, dismissed the former Money-Laundering Reporting Officer (MLRO) and compliance officer who raised serious issues with the company’s management. The dismissed MLRO has now sued her former employer on the grounds of unfair dismissal and, under oath, reveals the payment processor's incompliant business approach.

G

G

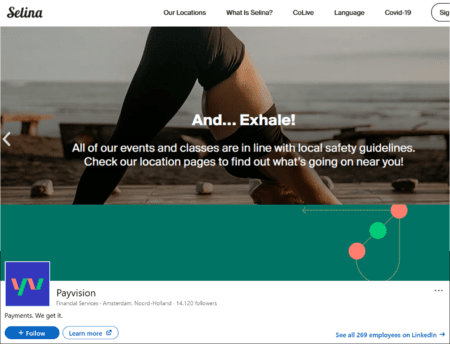

Good news for Payvision – Selina welcomes the disgraced payment processor

The Dutch high-risk payment processor Payvision is deeply involved in the swamp of broker scams around the Vienna Cybercrime Trials. It allegedly wilfully and knowingly facilitated broker fraud and money laundering. The presumption of innocence applies. Today's announcement of a partnership with the global hospitality platform Selina has to be appreciated. The idea is to provide Selina clients with ultimate payment experiences while traveling. Not an easy business model in the COVID-19 pandemic but hello, positive news though.

W

W

Wanted for funds – Maltese payment processor Paytah in legal troubles

Paytah is operated by Phoenix Payments Ltd, a company registered in Malta and regulated by MFSA. As reported by FinTelegram, PayTah has facilitated vast broker scams, including LincolnFX, RoyalsFX, CodexFX between 2019 and 2020. Victims of these scams have provided the European Fund Recovery Initiative (EFRI) with the Power of Attorney to recover their funds. Via its Maltese lawyer EFRI has taken actions to recover the victims' funds from Paytah. Currently, the Maltese connection is chasing after the Paytah people.

P

P

Payvision and Vienna Cybercrime Trials – Let’s scam the scammers and the EFRI Campaign

Oh yes, the alleged German cybercrime mastermind Uwe Lenhoff was a very good acquaintance of Payvision founder and CEO Rudolf Booker. They spent skiing vacations together in Austria and communicated a lot. Thanks to the frequent and very open communication between Lenhoff and Booker, their business details can be found in the criminal files. They show how high-risk payment processors work.

S

S

Scam-facilitating Maltese payment processor PayTah refused to recognize its legal responsibility

Payment processors must comply with the applicable KYC and AML regulations. Especially when onboarding new merchants and monitoring their transactions. Recently, we reported that the high-risk payment processor Phoenix Payments Ltd d/b/a Paytah (www.paytah.com). Paytah is to be held liable for this but has so far refused to accept its responsibility for intentionally or grossly negligently supporting the scams and refuses to provide any assistance to the victims.

V

V

Victims Alert – EFRI Fake scammers aggressively attack scam victims

FinTelegram is the co-founder of EFRI which is currently working closely with law enforcement in various jurisdictions to obtain restitution payments for the victims it represents. In recent weeks, however, victims have been attacked via e-mails and phone calls from alleged EFRI employees. They are offering scam victims to recover their funds on a fee basis. Victims receive fake EFRI invoices and are asked to pay for their purported services via Bitcoin (BTC).